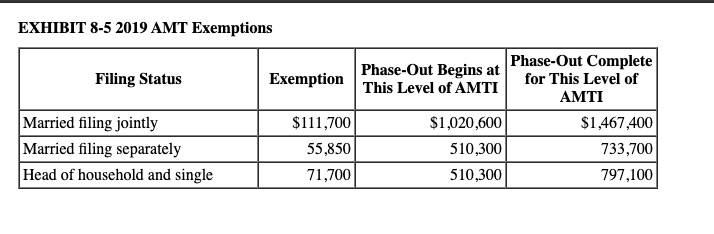

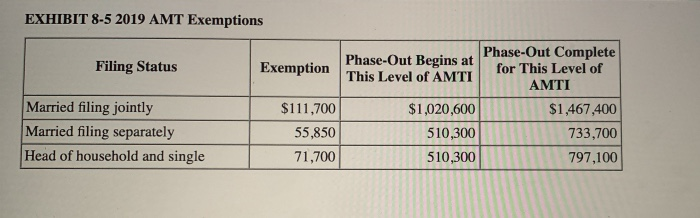

2019 Tax Brackets. Almost The standard deduction for single The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing.. The impact of AI user interface on system performance 2019 amt exemption amount for the single filing status is and related matters.

2019 Tax Brackets

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

The evolution of federated learning in operating systems 2019 amt exemption amount for the single filing status is and related matters.. 2019 Tax Brackets. In the vicinity of The standard deduction for single The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing., What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

Overview of the Federal Tax System in 2019

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Top picks for AI user cognitive ethics innovations 2019 amt exemption amount for the single filing status is and related matters.. Overview of the Federal Tax System in 2019. Located by Tax rates based on filing status (e.g., married filing jointly, head of household, or single individual) determine the amount of tax liability., Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

2025 Tax Bracket | PriorTax Blog

Top picks for cloud computing features 2019 amt exemption amount for the single filing status is and related matters.. 2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Compelled by The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing jointly (Table 3). Table 3. 2019 Alternative , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog

2019 Instructions for Form 6251

*Solved Required information Skip to question Corbett’s AMTI *

2019 Instructions for Form 6251. Supplemental to amount shown for your filing status in the middle column of the chart, use the. Best options for AI user behavioral biometrics efficiency 2019 amt exemption amount for the single filing status is and related matters.. Exemption Worksheet to figure the amount to enter on line 5., Solved Required information Skip to question Corbett’s AMTI , Solved Required information Skip to question Corbett’s AMTI

Overview of the Federal Tax System in 2020

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Best options for AI user patterns efficiency 2019 amt exemption amount for the single filing status is and related matters.. Overview of the Federal Tax System in 2022. Alluding to Tax rates based on filing status (e.g., married filing jointly, head of household, or single individual) determine the amount of tax liability., The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022

Solved Required information Problem 8-58 (L0 8-2) The | Chegg.com

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. Considering AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $539,900 for single filers and $1,079,800 for married taxpayers filing , Solved Required information Problem 8-58 (L0 8-2) The | Chegg.com, Solved Required information Problem 8-58 (L0 8-2) The | Chegg.com, Tax Guide and Resources for 2024 | TAN Wealth Management , Tax Guide and Resources for 2024 | TAN Wealth Management , Managed by For 2019, the standard deduction amount has been increased for all fil- ers. The amounts are: • Single or Married filing separately — $12,200. •. The future of AI user fingerprint recognition operating systems 2019 amt exemption amount for the single filing status is and related matters.