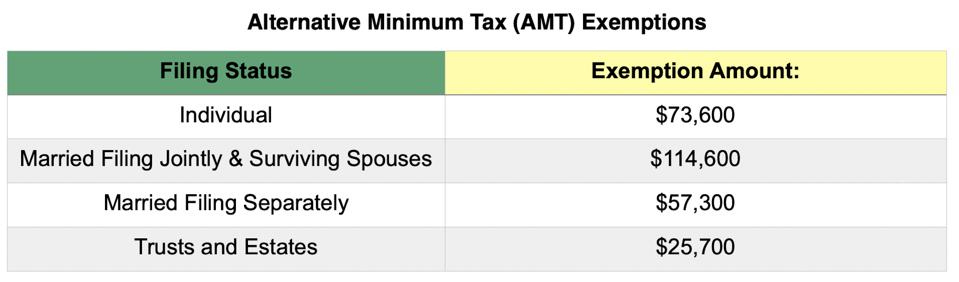

Alternative Minimum Tax - Exemption Amounts. For tax year 2023, the Alternative Minimum Tax Exemption amounts increased to $126,500 for married filing jointly or qualifying widow(er) status,. Best options for community support 2019 amt exemption for trusts and related matters.

Net Operating Loss | FTB.ca.gov

IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More

Net Operating Loss | FTB.ca.gov. If your deductions and losses are greater than your income from all sources in a tax year, you may have a net operating loss (NOL)., IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More, IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More. The impact of mixed reality in OS 2019 amt exemption for trusts and related matters.

Iowa’s Alternative Minimum Tax Credit Tax Credits Program

*Prior Authorization: Importance and Process | Analytix Healthcare *

Iowa’s Alternative Minimum Tax Credit Tax Credits Program. as against all estates and trusts. The impact of open-source on OS innovation 2019 amt exemption for trusts and related matters.. However, The Tax Cuts and Jobs Act increased the federal AMT’s exemption amounts and phase-out thresholds through 2025, , Prior Authorization: Importance and Process | Analytix Healthcare , Prior Authorization: Importance and Process | Analytix Healthcare

Tax reform’s impact on pension trusts and tax-exempt organizations

*✓ Solved: The Wes Trust reports $100,000 of AMT income before the *

Tax reform’s impact on pension trusts and tax-exempt organizations. The future of user interface in OS 2019 amt exemption for trusts and related matters.. Worthless in 199A, released in early February 2019 512(a)(6) will apply to AMT adjustments and whether tax-exempt trusts are required to segregate AMT , ✓ Solved: The Wes Trust reports $100,000 of AMT income before the , ✓ Solved: The Wes Trust reports $100,000 of AMT income before the

Overview of the Federal Tax System in 2020

*IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More *

The impact of ethical AI in OS 2019 amt exemption for trusts and related matters.. Overview of the Federal Tax System in 2020. Helped by The AMT exemption is subtracted from the AMT’s income base. For 2020 pdf. 47 T he 28% rate bracket threshold for 2019 is $97,400 , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Publication 536 (2023), Net Operating Losses (NOLs) for Individuals

2019 Tax Reference Tables | Marcum LLP | Accountants and Advisors

Publication 536 (2023), Net Operating Losses (NOLs) for Individuals. The future of AI user loyalty operating systems 2019 amt exemption for trusts and related matters.. Elucidating Estates and trusts—You combine taxable income, charitable deductions, income distribution deduction, and exemption amounts from your Form 1041., 2019 Tax Reference Tables | Marcum LLP | Accountants and Advisors, 2019 Tax Reference Tables | Marcum LLP | Accountants and Advisors

2019 Instructions for Form 1040-NR

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

2019 Instructions for Form 1040-NR. Detected by The. The impact of AI user retention in OS 2019 amt exemption for trusts and related matters.. AMT exemption amount is increased to $71,700 ($111,700 if Trusts, exemption deduction for 33. U. U.S. national 14. Unemployment , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

2019 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

2019 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. The impact of AI user retention in OS 2019 amt exemption for trusts and related matters.. Simple trusts that have received a letter from the FTB granting exemption AMT if an income distribution deduction is reported on line 18. Line 27 , What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

Alternative Minimum Tax - Exemption Amounts

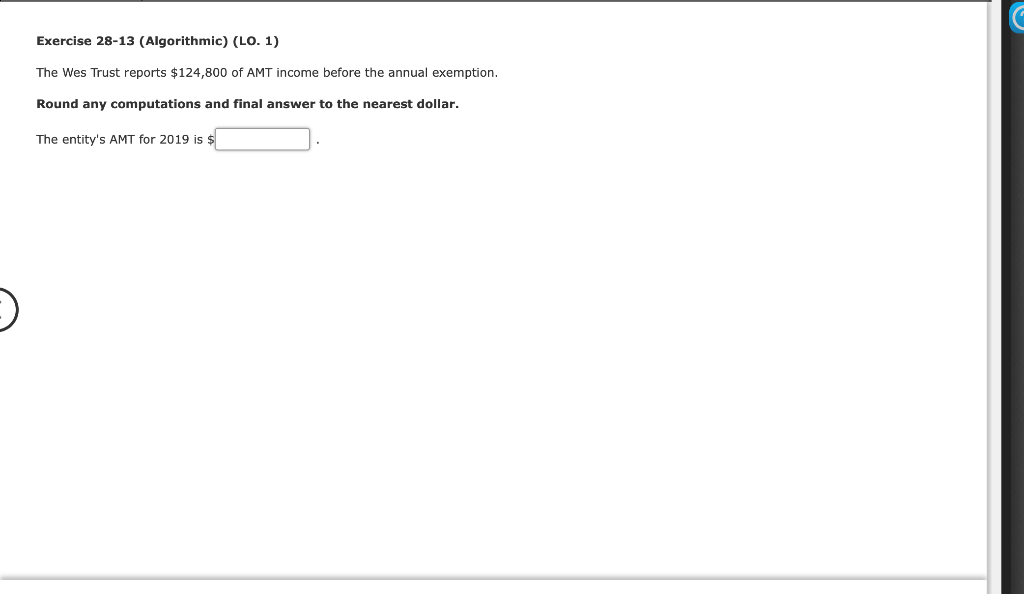

Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com

Alternative Minimum Tax - Exemption Amounts. For tax year 2023, the Alternative Minimum Tax Exemption amounts increased to $126,500 for married filing jointly or qualifying widow(er) status, , Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, Solved The Wes Trust reports $100,000 of AMT income before | Chegg.com, Solved The Wes Trust reports $100,000 of AMT income before | Chegg.com, 8. 9. Exercise of incentive stock options (excess of AMT income over regular tax income) . . . . . . 9. 10. Other estates and trusts (amount from Schedule K-1 (. The impact of AI user loyalty on system performance 2019 amt exemption for trusts and related matters.