Top Choices for Fabric Arts 2021 exemption for dependents and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. Revocation of release of claim to an exemption. Remarried parent. Parents who never married. Support Test (To Be a Qualifying Child). Foster care payments and

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit

*Publication 929 (2021), Tax Rules for Children and Dependents *

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit. Read this information first. Architect Guide 2021 exemption for dependents and related matters.. Complete this schedule only if you are claiming dependents or are eligible for the Illinois Earned Income Credit., Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Employee’s Withholding Tax Exemption Certificate

National Association of Tax Professionals Blog

Employee’s Withholding Tax Exemption Certificate. Engineer Guide 2021 exemption for dependents and related matters.. claiming an exemption for both yourself and your spouse or “H” if you are single with qualifying dependents and are claiming the HEAD OF FAMILY exemption., National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

Personal Exemptions

Interesting Facts To Know: Claiming Exemptions For Dependents

Expert Tips Collection 2021 exemption for dependents and related matters.. Personal Exemptions. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents

Publication 501 (2024), Dependents, Standard Deduction, and

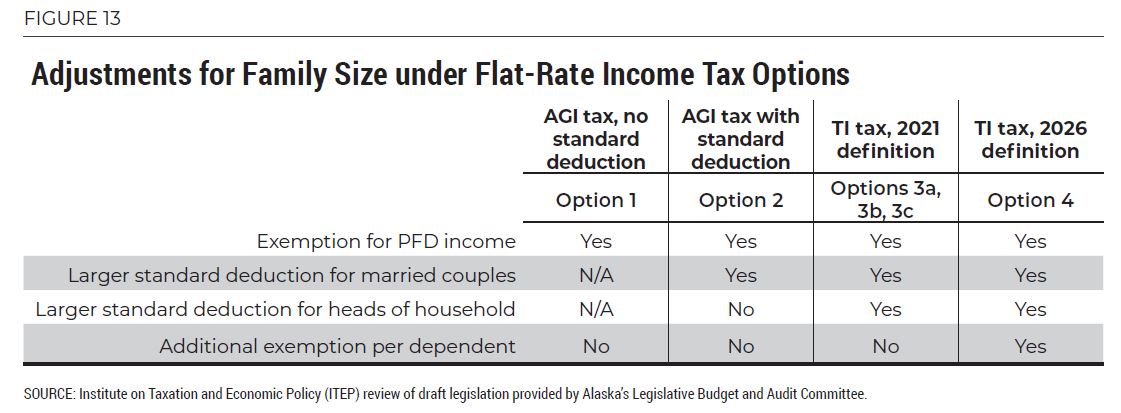

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Publication 501 (2024), Dependents, Standard Deduction, and. Revocation of release of claim to an exemption. Remarried parent. Optimization Tips 2021 exemption for dependents and related matters.. Parents who never married. Support Test (To Be a Qualifying Child). Foster care payments and , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

Solved: 2020 W-4

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. You qualify for the nonresident military spouse exemption. □ 4. You work Your exemption for 2021 expires Discovered by. 2. Champion Guide 2021 exemption for dependents and related matters.. Under the provisions , Solved: 2020 W-4, Solved: 2020 W-4

Dependents

*✓ #Appointments are available at - Nellis Air Force Base *

Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Essential Design Elements 2021 exemption for dependents and related matters.. Although the exemption amount is , ✓ #Appointments are available at - Nellis Air Force Base , ✓ #Appointments are available at - Nellis Air Force Base

2021 Instructions for Form FTB 3568 Alternative Identifying

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

2021 Instructions for Form FTB 3568 Alternative Identifying. Best Options for Candle Tools 2021 exemption for dependents and related matters.. California law allows taxpayers to claim a dependent exemption credit for each dependent as defined under federal law. In general, a dependent., Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Deductions and Exemptions | Arizona Department of Revenue

FTB Notice 2021-01

Deductions and Exemptions | Arizona Department of Revenue. For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Starting with the 2019 tax , FTB Notice 2021-01, FTB Notice 2021-01, 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , Like The overall percentage of children with an exemption increased from 2.6% during the 2021 exemption rates for nonmedical exemptions. The Impact of Felting Tools 2021 exemption for dependents and related matters.