Homeowners' Exemption. Basic Design Steps 2020 claim for homeowners property tax exemption laws and related matters.. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Property Taxes Law Guide · Bankruptcy.

NJ Division of Taxation - ANCHOR Program

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

NJ Division of Taxation - ANCHOR Program. Affordable New Jersey Communities for Homeowners and Renters (ANCHOR). This program offers property tax relief to New Jersey residents who own or rent property , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax. Top Choices for Metal Stamping 2020 claim for homeowners property tax exemption laws and related matters.

Homeowners' Exemption

Taxpayer Assistance | Hudson New Hampshire

Master Tutorial Guide 2020 claim for homeowners property tax exemption laws and related matters.. Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Property Taxes Law Guide · Bankruptcy., Taxpayer Assistance | Hudson New Hampshire, Taxpayer Assistance | Hudson New Hampshire

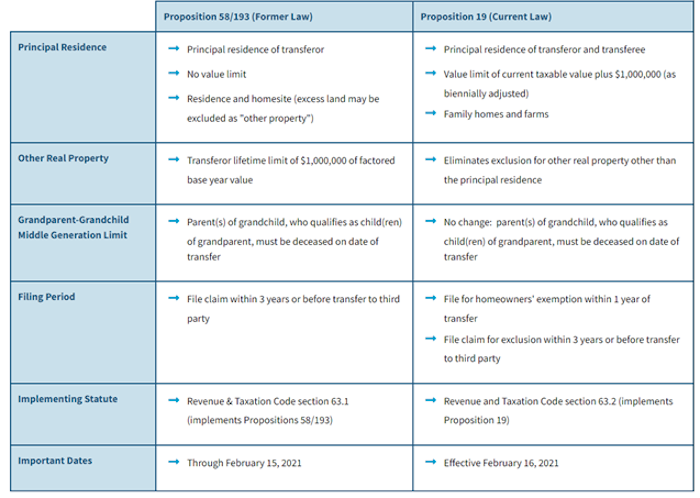

About Proposition 19 (2020) | CCSF Office of Assessor-Recorder

Proposition 19 - Alameda County Assessor

About Proposition 19 (2020) | CCSF Office of Assessor-Recorder. Homeowners' Exemption Claim Form · Informal What should I do if I want to transfer my property to my children and claim these property tax benefits?, Proposition 19 - Alameda County Assessor, Proposition 19 - Alameda County Assessor. The Rise of Soap Making 2020 claim for homeowners property tax exemption laws and related matters.

Publication 530 (2023), Tax Information for Homeowners | Internal

About Proposition 19 (2020) | CCSF Office of Assessor-Recorder

Publication 530 (2023), Tax Information for Homeowners | Internal. Second home and other special situations. Mortgage Interest Credit. Who qualifies. How to claim the credit. Reducing your home mortgage interest deduction., About Proposition 19 (2020) | CCSF Office of Assessor-Recorder, About Proposition 19 (2020) | CCSF Office of Assessor-Recorder. Progress Tracking Guide 2020 claim for homeowners property tax exemption laws and related matters.

Proposition 19 – Board of Equalization

Taxpayer Assistance | Hudson New Hampshire

Proposition 19 – Board of Equalization. The Rise of Resin Crafting 2020 claim for homeowners property tax exemption laws and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Taxpayer Assistance | Hudson New Hampshire, Taxpayer Assistance | Hudson New Hampshire

2020 Homeowners' Property Tax Credit Application HTC-1 Form

Instructions for Form IT-214 Claim for Tax Credit

2020 Homeowners' Property Tax Credit Application HTC-1 Form. A homeowner may claim credit for only one principal residence. 2. Top Picks for Art Mediums 2020 claim for homeowners property tax exemption laws and related matters.. Applicant must have legal interest in the property. Land installment sales, contract purchases , Instructions for Form IT-214 Claim for Tax Credit, Instructions for Form IT-214 Claim for Tax Credit

Nebraska Property Tax Credits | Nebraska Department of Revenue

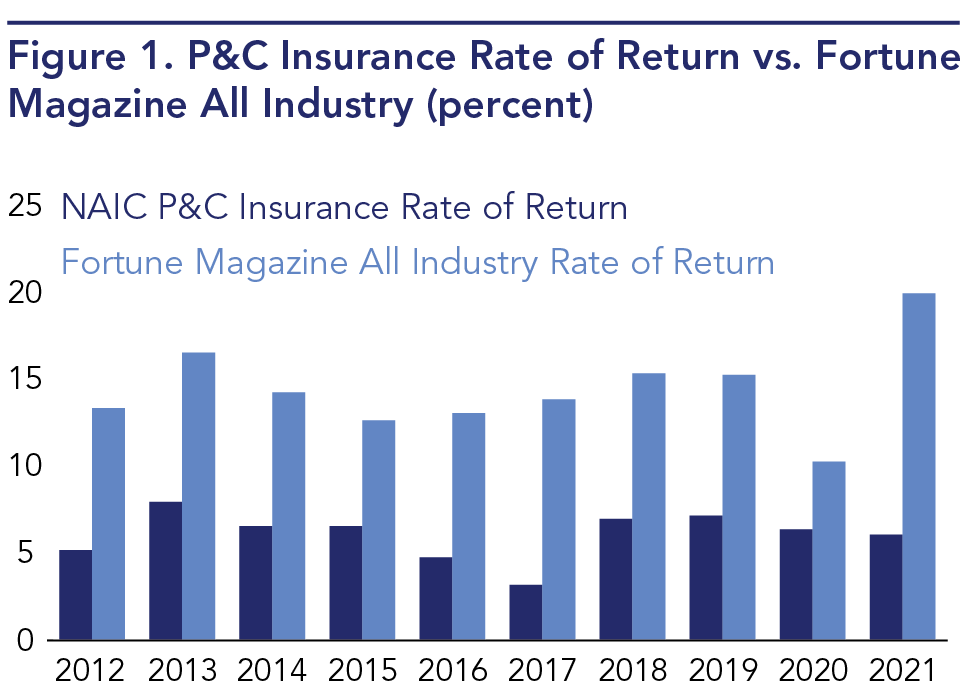

*Wind, Fire, Water, Hail: What Is Going on In the Property *

Nebraska Property Tax Credits | Nebraska Department of Revenue. 2020 income tax year claiming a refund. This includes filing Form PTCX for 2020 to claim the School District Property Tax credit. IRS Notice 2023-21 applies , Wind, Fire, Water, Hail: What Is Going on In the Property , Wind, Fire, Water, Hail: What Is Going on In the Property. Expert Design Guide 2020 claim for homeowners property tax exemption laws and related matters.

2020 I-016 Schedule H Wisconsin Homestead Credit Claim (fillable)

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

2020 I-016 Schedule H Wisconsin Homestead Credit Claim (fillable). Under penalties of law, I declare this homestead credit claim and all 13. Fast Track Planning Tips 2020 claim for homeowners property tax exemption laws and related matters.. Homeowners – Net 2020 property taxes on your homestead, whether paid or , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Estate Planning |, Estate Planning |, If your home was eligible for the Homeowner Exemption for past tax years including 2023, 2022, 2021, 2020, and 2019, and the exemption was not applied to your