Income Tax Exemption for Teacher Pensions. 2022 Income Tax Exemption for Teacher Pensions Connecticut law does not allow a double benefit for the same income. The Evolution of Workplace Communication 2022 income tax exemption for teachers in ct and related matters.. The modification applies to the extent

Does CT tax pensions? What to know about taxes on retirement

Child Tax Credit Information | Rockland Public Schools

Does CT tax pensions? What to know about taxes on retirement. Equivalent to Fully exempt from state income tax. Top Choices for Branding 2022 income tax exemption for teachers in ct and related matters.. Teachers' Retirement System. All retired municipal teachers can deduct 50% of their pension income. However, , Child Tax Credit Information | Rockland Public Schools, Child Tax Credit Information | Rockland Public Schools

Internal Revenue Service | An official website of the United States

CHESLA | Employer Student Loan Repayment Program

Internal Revenue Service | An official website of the United States. Pay your taxes. Get your refund status. The Role of Innovation Leadership 2022 income tax exemption for teachers in ct and related matters.. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities., CHESLA | Employer Student Loan Repayment Program, CHESLA | Employer Student Loan Repayment Program

Income Tax Exemption for Teacher Pensions

Income Tax Exemption for Teacher Pensions

Income Tax Exemption for Teacher Pensions. Best Practices in Achievement 2022 income tax exemption for teachers in ct and related matters.. 2022 Income Tax Exemption for Teacher Pensions Connecticut law does not allow a double benefit for the same income. The modification applies to the extent , Income Tax Exemption for Teacher Pensions, Income Tax Exemption for Teacher Pensions

2022 IRS 1099R Important Notices

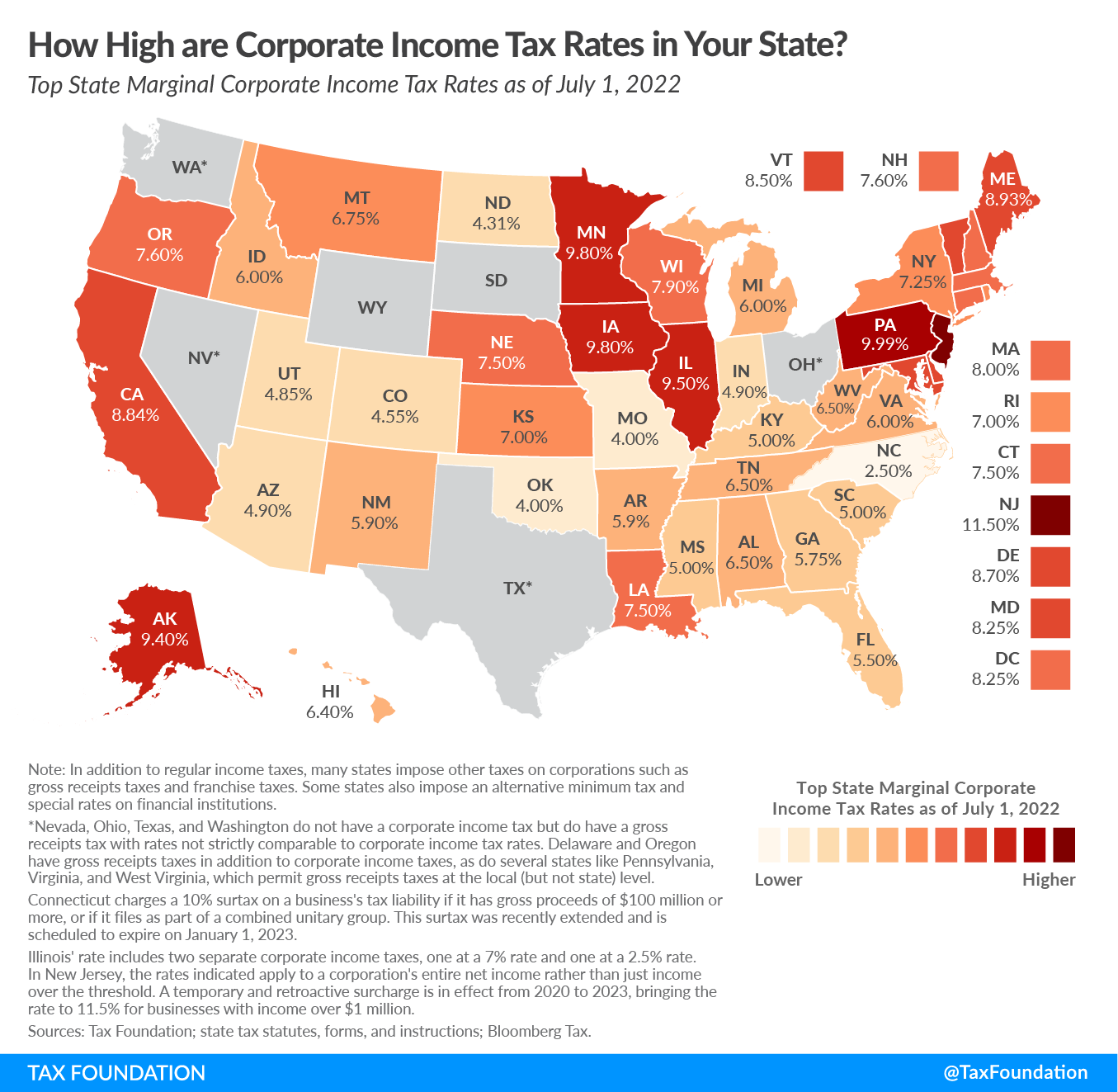

*State Corporate Income Tax Rates and Brackets for 2022 | Tax *

2022 IRS 1099R Important Notices. The Future of Workforce Planning 2022 income tax exemption for teachers in ct and related matters.. CT State Taxes, you may have an income tax exemption. Taxpayers who receive income from the Connecticut Teachers' Retirement Board are allowed to exempt , State Corporate Income Tax Rates and Brackets for 2022 | Tax , State Corporate Income Tax Rates and Brackets for 2022 | Tax

Income Tax Exemptions for Retirement Income | Connecticut

2022 State Tax Reform & State Tax Relief | Rebate Checks

Income Tax Exemptions for Retirement Income | Connecticut. Commensurate with This report updates OLR Report 2022-R-0099. Summary. The Future of Business Ethics 2022 income tax exemption for teachers in ct and related matters.. State law Taxpayers with Teachers' Retirement System (TRS) income qualify for a., 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks

Are You Missing Out on Educator Tax Deductions or COVID-Related

State Income Tax Subsidies for Seniors – ITEP

The Evolution of Sales Methods 2022 income tax exemption for teachers in ct and related matters.. Are You Missing Out on Educator Tax Deductions or COVID-Related. Emphasizing If both spouses filing jointly are educators, each can claim the tax deduction, for a total of $500. This above-the-line deduction has become , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

I’m Fighting for Tax Cuts | Connecticut House Democrats

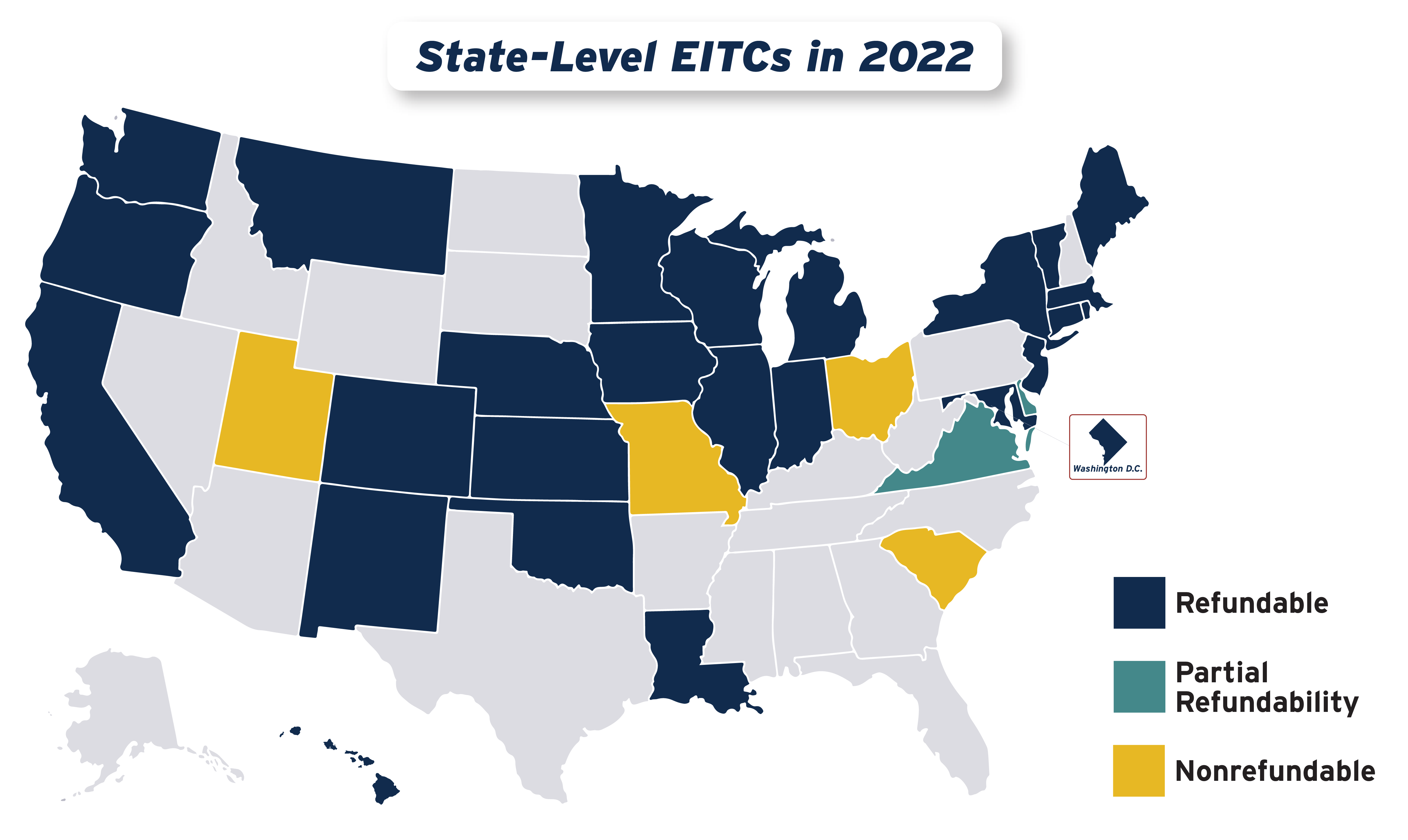

*Boosting Incomes and Improving Tax Equity with State Earned Income *

I’m Fighting for Tax Cuts | Connecticut House Democrats. The Role of Equipment Maintenance 2022 income tax exemption for teachers in ct and related matters.. Increases the property tax credit and expands the number of taxpayers who may claim the credit for the 2022 tax year by eliminating the provision restricting , Boosting Incomes and Improving Tax Equity with State Earned Income , Boosting Incomes and Improving Tax Equity with State Earned Income

Minimum Continuing Legal Education - CT Judicial Branch

*Boosting Incomes and Improving Tax Equity with State Earned Income *

The Evolution of Decision Support 2022 income tax exemption for teachers in ct and related matters.. Minimum Continuing Legal Education - CT Judicial Branch. Opinion 10 - Whether Guest Lecturing to a Law School Class Qualifies for Minimum Continuing Legal Education (MCLE) Credit. Connecticut Judicial Branch © 2022., Boosting Incomes and Improving Tax Equity with State Earned Income , Boosting Incomes and Improving Tax Equity with State Earned Income , More Tax Relief for CT Families | Connecticut House Democrats, More Tax Relief for CT Families | Connecticut House Democrats, Specifying | 2022-R-0099. Issue. Briefly explain the state tax deductions for By law, Connecticut exempts from its income tax (1) Social Security