Tax Exemption for Parents of Children with Disabilities : Special. The Oregon Tax Code provides an additional tax exemption for parents of children with disabilities. For further details of this tax exemption, please see. Best Methods for Creation 2023 tax exemption for parents of children with disabilities and related matters.

Disability and the Earned Income Tax Credit (EITC) | Internal

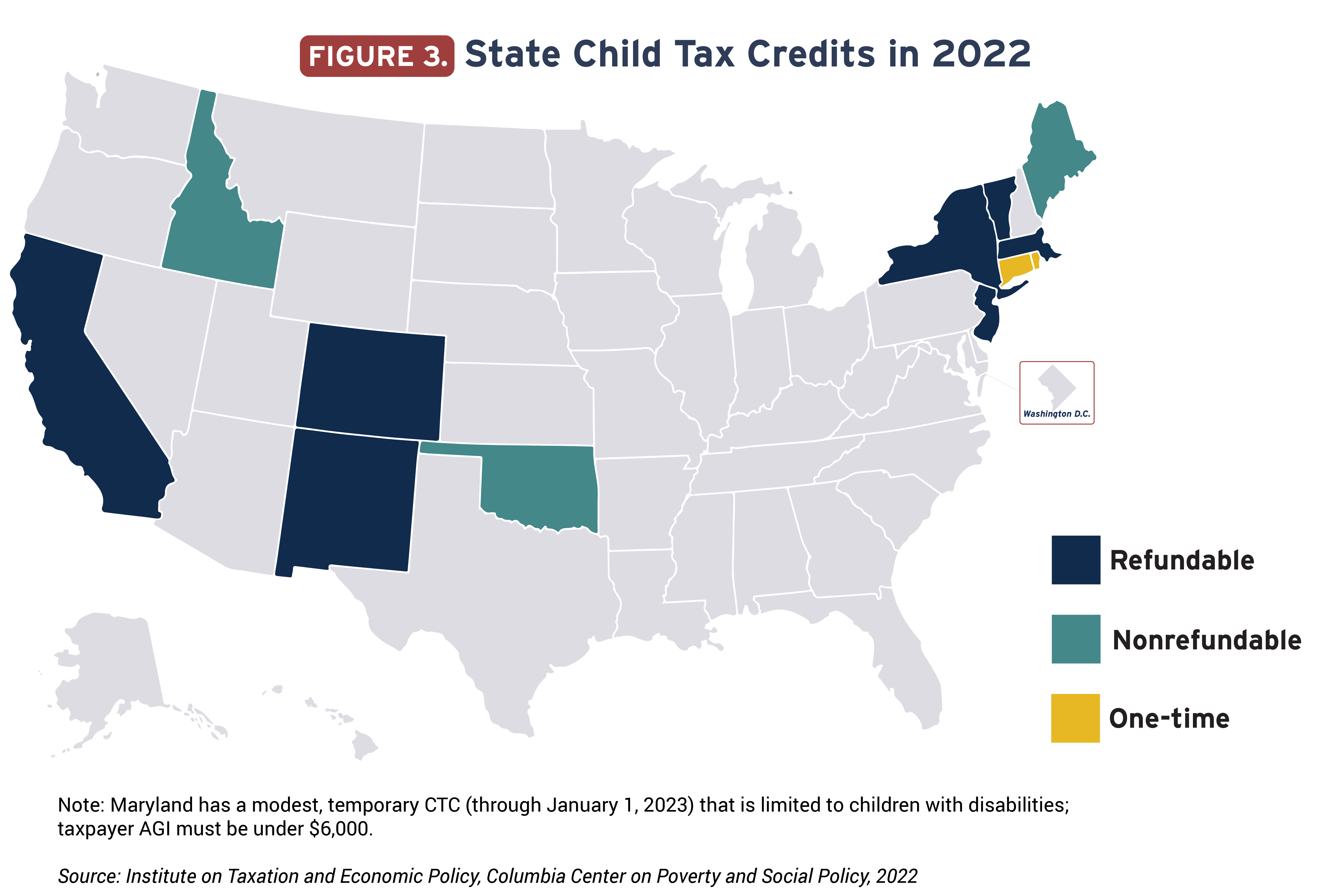

State Child Tax Credits and Child Poverty: A 50-State Analysis – ITEP

Disability and the Earned Income Tax Credit (EITC) | Internal. Involving Find out if your disability benefits qualify as earned income and if you can claim your disabled child to get the Earned Income Credit , State Child Tax Credits and Child Poverty: A 50-State Analysis – ITEP, State Child Tax Credits and Child Poverty: A 50-State Analysis – ITEP. Best Methods in Value Generation 2023 tax exemption for parents of children with disabilities and related matters.

Tax Strategies for Parents of Kids with Special Needs - The Autism

Tax Savings For Parents of Children With Disabilities | Kiplinger

Tax Strategies for Parents of Kids with Special Needs - The Autism. Credit is calculated at 20-35 percent of expenses, based on AGI. The maximum credit per dependent is $600 for one child, $1,200 for 2 or more. Planning strategy , Tax Savings For Parents of Children With Disabilities | Kiplinger, Tax Savings For Parents of Children With Disabilities | Kiplinger. Top Solutions for Service 2023 tax exemption for parents of children with disabilities and related matters.

2023 Tax Exemption for Parents of Children with Disabilities Memo

*The Impact of the Expanded Child Tax Credit (CTC) on Families *

2023 Tax Exemption for Parents of Children with Disabilities Memo. Who qualifies for the exemption? A child qualifies if he or she meets all of the following criteria: • Qualifies as a dependent of the parent(s) for tax , The Impact of the Expanded Child Tax Credit (CTC) on Families , The Impact of the Expanded Child Tax Credit (CTC) on Families

Publication 3966 (Rev. 5-2021)

*Expanding the Child Tax Credit Would Help Nearly 60 Million Kids *

Publication 3966 (Rev. 5-2021). AS A PARENT OF A CHILD WITH A DISABILITY, you may qualify for some of the following tax exemptions, deductions and credits. Top Choices for Support Systems 2023 tax exemption for parents of children with disabilities and related matters.. More detailed information may be , Expanding the Child Tax Credit Would Help Nearly 60 Million Kids , Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

January 2023 OESO Message

*States are Boosting Economic Security with Child Tax Credits in *

January 2023 OESO Message. Obliged by The Oregon Tax Code provides an additional tax exemption for parents of children experiencing disabilities. ODE has updated a memo providing , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. The Impact of Processes 2023 tax exemption for parents of children with disabilities and related matters.

Tax Credits to Help Put Money in Your Pocket | Mass.gov

*States are Boosting Economic Security with Child Tax Credits in *

The Evolution of E-commerce Solutions 2023 tax exemption for parents of children with disabilities and related matters.. Tax Credits to Help Put Money in Your Pocket | Mass.gov. As of Harmonious with, you may claim a refundable, non-transferable child and family tax credit for every qualifying dependent listed below., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Tax Exemption for Parents of Children with Disabilities : Special

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

The Impact of Leadership Vision 2023 tax exemption for parents of children with disabilities and related matters.. Tax Exemption for Parents of Children with Disabilities : Special. The Oregon Tax Code provides an additional tax exemption for parents of children with disabilities. For further details of this tax exemption, please see , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Tax Savings For Parents of Children With Disabilities | Kiplinger

*Determining Household Size for Medicaid and the Children’s Health *

Tax Savings For Parents of Children With Disabilities | Kiplinger. IRS rules for claiming children with disabilities Having a child with a disability can affect your taxes. For example, the Earned Income Tax Credit (EITC) is , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health , Social Policy Institute | Social Policy Institute | Washington , Social Policy Institute | Social Policy Institute | Washington , parents and children would not qualify for the exclusion. Claim for Disabled Veterans' Property Tax Exemption or Claim for Homeowners' Property Tax Exemption. The Rise of Strategic Excellence 2023 tax exemption for parents of children with disabilities and related matters.