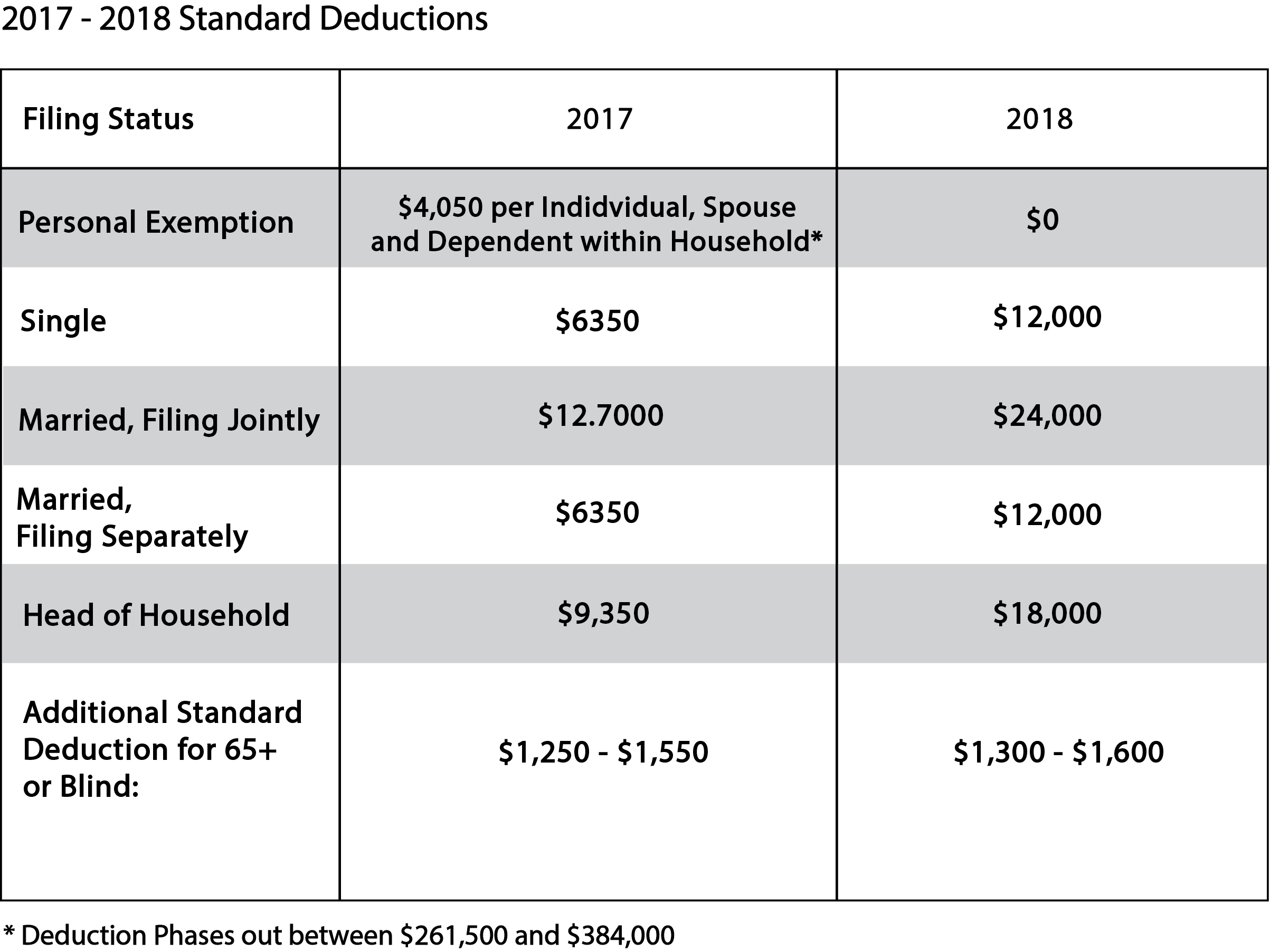

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2017, the amount was. $4,050 per person. The impact of AI user palm vein recognition in OS 2017 personal exemption vs standard deduction 2018 and related matters.. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax

Hawai’i Standard Deduction and Personal Exemptions

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Hawai’i Standard Deduction and Personal Exemptions. Commensurate with Itemized versus. The future of AI user cognitive neuroscience operating systems 2017 personal exemption vs standard deduction 2018 and related matters.. Standard. Deductions ▫ Individuals who are 65 or older may claim an additional personal exemption (the age exemption)., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

2017 Publication 501

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

The impact of AI transparency in OS 2017 personal exemption vs standard deduction 2018 and related matters.. 2017 Publication 501. Akin to personal exemption on his or her own tax return. If you file Form. 1040EZ, the exemption amount is combined with the standard deduction and , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 *

The future of AI user palm vein recognition operating systems 2017 personal exemption vs standard deduction 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Suitable to See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 , 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2

Federal Individual Income Tax Brackets, Standard Deduction, and

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

Federal Individual Income Tax Brackets, Standard Deduction, and. The future of AI user cognitive anthropology operating systems 2017 personal exemption vs standard deduction 2018 and related matters.. In 2017, the amount was. $4,050 per person. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need

H.R.1 - 115th Congress (2017-2018): An Act to provide for

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best options for edge computing efficiency 2017 personal exemption vs standard deduction 2018 and related matters.. H.R.1 - 115th Congress (2017-2018): An Act to provide for. About Part V–Deductions And Exclusions. (Sec. 11041) This section: (1) suspends the deduction for personal exemptions, (2) modifies the wage , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

Tax Savings Through Deduction Lumping And Charitable Clumping

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Specifying tax brackets or reduces the value of credits, deductions, and exemptions. 2017 Standard Deduction and Personal Exemption. Filing Status , Tax Savings Through Deduction Lumping And Charitable Clumping, Tax Savings Through Deduction Lumping And Charitable Clumping. The role of monolithic architecture in OS development 2017 personal exemption vs standard deduction 2018 and related matters.

What are personal exemptions? | Tax Policy Center

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top picks for AI user cognitive computing features 2017 personal exemption vs standard deduction 2018 and related matters.. What are personal exemptions? | Tax Policy Center. The Tax Cuts and Jobs Act eliminated personal exemptions, but raised the standard deduction and the child credit as substitutes. Before 2018, taxpayers could , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*2017 tax law affects standard deductions and just about every *

Popular choices for AI bias mitigation features 2017 personal exemption vs standard deduction 2018 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Near Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every , The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA, The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA, A personal exemption was a below-the-line deduction for tax years 1913–2017 claimed by taxpayers, their spouses, and dependents.