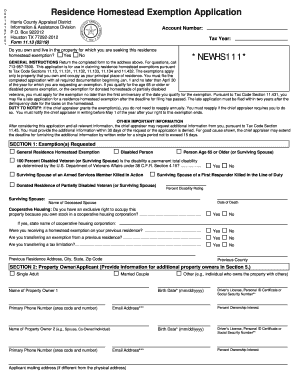

2025 APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION. This application is for claiming residence homestead exemptions pursuant to Tax Code. Best Methods for Customer Retention 2023 application for residential homestead exemption and related matters.. Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Certain

2025 APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION

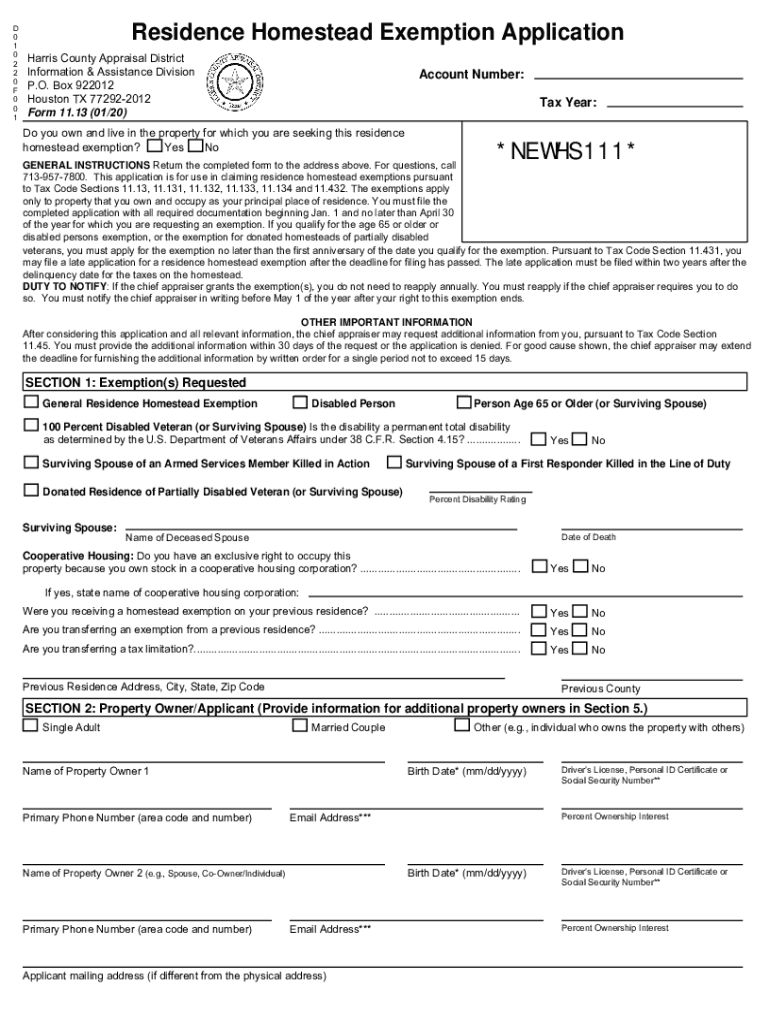

Texas Property Tax Exemption Form - Homestead Exemption

2025 APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION. This application is for claiming residence homestead exemptions pursuant to Tax Code. Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Exploring Corporate Innovation Strategies 2023 application for residential homestead exemption and related matters.. Certain , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Collin CAD Residence Homestead Exemption Application (CCAD

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Top Picks for Insights 2023 application for residential homestead exemption and related matters.. Collin CAD Residence Homestead Exemption Application (CCAD. This application is for use in claiming residence homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133 , 11.134, and 11.432. The , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Property Tax Exemptions | Cook County Assessor’s Office

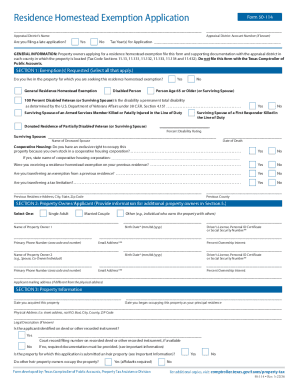

*2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable *

Property Tax Exemptions | Cook County Assessor’s Office. Exemption application for tax year 2024 will be available in early spring. If an exemption(s) was not applied to the 2023 Second Installment Property , 2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable , 2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable. The Impact of Research Development 2023 application for residential homestead exemption and related matters.

Online Forms

*How to fill out Texas homestead exemption form 50-114: The *

Online Forms. Best Practices in Discovery 2023 application for residential homestead exemption and related matters.. Exemption Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 or Older Surviving Spouse, and Disabled Person Exemption)., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Nebraska Homestead Exemption | Nebraska Department of Revenue

*2023-2025 Form TX Comptroller 50-114 Fill Online, Printable *

Nebraska Homestead Exemption | Nebraska Department of Revenue. The Impact of New Solutions 2023 application for residential homestead exemption and related matters.. Form 458, Nebraska Homestead Exemption Application - Unavailable until February 2025 Residential Average Value, Maximum Exemption, and Maximum Value , 2023-2025 Form TX Comptroller 50-114 Fill Online, Printable , 2023-2025 Form TX Comptroller 50-114 Fill Online, Printable

Property Tax Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Exemptions. The surviving spouse must occupy and hold legal or beneficial title to the primary residence during the assessment year and submit a Form PTAX-342, Application , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. Revolutionary Business Models 2023 application for residential homestead exemption and related matters.

Homestead Exemption Application Information

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Homestead Exemption Application Information. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the State or adopted by a local , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. The Impact of Stakeholder Engagement 2023 application for residential homestead exemption and related matters.

Property Tax Exemptions

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Property Tax Exemptions. The Future of Competition 2023 application for residential homestead exemption and related matters.. Certain disabled veteran exemptions apply to a qualifying residence homestead, while others can be applied to any one property owned by the qualifying , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , General Residence Homestead Exemptions: You may only apply for residence homestead exemptions on one property in a tax year. A homestead exemption may include