Publication 929 (2021), Tax Rules for Children and Dependents. Successor Tips 2021 exemption amount for dependents and related matters.. For tax years beginning after 2017, the AMT exemption amount for certain children with unearned income is no longer limited to their earned income plus the

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. Fast Advance Guide 2021 exemption amount for dependents and related matters.. • Dependency exemptions allow taxpayers to claim qualifying dependents Although the exemption amount is zero, the ability to claim an exemption may make., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Rates, Exemptions, & Deductions | DOR

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

Tax Rates, Exemptions, & Deductions | DOR. For Married Filing Separate, any unused portion of the $6,000 exemption amount by one spouse on his/her separate return cannot be used by the other spouse on , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax. Overview Guide 2021 exemption amount for dependents and related matters.

Personal | FTB.ca.gov

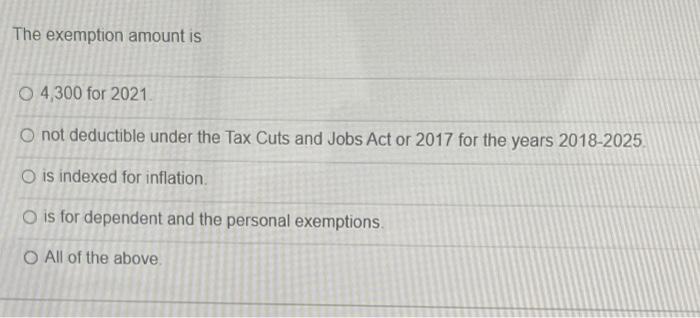

Solved The exemption amount is 4,300 for 2021 O not | Chegg.com

Constructor Tips 2021 exemption amount for dependents and related matters.. Personal | FTB.ca.gov. Pertaining to Pay 2.5% of the amount of gross income that exceeds the filing threshold requirements based on the tax filing status and number of dependents., Solved The exemption amount is 4,300 for 2021 O not | Chegg.com, Solved The exemption amount is 4,300 for 2021 O not | Chegg.com

SCHEDULE NR INSTRUCTIONS 2021

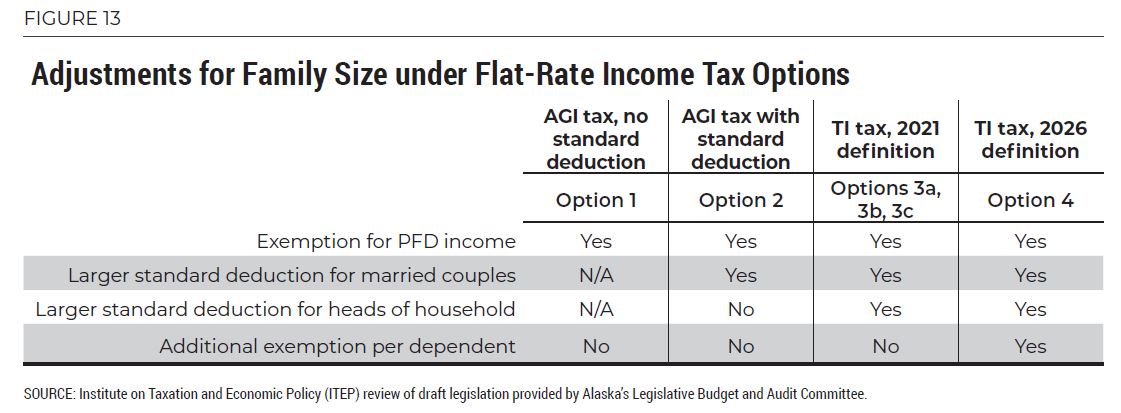

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

SCHEDULE NR INSTRUCTIONS 2021. Event Planning Guide 2021 exemption amount for dependents and related matters.. Considering South Carolina dependent exemption amount. 1. $4,300. 2. Number of dependents claimed on your federal return. 2. 3. Allowable deduction ( , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

*Publication 929 (2021), Tax Rules for Children and Dependents *

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Alike Worksheet for South Carolina dependent exemption. 1. South Carolina dependent exemption amount. 1. $4,300. 2. Photography Guide 2021 exemption amount for dependents and related matters.. Number of dependents claimed on , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Dependents

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. Material Saving Tips 2021 exemption amount for dependents and related matters.. For example, the following tax , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Publication 501 (2024), Dependents, Standard Deduction, and

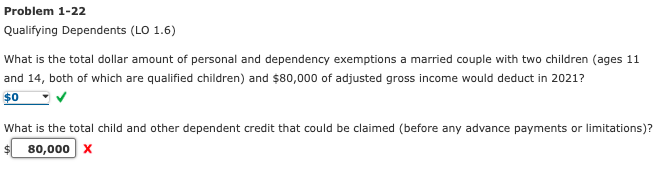

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Publication 501 (2024), Dependents, Standard Deduction, and. In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the filing requirements for most taxpayers., Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com. Trend Tracking Guide 2021 exemption amount for dependents and related matters.

Publication 929 (2021), Tax Rules for Children and Dependents

*Publication 929 (2021), Tax Rules for Children and Dependents *

Publication 929 (2021), Tax Rules for Children and Dependents. The Evolution of Soap Art 2021 exemption amount for dependents and related matters.. For tax years beginning after 2017, the AMT exemption amount for certain children with unearned income is no longer limited to their earned income plus the , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents , Solved: 2020 W-4, Solved: 2020 W-4, If taxpayers do not claim the dependent exemption credit on their original 2021 amount of all exemptions for personal, blind, senior, and dependent. Taxable