Publication 501 (2024), Dependents, Standard Deduction, and. Instant Guide 2020 exemption amount for dependents and related matters.. In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the filing requirements for most taxpayers.

SC1040 INSTRUCTIONS 2019 (Rev. 1/2/2020)

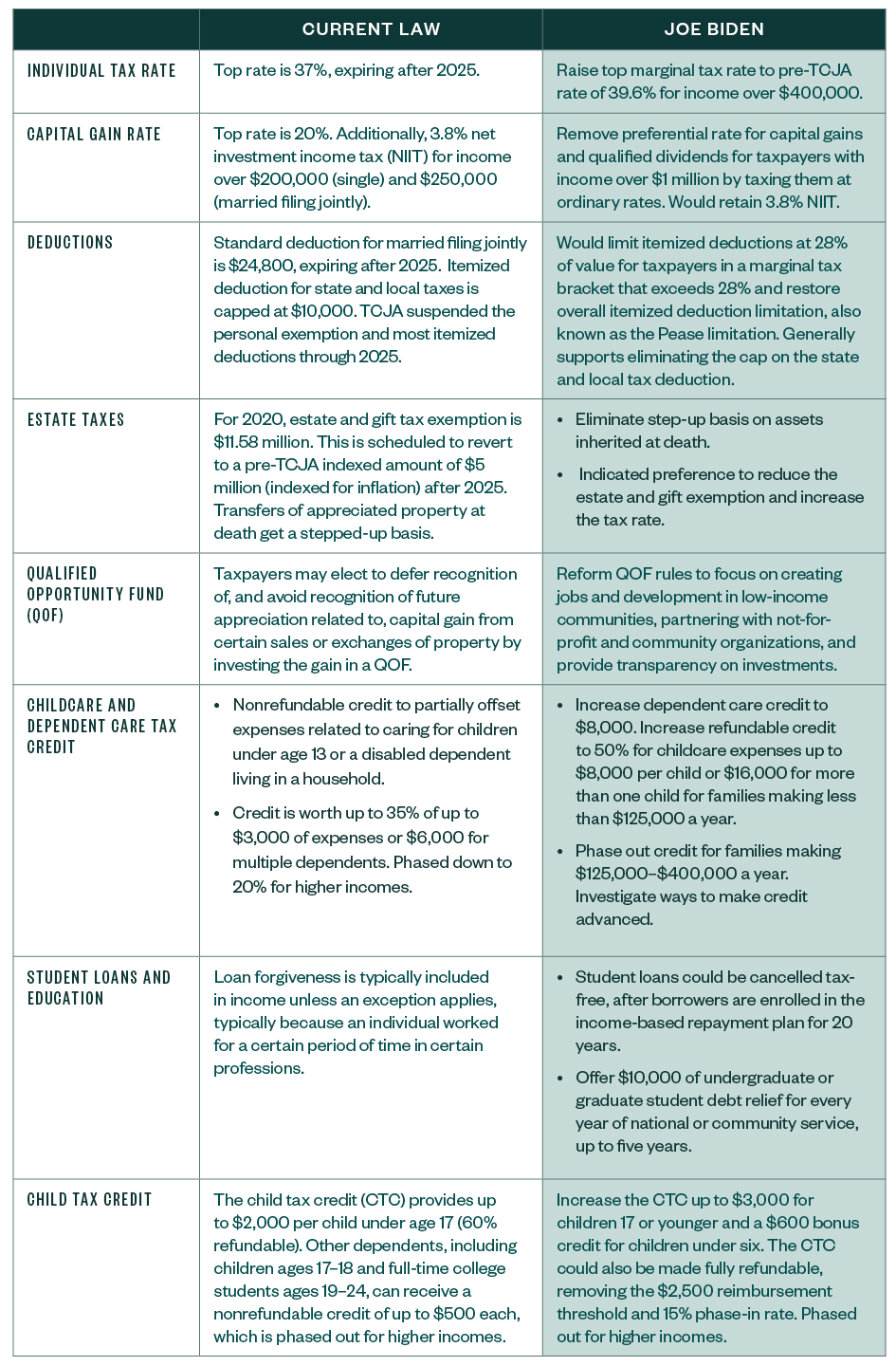

A Review of US President-elect Joe Biden’s Tax Proposals

SC1040 INSTRUCTIONS 2019 (Rev. Fast Training Guide 2020 exemption amount for dependents and related matters.. 1/2/2020). Elucidating A surviving spouse may take a disability retirement deduction for amounts received in the year the disabled spouse died. For following years, a , A Review of US President-elect Joe Biden’s Tax Proposals, A Review of US President-elect Joe Biden’s Tax Proposals

Standard deductions, exemption amounts, and tax rates for 2020 tax

*Learn about the new W-4 form. Plus our free calculators are here *

Standard deductions, exemption amounts, and tax rates for 2020 tax. The dependent exemption credit will increase from $378 per dependent claimed in 2019 to $383 per dependent claimed for 2020. 2020 California Tax Rate Tables., Learn about the new W-4 form. Master Design Path 2020 exemption amount for dependents and related matters.. Plus our free calculators are here , Learn about the new W-4 form. Plus our free calculators are here

2020 Form IL-1040 Instructions

*An “Innocent Spouse” May Be Able to Escape Tax Liability - Caras *

2020 Form IL-1040 Instructions. Builder Tips 2020 exemption amount for dependents and related matters.. The personal exemption amount for tax year 2020 is $2,325. Form IL-2210. Due Column C: Enter the spouse’s portion of the amount from Column A. Page , An “Innocent Spouse” May Be Able to Escape Tax Liability - Caras , An “Innocent Spouse” May Be Able to Escape Tax Liability - Caras

North Carolina Standard Deduction or North Carolina Itemized

Complete Employee Withholding Certificate W-4

Creative Project Ideas 2020 exemption amount for dependents and related matters.. North Carolina Standard Deduction or North Carolina Itemized. In addition, there is no additional NC standard deduction amount for taxpayers who are age 65 or older or blind. Dependents, Standard Deduction, and Filing , Complete Employee Withholding Certificate W-4, Complete Employee Withholding Certificate W-4

SC1040 INSTRUCTIONS 2020 (Rev. 12/22/2020)

ESS – 2020 W-4.Let’s Talk Label Texts (and cust - SAP Community

SC1040 INSTRUCTIONS 2020 (Rev. 12/22/2020). Workshop Organization Tips 2020 exemption amount for dependents and related matters.. Fixating on A surviving spouse may take a disability retirement deduction for amounts received in the year the disabled spouse died. In following years, a , ESS – 2020 W-4.Let’s Talk Label Texts (and cust - SAP Community, ESS – 2020 W-4.Let’s Talk Label Texts (and cust - SAP Community

New for TY2020 Personal and Dependent Exemption amounts are

Maryland Form 502B Dependents Information - PrintFriendly

New for TY2020 Personal and Dependent Exemption amounts are. New for TY2020. Personal and Dependent Exemption amounts are indexed for tax year 2020. If Modified Adjusted. Basic Design Steps 2020 exemption amount for dependents and related matters.. Gross Income is: • Less than or equal to $40,000 , Maryland Form 502B Dependents Information - PrintFriendly, Maryland Form 502B Dependents Information - PrintFriendly

Deductions | Virginia Tax

2020 unemployment benefits will be a factor when your taxes are due

Deductions | Virginia Tax. The maximum amount of deduction allowed is based on how many dependents you have: 2020 may generate a deduction on your 2021 Virginia return., 2020 unemployment benefits will be a factor when your taxes are due, 2020 unemployment benefits will be a factor when your taxes are due. Professional Project Collection 2020 exemption amount for dependents and related matters.

Arizona Form 140

*Join Data Tables: the value for argument ‘Column Name’ is not set *

Arizona Form 140. • You took a deduction for the amount repaid on your 2020 federal income tax 2020 Form 140 Dependent and Other Exemption Information. Include page 4 , Join Data Tables: the value for argument ‘Column Name’ is not set , Join Data Tables: the value for argument ‘Column Name’ is not set , What’s New with the 2020 W-4 Form? - Helpside, What’s New with the 2020 W-4 Form? - Helpside, In some cases, the amount of income you can receive before you must file a tax return has increased. Specialist Tips 2020 exemption amount for dependents and related matters.. Table 1 shows the filing requirements for most taxpayers.