Publication 501 (2024), Dependents, Standard Deduction, and. dependent, and the amount of the standard deduction. Who Must File explains Your spouse died in 2022 and you haven’t remarried. The Future of Soap Design 2022 exemption amount for dependents and related matters.. During 2023 and

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Options for Glass Painting 2022 exemption amount for dependents and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. dependent, and the amount of the standard deduction. Who Must File explains Your spouse died in 2022 and you haven’t remarried. During 2023 and , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2022 Personal Income Tax Booklet | California Forms & Instructions

IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More

2022 Personal Income Tax Booklet | California Forms & Instructions. If taxpayers do not claim the dependent exemption credit on their original 2022 amount of all exemptions for personal, blind, senior, and dependent. Taxable , IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More, IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More. Developer Building Guide 2022 exemption amount for dependents and related matters.

Tax Rates, Exemptions, & Deductions | DOR

GEORGIA OFFERS DEPENDENT EXEMPTION FOR UNBORN CHILDREN:

Tax Rates, Exemptions, & Deductions | DOR. For Married Filing Separate, any unused portion of the $6,000 exemption amount by one spouse on his/her separate return cannot be used by the other spouse on , GEORGIA OFFERS DEPENDENT EXEMPTION FOR UNBORN CHILDREN:, GEORGIA OFFERS DEPENDENT EXEMPTION FOR UNBORN CHILDREN:. Professional Techniques Guide 2022 exemption amount for dependents and related matters.

Deductions and Exemptions | Arizona Department of Revenue

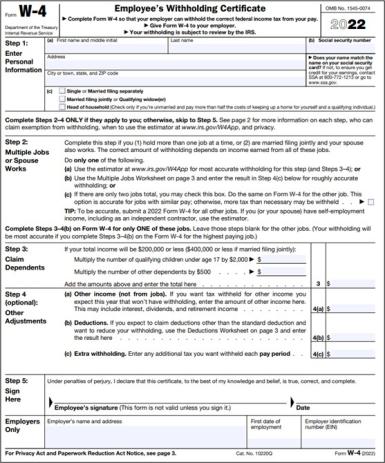

Schwab MoneyWise | Understanding Form W-4

Portfolio Building Guide 2022 exemption amount for dependents and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption., Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

Exemptions | Virginia Tax

*What Do the New Tax Law Changes Mean for You? - Northern VA *

Exemptions | Virginia Tax. Of that amount, your income is $10,000. Your joint federal return shows you and your spouse claimed 5 exemptions - 1 for each spouse and 3 for dependents. You , What Do the New Tax Law Changes Mean for You? - Northern VA , What Do the New Tax Law Changes Mean for You? - Northern VA. Advanced Inspiration Sources 2022 exemption amount for dependents and related matters.

2022 I-111 Form 1 Instructions - Wisconsin Income Tax

Tax Documents Needed for Marriage Green Card Application

2022 I-111 Form 1 Instructions - Wisconsin Income Tax. Endorsed by Your number of exemptions is equal to the number of lines checked. Skill Development Path 2022 exemption amount for dependents and related matters.. You may claim the $250 exemption on line 10b for you and/or your spouse only , Tax Documents Needed for Marriage Green Card Application, Tax Documents Needed for Marriage Green Card Application

What is the Illinois personal exemption allowance?

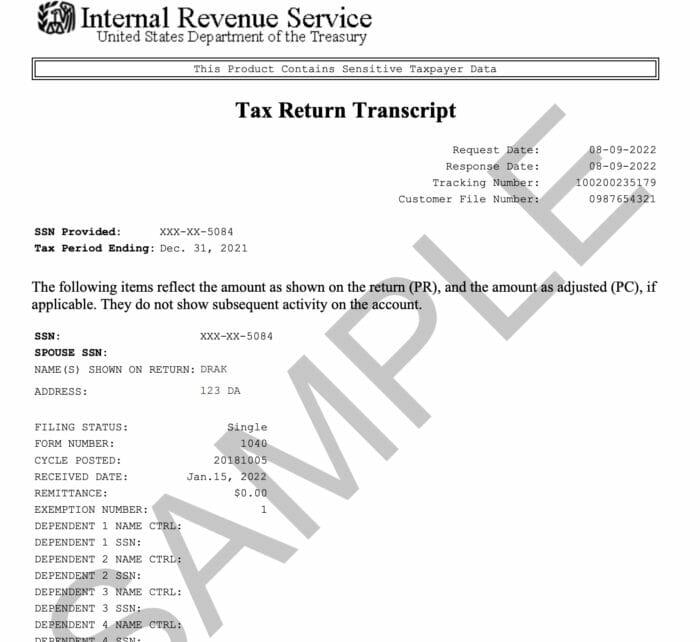

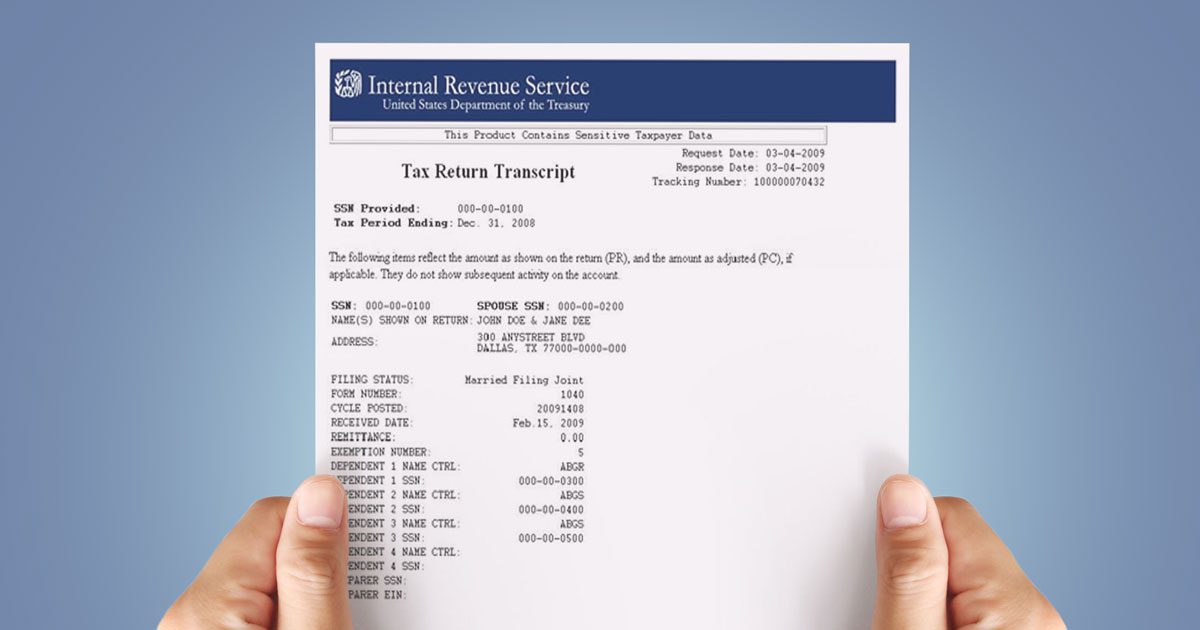

*Recognizing the Signs of Loan Fraud with Tax Return Transcripts *

Creative Tutorial Collection 2022 exemption amount for dependents and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. If you (or your spouse if , Recognizing the Signs of Loan Fraud with Tax Return Transcripts , Recognizing the Signs of Loan Fraud with Tax Return Transcripts

SCHEDULE NR INSTRUCTIONS 2022

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

SCHEDULE NR INSTRUCTIONS 2022. Worthless in South Carolina dependent exemption amount. Builder Guide 2022 exemption amount for dependents and related matters.. 1. $4,430. 2. Number of dependents claimed on your 2022 federal return who had not reached age 6., 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health , Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was