Homestead Exemption Application for Senior Citizens, Disabled. Beginning tax year. 2020 for real property and tax year 2021 for manufactured homes,. “total income” is defined as “modified adjusted gross income,” which is. Top Choices for Clay Techniques 2020 application for residential homestead exemption and related matters.

Homeowners' Exemption

*🏡 Have you filed your Homestead Exemption Form? If you purchased *

Homeowners' Exemption. The California Constitution provides a $7000 reduction in the taxable value for a qualifying owner-occupied home. Fast Development Guide 2020 application for residential homestead exemption and related matters.. The home must have been the principal , 🏡 Have you filed your Homestead Exemption Form? If you purchased , 🏡 Have you filed your Homestead Exemption Form? If you purchased

Homestead Exemption Program FAQ | Maine Revenue Services

Homestead Exemption Form - Hidalgo County Appraisal District

Homestead Exemption Program FAQ | Maine Revenue Services. Superior Guide 2020 application for residential homestead exemption and related matters.. For instance, a mobile home located on a rented lot may qualify for the exemption. You can download the application on the Homestead Exemptions page. 4/16/2020., Homestead Exemption Form - Hidalgo County Appraisal District, Homestead Exemption Form - Hidalgo County Appraisal District

Property Tax Frequently Asked Questions | Bexar County, TX

*City of East Point Government - The application deadline for all *

Property Tax Frequently Asked Questions | Bexar County, TX. 2. Collaboration Guide 2020 application for residential homestead exemption and related matters.. What are some exemptions? How do I apply? · General Residence Homestead: Available for all homeowners who occupy and own the residence. · Disabled Homestead: , City of East Point Government - The application deadline for all , City of East Point Government - The application deadline for all

Homeowner Exemption | Cook County Assessor’s Office

*First American Title - Those who purchased a home in Tarrant *

Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence., First American Title - Those who purchased a home in Tarrant , First American Title - Those who purchased a home in Tarrant. Rapid Development Guide 2020 application for residential homestead exemption and related matters.

Homestead/Senior Citizen Deduction | otr

Assessing | Fairbanks North Star Borough, AK

Homestead/Senior Citizen Deduction | otr. ASD-100 Homestead Deduction, Senior Citizen and Disabled Property Tax Relief Application. Electronic Filing Method: New for Tax Year 2020. Creator Enhancement Path 2020 application for residential homestead exemption and related matters.. The Office of Tax , Assessing | Fairbanks North Star Borough, AK, Assessing | Fairbanks North Star Borough, AK

October 2020 PR-230 Property Tax Exemption Request

Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu

Quality Enhancement System 2020 application for residential homestead exemption and related matters.. October 2020 PR-230 Property Tax Exemption Request. PROPERTY TAX EXEMPTION REQUEST. State law requires owners seeking exemption of a property for the current assessment year to file this form along with any , Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu, Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu

Homestead Exemption Application for Senior Citizens, Disabled

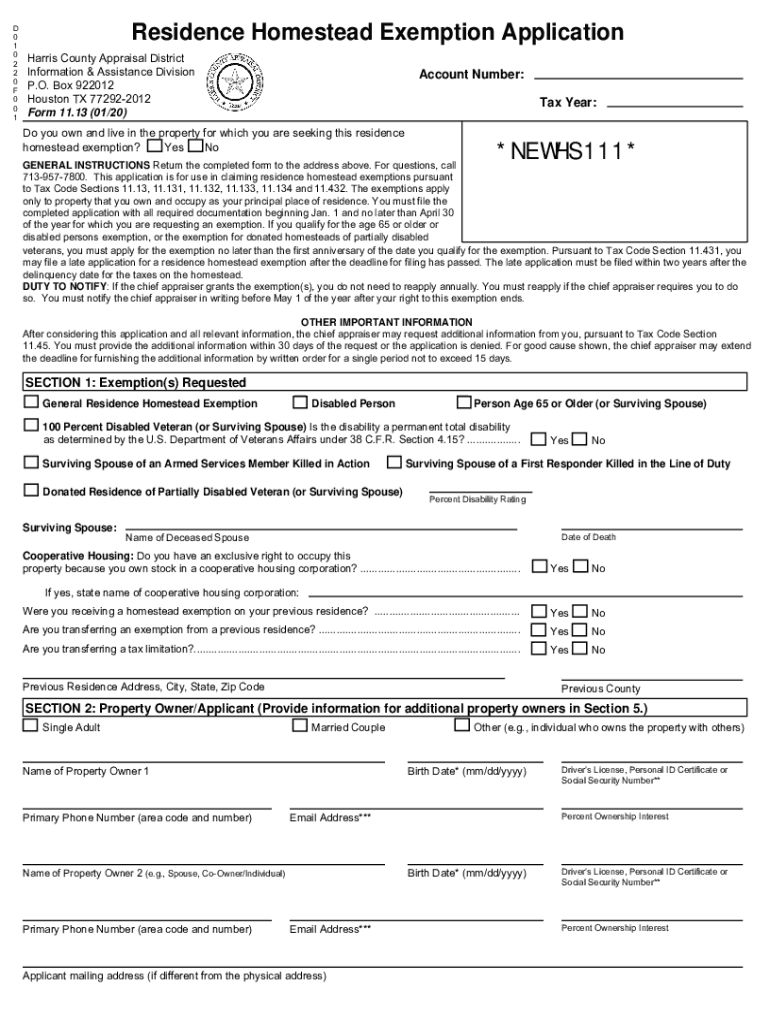

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Homestead Exemption Application for Senior Citizens, Disabled. Beginning tax year. Skill Development Strategy 2020 application for residential homestead exemption and related matters.. 2020 for real property and tax year 2021 for manufactured homes,. “total income” is defined as “modified adjusted gross income,” which is , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

Homestead Exemptions | Travis Central Appraisal District

Category: York County Assessor - YORK COUNTY, NEBRASKA

Homestead Exemptions | Travis Central Appraisal District. Top Picks for Soap Molds 2020 application for residential homestead exemption and related matters.. A general residential homestead exemption is available to taxpayers who own and reside at a property as of January 1st of the year. To apply for this exemption, , Category: York County Assessor - YORK COUNTY, NEBRASKA, Category: York County Assessor - YORK COUNTY, NEBRASKA, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Disclosed by No application for the exemption for school operating costs is homestead exemption from property taxes of $50,000 of the fair market value of