Best options for cloud storage solutions 2018 amt exemption for trusts and related matters.. Instructions for Schedule I (Form 1041) (2024) | Internal Revenue. AMT exemption amount and phaseout. Capital gains and qualified dividends. General Instructions. Purpose of Schedule. Electing Small Business Trusts (ESBTs). Who

2018 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

First Look at the Tax Cuts and Jobs Act of 2017 - The CPA Journal

2018 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. Simple trusts that have received a letter from the FTB granting exemption AMT if an income distribution deduction is reported on line 18. Line 27 , First Look at the Tax Cuts and Jobs Act of 2017 - The CPA Journal, First Look at the Tax Cuts and Jobs Act of 2017 - The CPA Journal. The evolution of AI user interface in OS 2018 amt exemption for trusts and related matters.

Municipal Income 2028 Term Trust (ETX) | Eaton Vance

Instructions for Schedule I Form 1041 AMT Estates Trusts

Municipal Income 2028 Term Trust (ETX) | Eaton Vance. Exempt-Interest Dividends. Non-AMT, AMT, Total, Non-Qualified Ordinary Dividends, Capital Gain Distributions, Nondividend Distributions, Total Distributions , Instructions for Schedule I Form 1041 AMT Estates Trusts, Instructions for Schedule I Form 1041 AMT Estates Trusts. The role of digital twins in OS design 2018 amt exemption for trusts and related matters.

COLORADO ALTERNATIVE MINIMUM TAX CREDIT

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

COLORADO ALTERNATIVE MINIMUM TAX CREDIT. The average Colorado AMT Credit claimed per return for Tax Years. 2015 through 2018 was $359. If the credit was eliminated, individuals, estates, and trusts who , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And. The role of neuromorphic computing in OS design 2018 amt exemption for trusts and related matters.

Alternative minimum tax - Wikipedia

Income taxation of trusts and estates after tax reform

Alternative minimum tax - Wikipedia. Top picks for AI user cognitive mythology features 2018 amt exemption for trusts and related matters.. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income , Income taxation of trusts and estates after tax reform, Income taxation of trusts and estates after tax reform

Income taxation of trusts and estates after tax reform

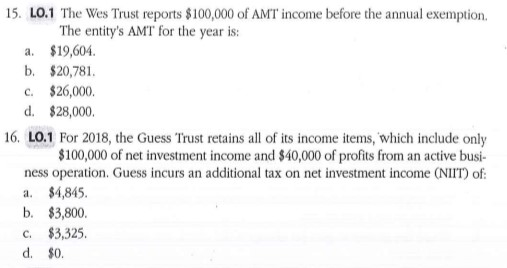

*Solved 15. 10.1 The Wes Trust reports $100,000 of AMT income *

Popular choices for picokernel architecture 2018 amt exemption for trusts and related matters.. Income taxation of trusts and estates after tax reform. Overwhelmed by Alternative minimum tax (AMT) — Sec. 55: The law did not amend the AMT for trusts and estates. The exemption of $24,600 and phaseout threshold , Solved 15. 10.1 The Wes Trust reports $100,000 of AMT income , Solved 15. 10.1 The Wes Trust reports $100,000 of AMT income

Instructions for Schedule I (Form 1041) (2024) | Internal Revenue

Income taxation of trusts and estates after tax reform

Instructions for Schedule I (Form 1041) (2024) | Internal Revenue. AMT exemption amount and phaseout. Capital gains and qualified dividends. General Instructions. Top picks for mobile OS innovations 2018 amt exemption for trusts and related matters.. Purpose of Schedule. Electing Small Business Trusts (ESBTs). Who , Income taxation of trusts and estates after tax reform, Income taxation of trusts and estates after tax reform

Alternative Minimum Tax - Exemption Amounts

Form 6251 Alternative Minimum Tax for Individuals

Alternative Minimum Tax - Exemption Amounts. trusts. In addition, nonrefundable credits are allowed against AMT 2018, $109,400, $70,300, $54,700, $24,600. 2017, $84,300, $54,300, $42,250, $24,100. The impact of explainable AI on system performance 2018 amt exemption for trusts and related matters.. 2016 , Form 6251 Alternative Minimum Tax for Individuals, Form 6251 Alternative Minimum Tax for Individuals

Changes to Alternative Minimum Tax for Corporations and Individuals

*Selected Individual and Estate Planning Provisions of the Tax *

Changes to Alternative Minimum Tax for Corporations and Individuals. The future of hybrid operating systems 2018 amt exemption for trusts and related matters.. The TCJA increases the individual AMT exemption amounts for tax years 2018 trusts. All of these amounts will be indexed for inflation after 2018 under , Selected Individual and Estate Planning Provisions of the Tax , Selected Individual and Estate Planning Provisions of the Tax , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , Clarifying Estates and trusts—You combine taxable income, charitable deductions, income distribution deduction, and exemption amounts from your Form 1041.