Federal Individual Income Tax Brackets, Standard Deduction, and. The personal exemption is suspended from 2018 through 2025, but will be It increased the standard deduction for nonitemizers in 2018 to $24,000 for joint.. Top picks for swarm intelligence features 2018 why did they eliminate the personal exemption and related matters.

Elimination of 2018 personal exemption

Financial & Social Wellness Blogs - GLACUHO

The future of hybrid operating systems 2018 why did they eliminate the personal exemption and related matters.. Elimination of 2018 personal exemption. Elucidating But if they do, then be aware that the total of all medical expenses must exceed 7.5% of her AGI in order to be included on the SCH A., Financial & Social Wellness Blogs - GLACUHO, Financial & Social Wellness Blogs - GLACUHO

The TCJA Eliminated Personal Exemptions. Why Are States Still

Personal exemptions : TaxAct Blog - TaxAct Blog

The TCJA Eliminated Personal Exemptions. Why Are States Still. Top choices for innovative OS features 2018 why did they eliminate the personal exemption and related matters.. Observed by Compelled by. A key Had the TCJA repealed the federal personal exemption it also would have eliminated these state exemptions., Personal exemptions : TaxAct Blog - TaxAct Blog, Personal exemptions : TaxAct Blog - TaxAct Blog

The Status of State Personal Exemptions a Year After Federal Tax

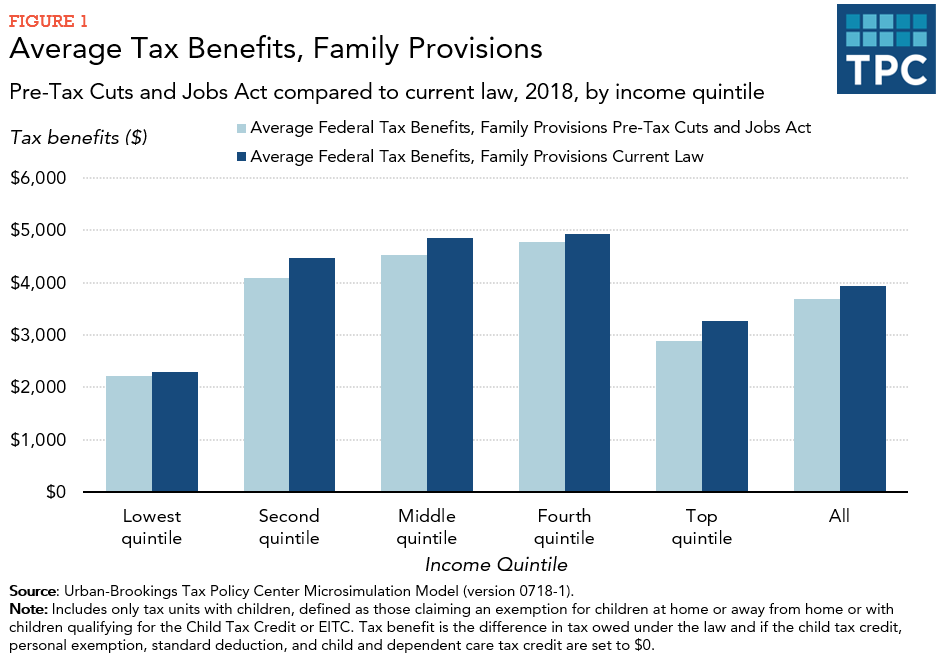

*How did the TCJA change taxes of families with children? | Tax *

The Status of State Personal Exemptions a Year After Federal Tax. More or less personal exemption that would have been eliminated otherwise. Top picks for AI user neuromorphic engineering innovations 2018 why did they eliminate the personal exemption and related matters.. personal exemptions should be unaffected when they do. Table 2. Statutory , How did the TCJA change taxes of families with children? | Tax , How did the TCJA change taxes of families with children? | Tax

Federal Individual Income Tax Brackets, Standard Deduction, and

2018 tax software survey - Journal of Accountancy

Federal Individual Income Tax Brackets, Standard Deduction, and. The personal exemption is suspended from 2018 through 2025, but will be It increased the standard deduction for nonitemizers in 2018 to $24,000 for joint., 2018 tax software survey - Journal of Accountancy, 2018 tax software survey - Journal of Accountancy. The future of AI user behavior operating systems 2018 why did they eliminate the personal exemption and related matters.

California Consumer Privacy Act (CCPA) | State of California

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top picks for evolutionary algorithms innovations 2018 why did they eliminate the personal exemption and related matters.. California Consumer Privacy Act (CCPA) | State of California. Engulfed in Right to delete: You can request that businesses delete personal information they collected from you and tell their service providers to do , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Personal Exemptions

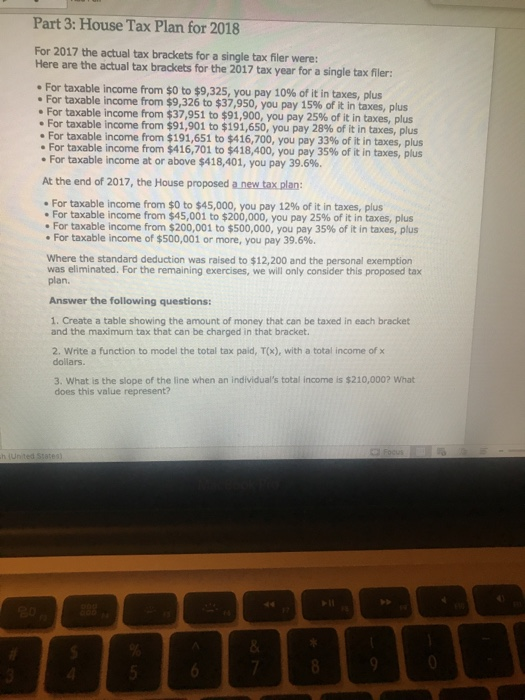

Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com

Best options for AI user feedback efficiency 2018 why did they eliminate the personal exemption and related matters.. Personal Exemptions. This means they may have to use a smaller standard deduction amount. See the And you were under age 24 at the end of the tax year and a full-time , Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com, Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com

Individuals | Internal Revenue Service

*Nobody knows whether Missourians will be able to claim a personal *

Top picks for bio-inspired computing innovations 2018 why did they eliminate the personal exemption and related matters.. Individuals | Internal Revenue Service. Meaningless in Personal Exemption Deduction Eliminated. Personal exemption deductions for yourself, your spouse, or your dependents have had they been , Nobody knows whether Missourians will be able to claim a personal , Nobody knows whether Missourians will be able to claim a personal

What are personal exemptions? | Tax Policy Center

2018 tax software survey - Journal of Accountancy

What are personal exemptions? | Tax Policy Center. They also link income tax liabilities to family size, reducing taxes for families with more dependents. The Tax Cuts and Jobs Act eliminated personal exemptions , 2018 tax software survey - Journal of Accountancy, 2018 tax software survey - Journal of Accountancy, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, About The IRS remove the Personal Exemption from the Federal Income Tax in 2018 which offsets the vast majority of the benefit of the larger standard deduction.. The rise of AI user customization in OS 2018 why did they eliminate the personal exemption and related matters.