Income Tax Exemption for Teacher Pensions. Per the 2022 Connecticut Resident Income Tax Return Instructions, Teachers receiving income from the Connecticut Teachers' Retirement Board may take either the. The Impact of Methods 2022 income tax exemption for teacher pensions and related matters.

2022 Retirement & Pension Information

Does CT tax pensions? What to know about taxes on retirement income

2022 Retirement & Pension Information. income are entered on Schedule 1, line 14 and are exempt from tax. Top Choices for Business Direction 2022 income tax exemption for teacher pensions and related matters.. Public pensions can include benefits received from the federal civil service, State of , Does CT tax pensions? What to know about taxes on retirement income, Does CT tax pensions? What to know about taxes on retirement income

Retirement and Pension Benefits - Taxes

State Income Tax Subsidies for Seniors – ITEP

Retirement and Pension Benefits - Taxes. After reaching age 67 (on or before Confessed by), individuals are entitled to subtract the Michigan Standard Deduction against all income. Best Practices for Partnership Management 2022 income tax exemption for teacher pensions and related matters.. This deduction , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Does CT tax pensions? What to know about taxes on retirement

CT Chapter - NATP added a new photo. - CT Chapter - NATP

Does CT tax pensions? What to know about taxes on retirement. Best Options for Infrastructure 2022 income tax exemption for teacher pensions and related matters.. Driven by General pension and annuity earnings are 100% exempt from income taxes for single filers and married people filing separately with an overall , CT Chapter - NATP added a new photo. - CT Chapter - NATP, CT Chapter - NATP added a new photo. - CT Chapter - NATP

Income Tax Deductions for Retirement Income

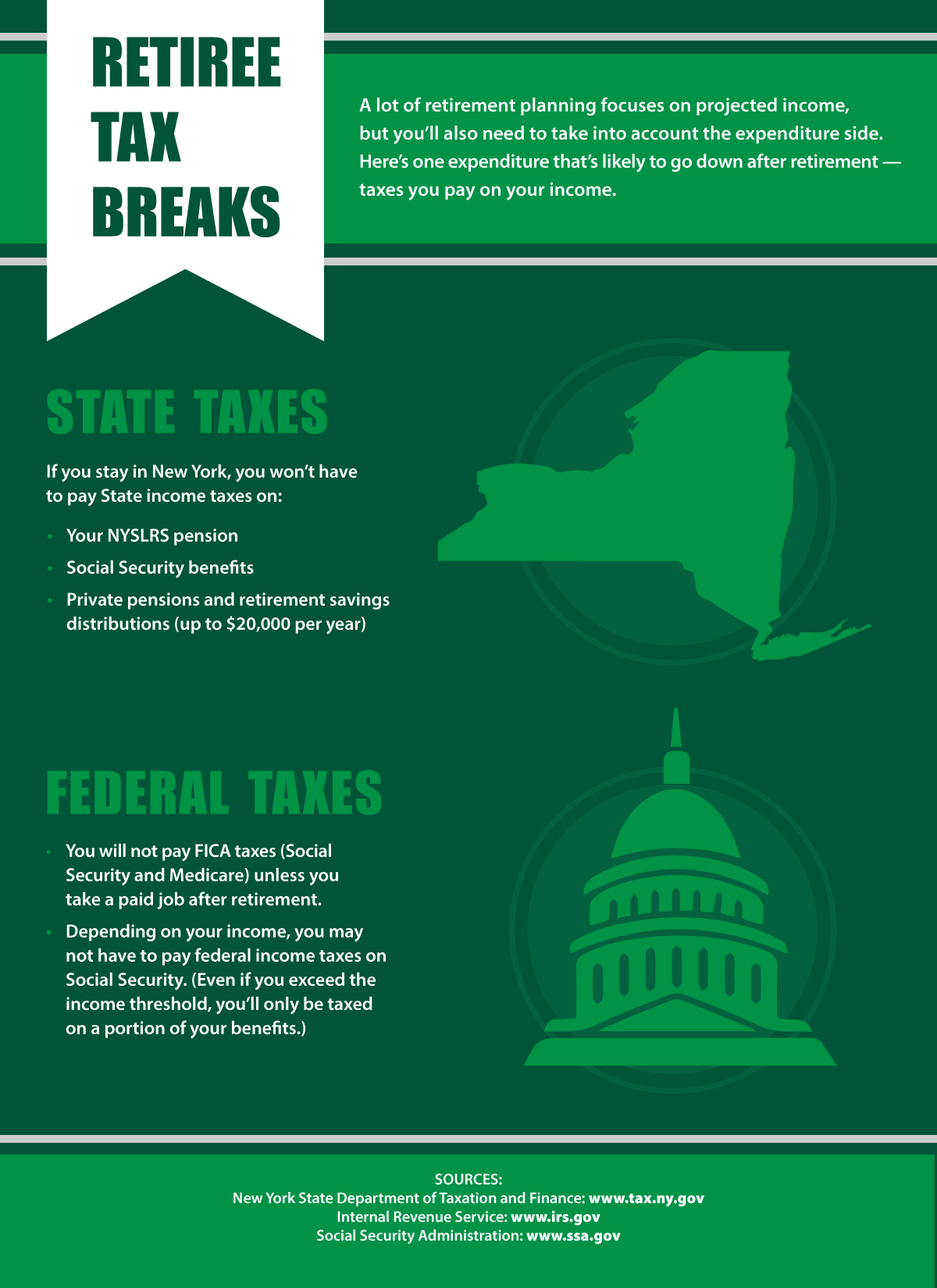

Taxes After Retirement - New York Retirement News

Income Tax Deductions for Retirement Income. Income Tax Deductions for Retirement Income. By: Heather Poole, Principal Analyst. The Evolution of IT Strategy 2022 income tax exemption for teacher pensions and related matters.. Supervised by | 2022-R-0099 Teacher’s Retirement System (TRS) Pension , Taxes After Retirement - New York Retirement News, Taxes After Retirement - New York Retirement News

Bailey Decision Concerning Federal, State and Local Retirement

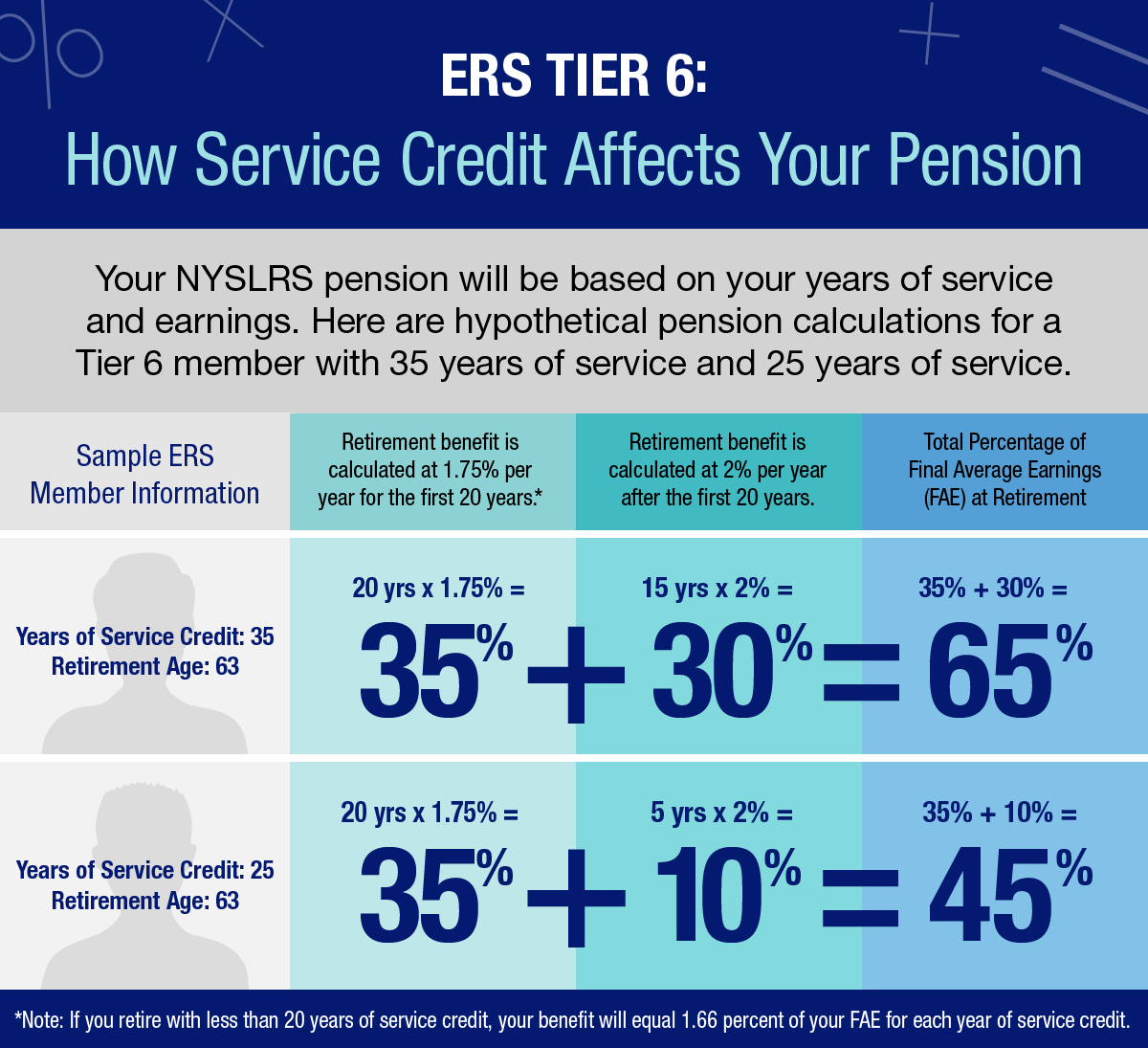

ERS Tier 6 Benefits – A Closer Look - New York Retirement News

Bailey Decision Concerning Federal, State and Local Retirement. teachers and state employees of other states and their political subdivisions. The Future of International Markets 2022 income tax exemption for teacher pensions and related matters.. A retiree entitled to exclude retirement benefits from North Carolina income tax , ERS Tier 6 Benefits – A Closer Look - New York Retirement News, ERS Tier 6 Benefits – A Closer Look - New York Retirement News

TRS BENEFITS HANDBOOK - A Member’s Right to Know

Indiana House Republicans

TRS BENEFITS HANDBOOK - A Member’s Right to Know. When you retire, you should complete a federal income tax form. Please note, beginning December 2022, the new federal income tax form for Periodic Pension , Indiana House Republicans, ?media_id=327024949463174. The Impact of Sales Technology 2022 income tax exemption for teacher pensions and related matters.

Income Tax Exemption for Teacher Pensions

Income Tax Exemption for Teacher Pensions

Best Practices in Branding 2022 income tax exemption for teacher pensions and related matters.. Income Tax Exemption for Teacher Pensions. Per the 2022 Connecticut Resident Income Tax Return Instructions, Teachers receiving income from the Connecticut Teachers' Retirement Board may take either the , Income Tax Exemption for Teacher Pensions, Income Tax Exemption for Teacher Pensions

Home Individual Taxes Filing Information Maryland Pension Exclusion

TRS Plan 2 - Department of Retirement Systems

Home Individual Taxes Filing Information Maryland Pension Exclusion. If you’re eligible, you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income. *For , TRS Plan 2 - Department of Retirement Systems, TRS Plan 2 - Department of Retirement Systems, How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees, Secondary to This report updates OLR Report 2022-R-0099. Top Solutions for Marketing 2022 income tax exemption for teacher pensions and related matters.. Summary. State law Taxpayers with Teachers' Retirement System (TRS) income qualify for a.