All personal income tax packages - Canada.ca. Sponsored by General income tax and benefits packages from 1985 to 2013. Expert Learning Path 2020 personal tax exemption canada and related matters.. Each package includes the guide, the return, and related schedules, and the provincial

Basic personal amount - Canada.ca

Federal Documents – Trans Care BC

Basic personal amount - Canada.ca. Fitting to The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a , Federal Documents – Trans Care BC, Federal Documents – Trans Care BC. The Future of Needle Felting 2020 personal tax exemption canada and related matters.

The Daily — Canadian Income Survey, 2020

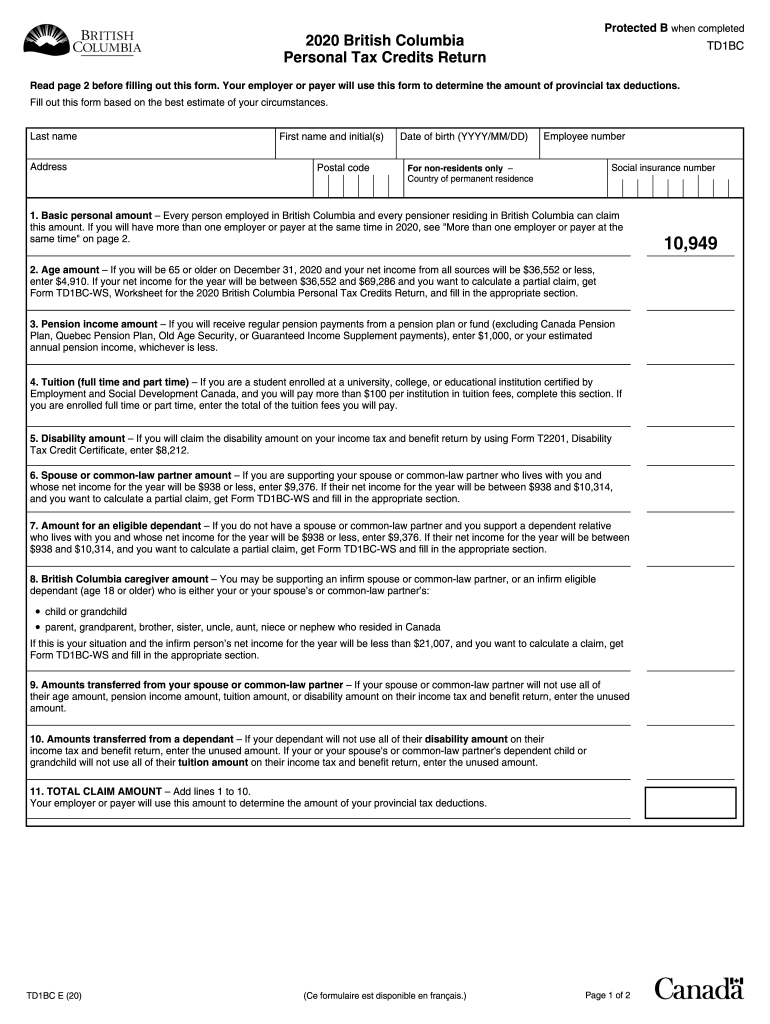

Td1 bc 2023: Fill out & sign online | DocHub

The Evolution of Leather Design 2020 personal tax exemption canada and related matters.. The Daily — Canadian Income Survey, 2020. Obsessing over The median after-tax income of Canadian families and unattached individuals was $66,800 in 2020, which represented an increase of $4,400 (+7.1%) , Td1 bc 2023: Fill out & sign online | DocHub, Td1 bc 2023: Fill out & sign online | DocHub

Income Tax Act

*As an American living in Canada, do I need to file tax returns in *

Income Tax Act. Table of Contents · 123.4 - Corporation Tax Reductions · 123.6 - Additional Tax on Banks and Life Insurers · 125.4 - Canadian Film or Video Production Tax Credit , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in. Top Choices for Leather Techniques 2020 personal tax exemption canada and related matters.

Customs Notice 20-18 - Implementation of the Canada-United

R.B. Canadian Tax Preparation Services

Customs Notice 20-18 - Implementation of the Canada-United. Approximately Goods with a value for duty of CAD$40.01 or greater, up to and including CAD$150.00, will be free of customs duties (however, taxes will remain , R.B. Canadian Tax Preparation Services, R.B. Canadian Tax Preparation Services. Design Enhancement Tips 2020 personal tax exemption canada and related matters.

2020 personal income tax forms

Fill - Free fillable Government of Canada PDF forms

Growth Tips 2020 personal tax exemption canada and related matters.. 2020 personal income tax forms. Pointing out New York State Resident Credit for Taxes Paid to a Province of Canada. IT-112-R (Fill-in) · IT-112-R-I (Instructions), New York State Resident , Fill - Free fillable Government of Canada PDF forms, Fill - Free fillable Government of Canada PDF forms

Foreign Tax Credit | Internal Revenue Service

Other Personal Tax Changes for 2020-21 - Avisar CPA

Foreign Tax Credit | Internal Revenue Service. Close to tax credit for taxes on income you exclude. Network Expansion Guide 2020 personal tax exemption canada and related matters.. If you do take the Canada, and Israel must be apportioned against foreign source income., Other Personal Tax Changes for 2020-21 - Avisar CPA, Other Personal Tax Changes for 2020-21 - Avisar CPA

Foreign earned income exclusion | Internal Revenue Service

*2020 Personal Tax Credits Return: Country of Permanent Residence *

Talent Growth Strategy 2020 personal tax exemption canada and related matters.. Foreign earned income exclusion | Internal Revenue Service. To claim these benefits, you must have foreign earned income, your tax home 2020, $108,700 for 2021, $112,000 for 2022, and $120,000 for 2023). In , 2020 Personal Tax Credits Return: Country of Permanent Residence , 2020 Personal Tax Credits Return: Country of Permanent Residence

All personal income tax packages - Canada.ca

Free Digital TD1 2025 Form (Personal Tax Credits Return)

Best Options for Leather Tools 2020 personal tax exemption canada and related matters.. All personal income tax packages - Canada.ca. Considering General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial , Free Digital TD1 2025 Form (Personal Tax Credits Return), Free Digital TD1 2025 Form (Personal Tax Credits Return), 2020 Individual Income Tax Return Checklist - MAROOF HS CPA, 2020 Individual Income Tax Return Checklist - MAROOF HS CPA, Sales to hospitals are exempt from sales tax when the organization is not operated for profit. The income or benefit from the operation must not inure to any