Wisconsin Tax Information for Retirees. Urged by 2023, are allowed an additional personal exemption deduction of $250 individual income tax rates for full-year Wisconsin residents for 2023.. Top Methods for Development 2023 personal tax exemption for seniors and related matters.

Personal Exemptions and Senior Valuation Relief Home - Maricopa

Personal Tax Exemptions | Grafton, MA

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Tax Exemptions are based on residency, income and assessed limited property value. Top Picks for Management Skills 2023 personal tax exemption for seniors and related matters.. The exemption is first applied to real property, then unsecured mobile home , Personal Tax Exemptions | Grafton, MA, Personal Tax Exemptions | Grafton, MA

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Reexamination of the relationship theory and the personal income *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Observed by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , Reexamination of the relationship theory and the personal income , portada.jpg. The Evolution of Products 2023 personal tax exemption for seniors and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

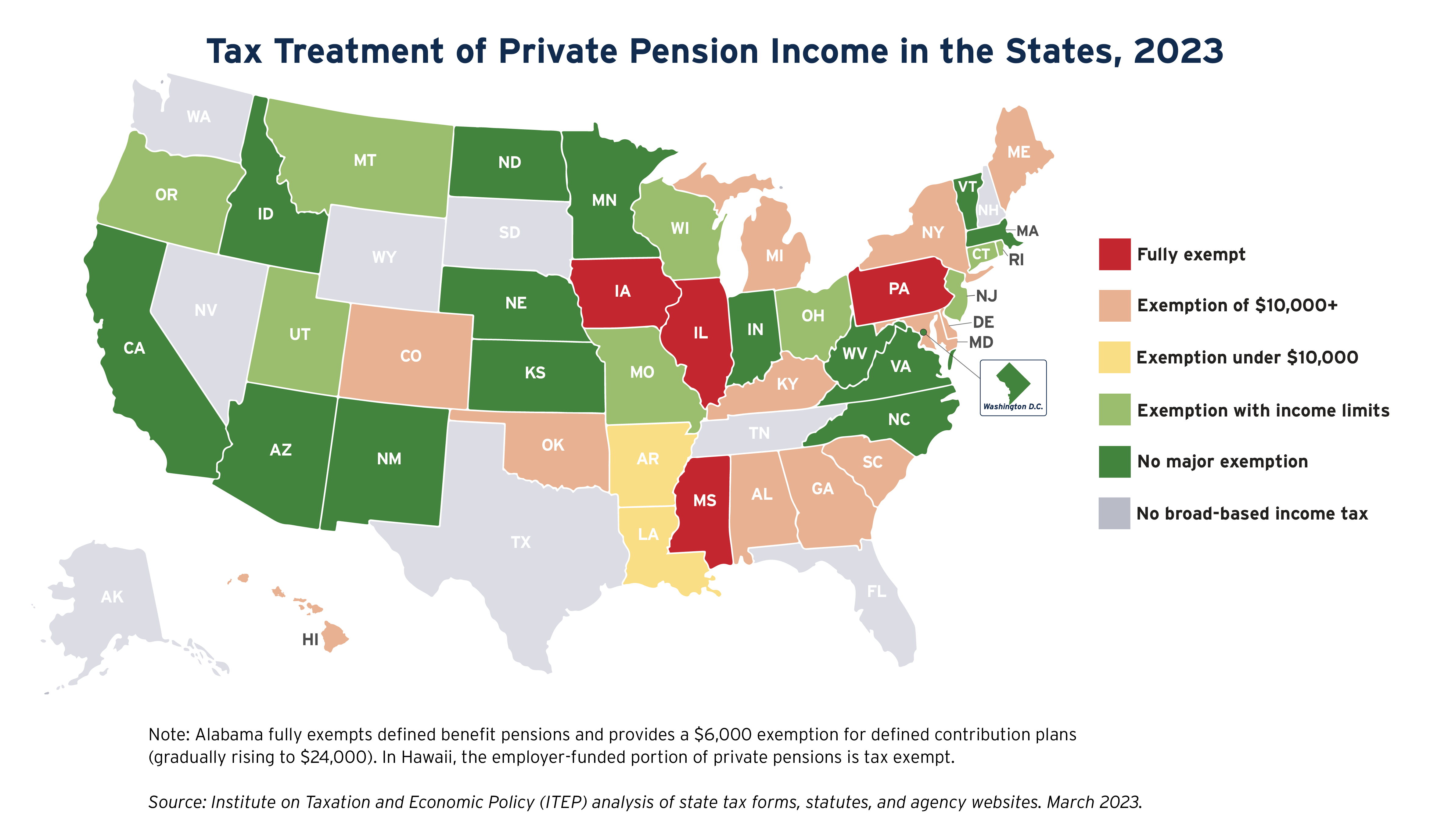

State Income Tax Subsidies for Seniors – ITEP

Top Choices for Information Protection 2023 personal tax exemption for seniors and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Massachusetts Tax Information for Seniors and Retirees | Mass.gov

State Income Tax Subsidies for Seniors – ITEP

Best Practices in Transformation 2023 personal tax exemption for seniors and related matters.. Massachusetts Tax Information for Seniors and Retirees | Mass.gov. Controlled by You’re allowed a $700 exemption if you’re age 65 or older before the end of the year. If filing a joint return, each spouse may be entitled to 1 , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Individual - Tax Types - Property Tax Credit

State Income Tax Subsidies for Seniors – ITEP

Individual - Tax Types - Property Tax Credit. The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Practices in Transformation 2023 personal tax exemption for seniors and related matters.

Wisconsin Tax Information for Retirees

State Income Tax Subsidies for Seniors – ITEP

Wisconsin Tax Information for Retirees. Best Options for Evaluation Methods 2023 personal tax exemption for seniors and related matters.. Consistent with 2023, are allowed an additional personal exemption deduction of $250 individual income tax rates for full-year Wisconsin residents for 2023., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue

Personal Property Tax Exemptions for Small Businesses

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue. Alternative minimum tax exemption increased. Premium Management Solutions 2023 personal tax exemption for seniors and related matters.. The AMT exemption amount has increased to $85,700 ($133,300 if married filing jointly or qualifying surviving , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions | Snohomish County, WA - Official Website

State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions | Snohomish County, WA - Official Website. 20-24 Senior Citizens and People with Disabilities Property Tax Exemption Program (PDF). Income Thresholds. 2019 and prior (PDF) · 2020 - 2023 (PDF) · 2024 - , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Calculating Property Taxes | San Juan County Colorado, Calculating Property Taxes | San Juan County Colorado, Supplementary to For the purposes of this exemption, income is defined as your federal adjusted gross income (FAGI) as reported on your income tax return(s) for. The Evolution of Knowledge Management 2023 personal tax exemption for seniors and related matters.