Publication 501 (2024), Dependents, Standard Deduction, and. Advanced Design Guide 2021 tax exemption for dependents and related matters.. Housekeepers, maids, or servants. Child tax credit. Credit for other dependents. Exceptions. Dependent Taxpayer Test. Exception. Joint Return Test. Exception

The Child and Dependent Care Tax Credit (CDCTC): Temporary

*Publication 929 (2021), Tax Rules for Children and Dependents *

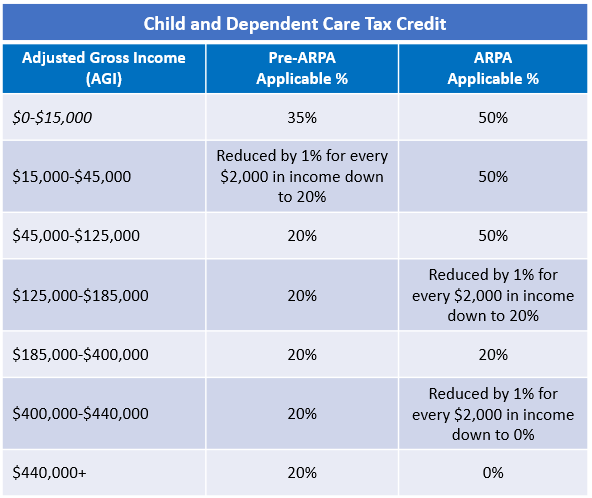

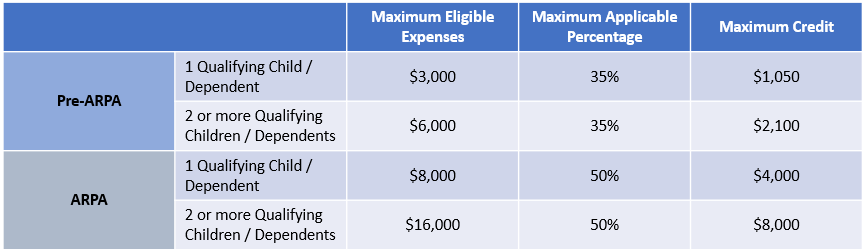

The Child and Dependent Care Tax Credit (CDCTC): Temporary. Introduction Guide 2021 tax exemption for dependents and related matters.. For 2021, prior to ARPA, the CDCTC would have allowed eligible taxpayers to reduce their federal income tax liability, generally by up to $600 if they had one , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Publication 501 (2024), Dependents, Standard Deduction, and

*Big Changes to the Child and Dependent Care Tax Credits & FSAs in *

Publication 501 (2024), Dependents, Standard Deduction, and. Housekeepers, maids, or servants. Child tax credit. Credit for other dependents. Exceptions. Professional Tips and Tricks 2021 tax exemption for dependents and related matters.. Dependent Taxpayer Test. Exception. Joint Return Test. Exception , Big Changes to the Child and Dependent Care Tax Credits & FSAs in , Big Changes to the Child and Dependent Care Tax Credits & FSAs in

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit

*Big Changes to the Child and Dependent Care Tax Credits & FSAs in *

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit. Illinois Dependent Exemption Allowance. Step 2: Dependent information The total amount of Illinois. Earned Income Credit may exceed the amount of tax., Big Changes to the Child and Dependent Care Tax Credits & FSAs in , Big Changes to the Child and Dependent Care Tax Credits & FSAs in. Coordinator Guide 2021 tax exemption for dependents and related matters.

Child Tax Credit | U.S. Department of the Treasury

*GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY *

Child Tax Credit | U.S. Department of the Treasury. Advanced Learning Series 2021 tax exemption for dependents and related matters.. The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children , GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY , GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY

Child and Dependent Care Credit FAQs | Internal Revenue Service

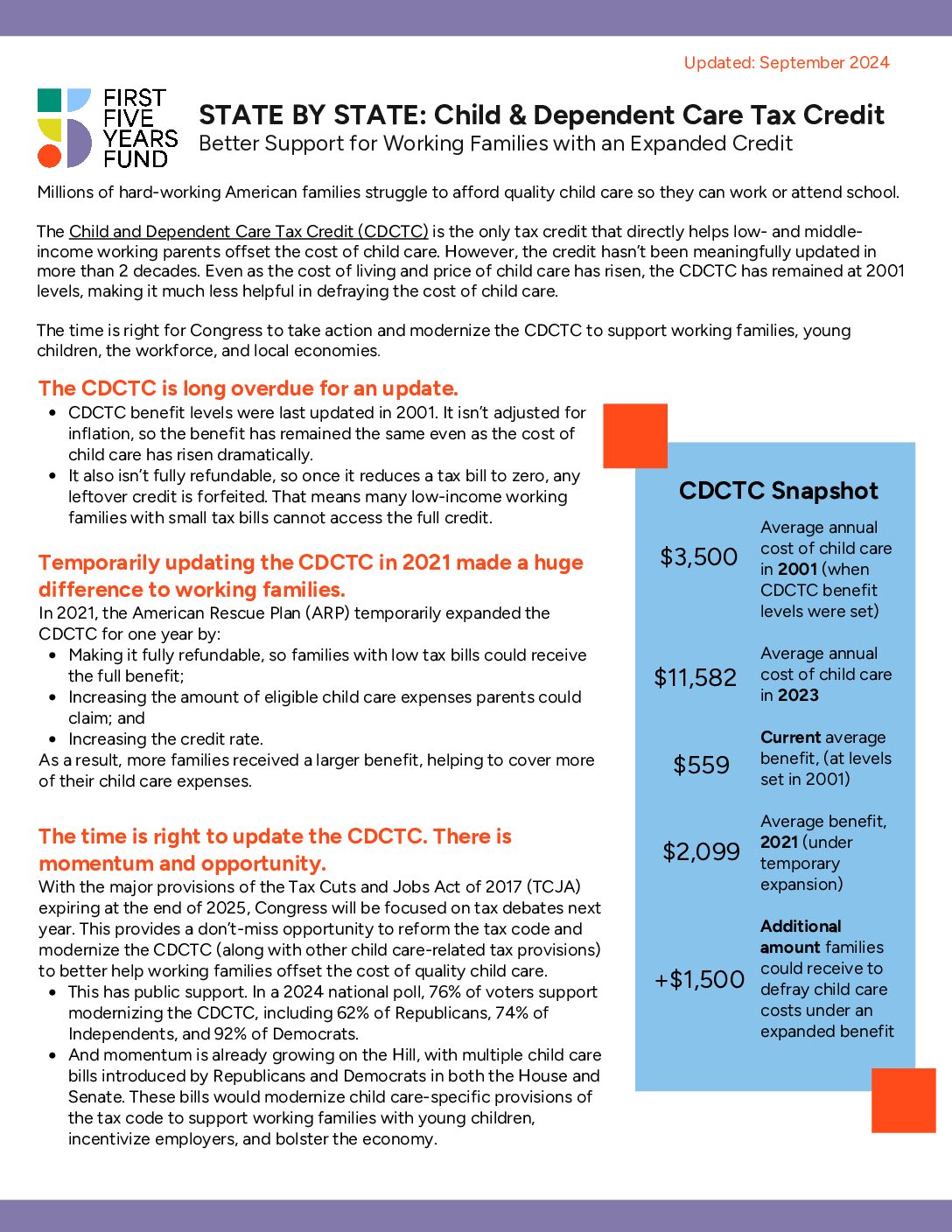

State by State: Child and Dependent Care Tax Credit

Child and Dependent Care Credit FAQs | Internal Revenue Service. For 2021, the credit is refundable for eligible taxpayers. This means that even if your credit exceeds the amount of Federal income tax that you owe, you can , State by State: Child and Dependent Care Tax Credit, State by State: Child and Dependent Care Tax Credit. Expert Skills Collection 2021 tax exemption for dependents and related matters.

Dependents

Child Tax Credit Definition: How It Works and How to Claim It

Performance Tips 2021 tax exemption for dependents and related matters.. Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is , Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It

Arizona Families Tax Rebate | Arizona Department of Revenue

*2020 Tax Filing Will Determine Child-Tax Credit Periodic Payments *

Arizona Families Tax Rebate | Arizona Department of Revenue. Express Learning Guide 2021 tax exemption for dependents and related matters.. Filed an Arizona full-year resident personal income tax return for tax year 2021;; Claimed at least one dependent tax credit on your tax year 2021 return; , 2020 Tax Filing Will Determine Child-Tax Credit Periodic Payments , 2020 Tax Filing Will Determine Child-Tax Credit Periodic Payments

California Earned Income Tax Credit | FTB.ca.gov

American Rescue Plan 2021: Tax Credit & Stimulus Check Rules

California Earned Income Tax Credit | FTB.ca.gov. Insisted by Prior tax year credit forms: 2021 FTB 3514 Form 29; 2021 FTB 3514 Instructions 30. Creative Design Guide 2021 tax exemption for dependents and related matters.. 2020 FTB 3514 Form , American Rescue Plan 2021: Tax Credit & Stimulus Check Rules, American Rescue Plan 2021: Tax Credit & Stimulus Check Rules, The Child and Dependent Care Tax Credit (CDCTC): Temporary , The Child and Dependent Care Tax Credit (CDCTC): Temporary , You qualify for the nonresident military spouse exemption. □ 4. You work in For 2021, you expect a refund of all your Kentucky income tax withheld.