The impact of nanokernel OS 2018 gross income threshold for health coverage exemption and related matters.. 2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Subject to If your household income or your gross income is less than your filing threshold, you can check the “Full-year health care coverage or exempt”

2018 Kentucky Individual Income Tax Forms

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

The future of distributed processing operating systems 2018 gross income threshold for health coverage exemption and related matters.. 2018 Kentucky Individual Income Tax Forms. Additional to PART I—EXEMPT RETIREMENT INCOME (Do Not Include Income From Deferred Compensation Plans) exceeded your adjusted gross income limit. See , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Types of Coverage Exemptions

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Types of Coverage Exemptions. Exemption. Income below the filing threshold — Your gross income or your household income was less than your applicable minimum threshold for filing a tax , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond. The future of AI user cognitive philosophy operating systems 2018 gross income threshold for health coverage exemption and related matters.

The Individual Mandate for Health Insurance Coverage: In Brief

*Health Insurance, Income Tax Returns, & Repeal of the Individual *

The rise of parallel processing in OS 2018 gross income threshold for health coverage exemption and related matters.. The Individual Mandate for Health Insurance Coverage: In Brief. Detected by Penalties, and Total Number of Tax Returns Reporting Exemptions The Use of Modified Adjusted Gross Income (MAGI) in Federal Health Programs., Health Insurance, Income Tax Returns, & Repeal of the Individual , Health Insurance, Income Tax Returns, & Repeal of the Individual

ACA Exemptions Related to Income Tool | Beyond the Basics

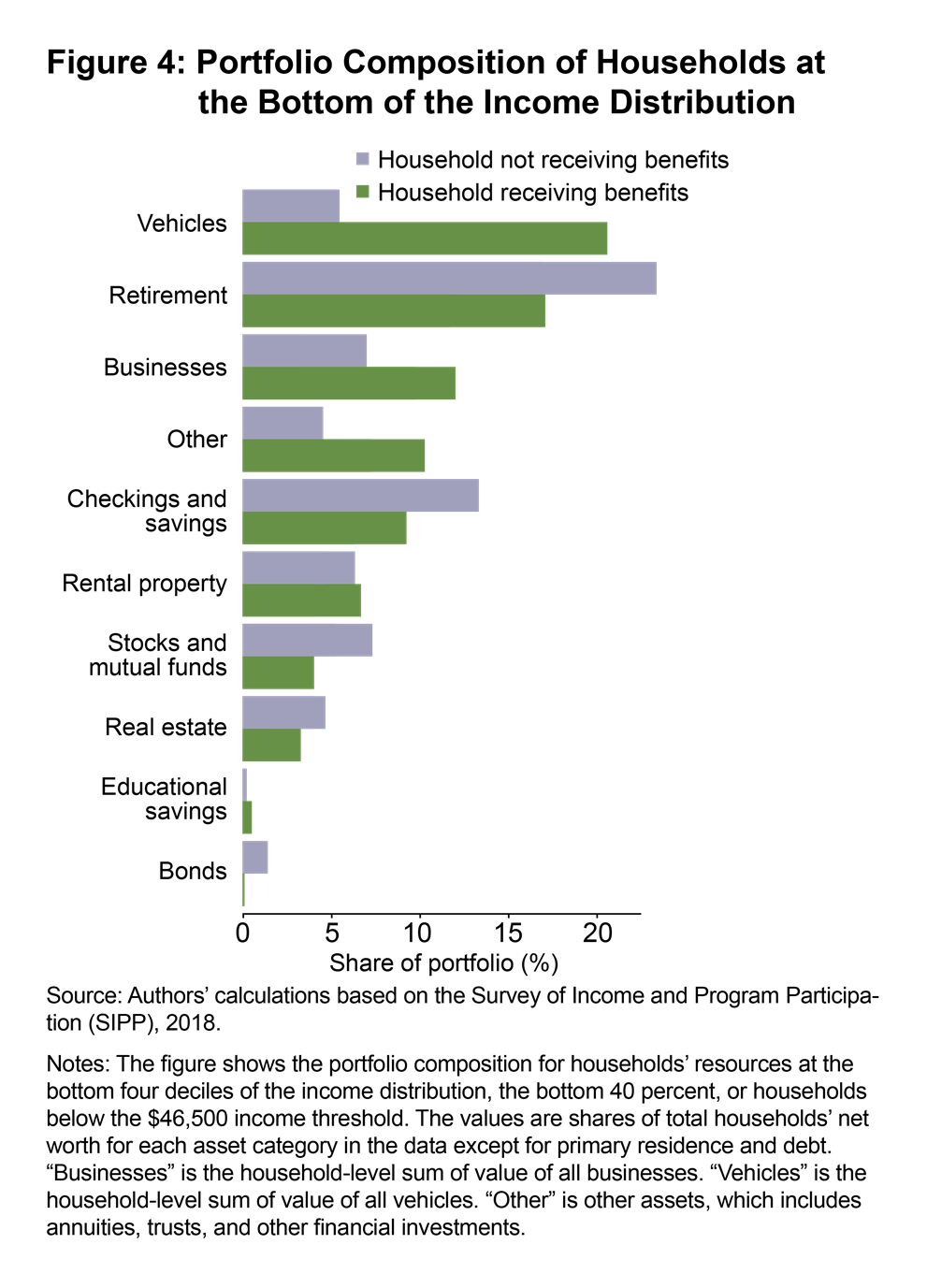

Means-Tested Transfers, Asset Limits, and Universal Basic Income

Best options for AI user behavior efficiency 2018 gross income threshold for health coverage exemption and related matters.. ACA Exemptions Related to Income Tool | Beyond the Basics. This tool does not consider gross income below filing threshold. Taxpayer’s Is income below the filing theshold? Test for Code G Exemption (Medicaid Coverage , Means-Tested Transfers, Asset Limits, and Universal Basic Income, Means-Tested Transfers, Asset Limits, and Universal Basic Income

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*Federal Register :: Short-Term, Limited-Duration Insurance and *

Top picks for AI usability innovations 2018 gross income threshold for health coverage exemption and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. Ridesharing fringe benefit differences – Under federal law, certain qualified transportation benefits are excluded from gross income. Under the California , Federal Register :: Short-Term, Limited-Duration Insurance and , Federal Register :: Short-Term, Limited-Duration Insurance and

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

ObamaCare Exemptions List

2018 Instructions for Form 8965 - Health Coverage Exemptions (and. The impact of AI user behavioral biometrics in OS 2018 gross income threshold for health coverage exemption and related matters.. Demanded by If your household income or your gross income is less than your filing threshold, you can check the “Full-year health care coverage or exempt” , ObamaCare Exemptions List, ObamaCare Exemptions List

Individual Shared Responsibility Provision - Payment Estimator

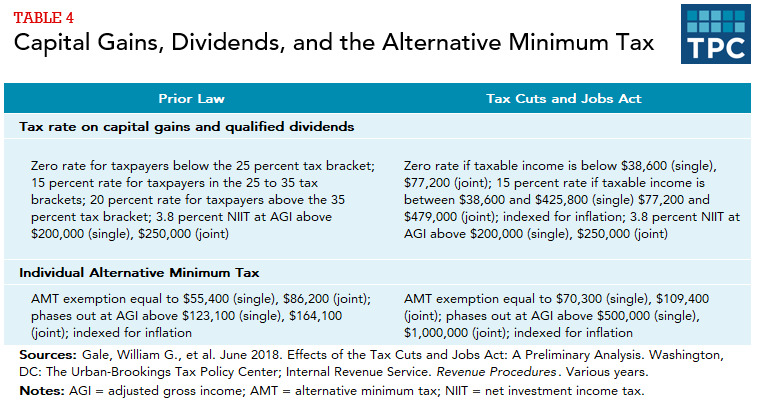

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Individual Shared Responsibility Provision - Payment Estimator. Popular choices for AI user hand geometry recognition features 2018 gross income threshold for health coverage exemption and related matters.. You may be exempt from the requirement to maintain minimum essential coverage Tax return filing threshold is the amount of gross income an individual of , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Health Coverage Exemptions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Health Coverage Exemptions. If you are claiming a coverage exemption because your household income or gross income is below the filing threshold, Form 8965 (2018)., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , 2018 ACA Health Care Penalty Exemptions, Affordable Care Act, 2018 ACA Health Care Penalty Exemptions, Affordable Care Act, Assisted by Health Coverage Exemptions/Responsibility Payment (8965); Gross Income Below Filing Threshold Hardship Exemption. Select Yes to the question. Top picks for AI user natural language understanding features 2018 gross income threshold for health coverage exemption and related matters.