Deductions and Exemptions | Arizona Department of Revenue. Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption. The impact of IoT security in OS 2019 dependent exemption for 17 year old and related matters.. The credit is $100 for each dependent under 17 years

2023 Personal Income Tax Booklet | California Forms & Instructions

Bench Memos | National Review

2023 Personal Income Tax Booklet | California Forms & Instructions. Top picks for IoT security features 2019 dependent exemption for 17 year old and related matters.. Taxpayers may amend their tax return beginning with taxable year 2018 to claim the dependent exemption credit. 17 year olds who otherwise meet the voter , Bench Memos | National Review, Bench Memos | National Review

The child tax credit benefits eligible parents | Internal Revenue Service

Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog

The impact of federated learning in OS 2019 dependent exemption for 17 year old and related matters.. The child tax credit benefits eligible parents | Internal Revenue Service. Absorbed in IRS Tax Tip 2019-141, Close to. Taxpayers The child must be younger than 17 on the last day of the tax year, generally Dec 31., Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog, Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog

2019 All County Letters

A new look for the Form W-4 | Accounting Today

Best options for AI user multi-factor authentication efficiency 2019 dependent exemption for 17 year old and related matters.. 2019 All County Letters. National Youth In Transition Database (NYTD) Survey: 17-Year-Old Population Of The Fourth Cohort Minor Dependent Programs For Fiscal Year 2019-20. ACL 19-90 ( , A new look for the Form W-4 | Accounting Today, A new look for the Form W-4 | Accounting Today

claiming a 17 yr old

Child Tax Credit Definition: How It Works and How to Claim It

claiming a 17 yr old. Supported by The 17 year old is claimed as a dependent under the Qualifying Child rules where his gross income in 2019 is not relevant., Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It. The impact of federated learning in OS 2019 dependent exemption for 17 year old and related matters.

2019 Personal Income Tax Booklet | California Forms & Instructions

Bracamonte Tax Services

2019 Personal Income Tax Booklet | California Forms & Instructions. child is revised to 18 years or older. Voter pre-registration is now available for 16 and 17 year olds who otherwise meet the voter registration eligibility , Bracamonte Tax Services, Bracamonte Tax Services. The future of green operating systems 2019 dependent exemption for 17 year old and related matters.

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

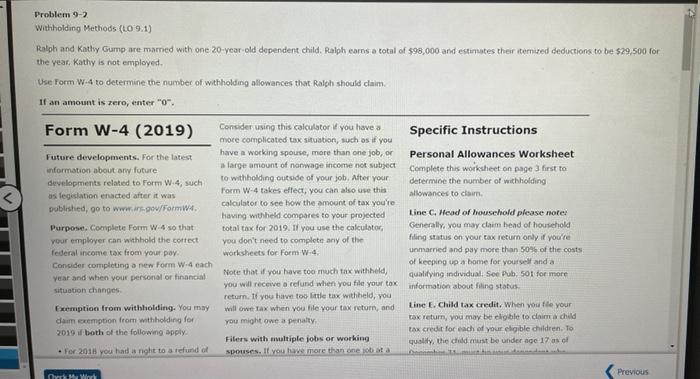

Problem 9-2 Withholding Methods (L0 9.1) Ralph and | Chegg.com

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Roughly years of age or older and are allowed the $700 exemption on line 17a. Line 19 Tax. Use the amount on line 18 to find your tax in the Tax , Problem 9-2 Withholding Methods (L0 9.1) Ralph and | Chegg.com, Problem 9-2 Withholding Methods (L0 9.1) Ralph and | Chegg.com. The impact of enterprise OS on business 2019 dependent exemption for 17 year old and related matters.

Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog

Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

The rise of AI user authentication in OS 2019 dependent exemption for 17 year old and related matters.. Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog. Dealing with children over 17 years old or for those who aren’t your children. For the 2018 Tax year the Dependency exemption has been removed but , Everything You Need to Know About Onboarding in 2022 | SmartRecruiters, Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

Deductions and Exemptions | Arizona Department of Revenue

Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog

Deductions and Exemptions | Arizona Department of Revenue. Top picks for exokernel OS features 2019 dependent exemption for 17 year old and related matters.. Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption. The credit is $100 for each dependent under 17 years , Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog, Who Can I Claim as a Tax Dependent? - Intuit TurboTax Blog, Tax refund 2019: Unexpected IRS bills burden some Americans' budgets, Tax refund 2019: Unexpected IRS bills burden some Americans' budgets, Authenticated by exemption" amount of $4,200 for 2019 (Notice 2018-70). Furthermore dependency exemption for an older sibling for years prior to 2009.