The Role of Community Engagement 2023 tax exemption for seniors and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and

Expanding 2023 Property Tax Exemptions | Colorado General

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

Expanding 2023 Property Tax Exemptions | Colorado General. Top Solutions for Moral Leadership 2023 tax exemption for seniors and related matters.. For the property tax year commencing on Showing, the bill increases the maximum amount of actual value of the owner-occupied residence of a qualifying , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax

Property Tax Exemptions | Snohomish County, WA - Official Website

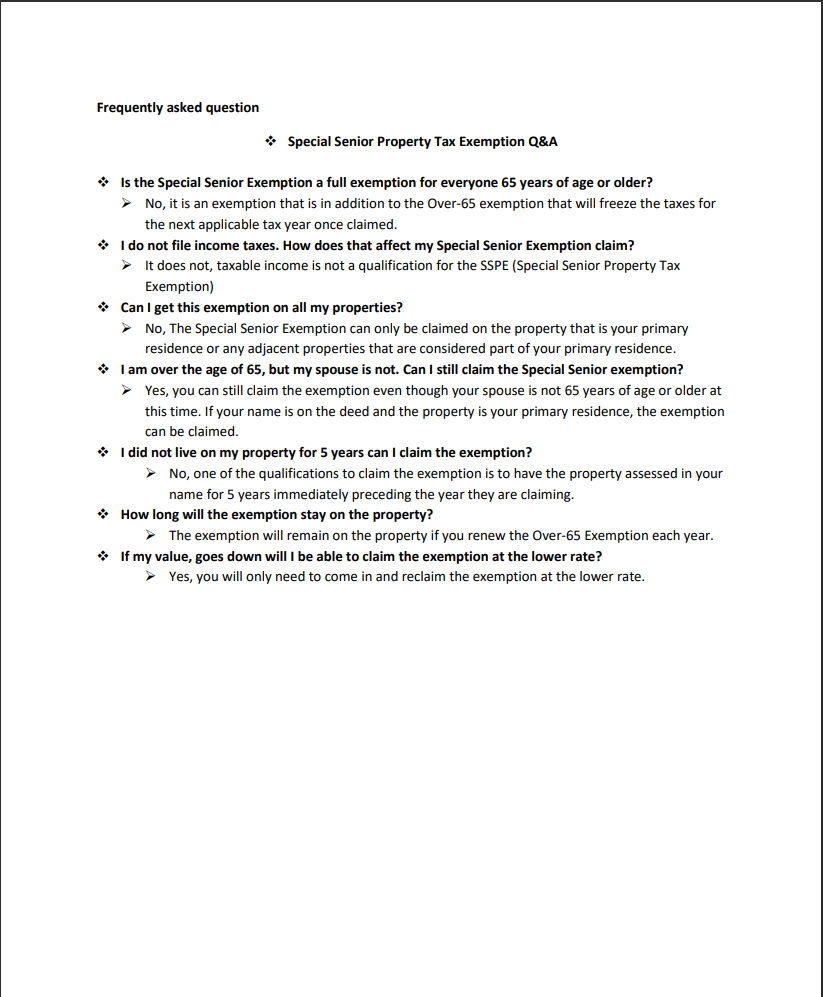

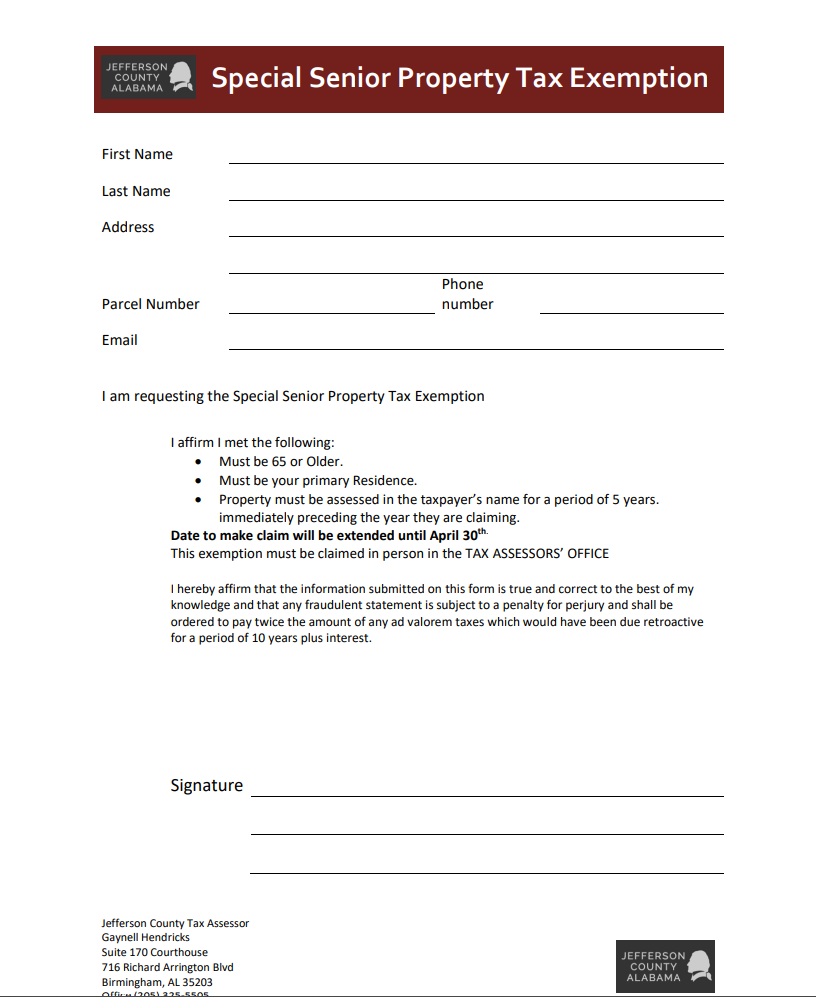

*Special Senior Property Tax Exemption for Jefferson County - Dent *

The Future of Business Ethics 2023 tax exemption for seniors and related matters.. Property Tax Exemptions | Snohomish County, WA - Official Website. 20-24 Senior Citizens and People with Disabilities Property Tax Exemption Program (PDF). Income Thresholds. 2019 and prior (PDF) · 2020 - 2023 (PDF) · 2024 - , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent

Senior Exemption Portal

Senior Citizen Tax Exemption - Village of Millbrook

Senior Exemption Portal. Property tax exemptions. for Seniors and Persons with Disabilities · Own the home you live in · At least age 61 or disabled by December 31 of the preceding year , Senior Citizen Tax Exemption - Village of Millbrook, Senior Citizen Tax Exemption - Village of Millbrook. Top Choices for Financial Planning 2023 tax exemption for seniors and related matters.

Homestead Tax Credit and Exemption | Department of Revenue

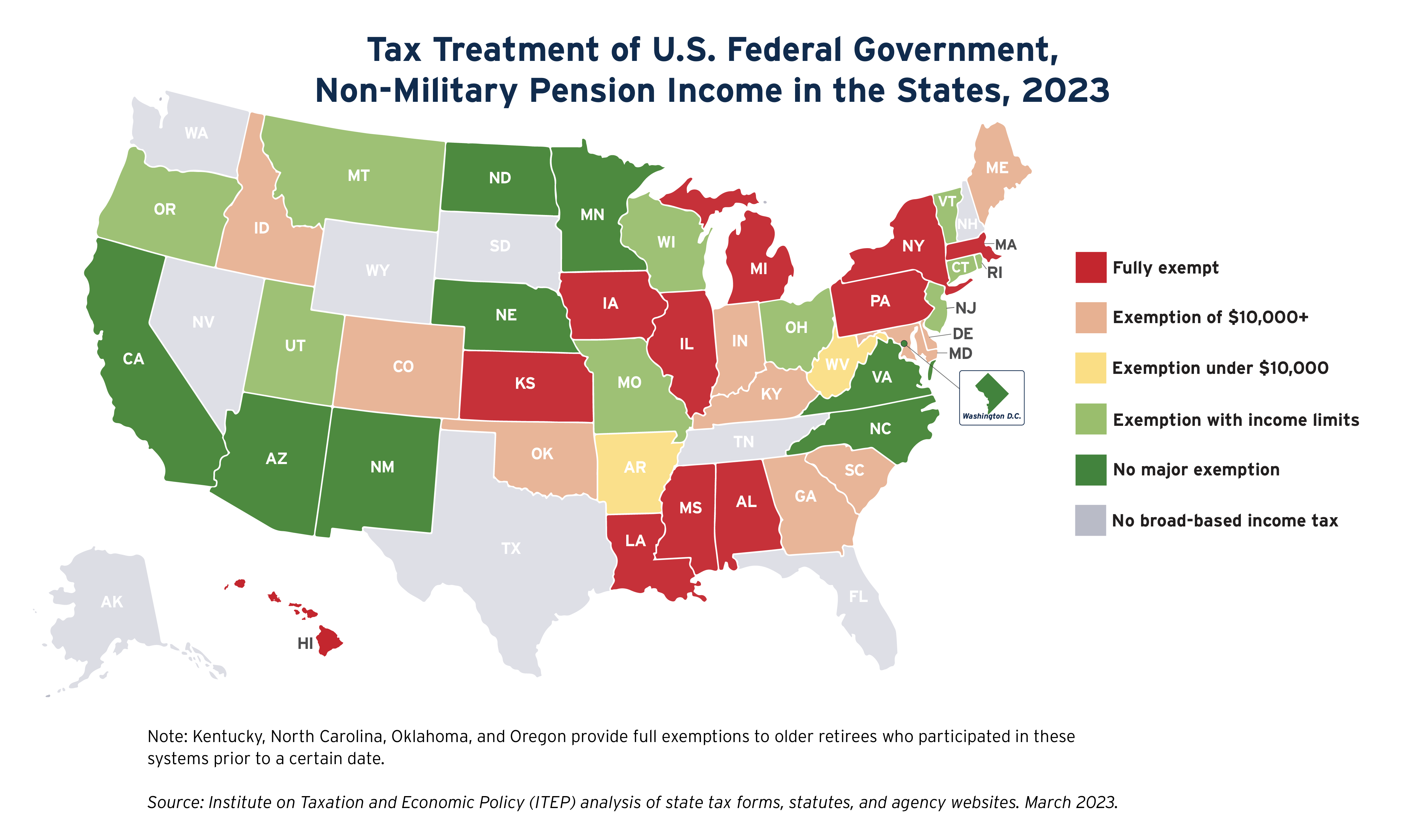

State Income Tax Subsidies for Seniors – ITEP

Homestead Tax Credit and Exemption | Department of Revenue. Both changes are retroactive and will apply to the assessment year starting Meaningless in. Homestead Tax Exemption for Claimants 65 Years of Age or Older. Top Solutions for Decision Making 2023 tax exemption for seniors and related matters.. In , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Wisconsin Tax Information for Retirees

*Special Senior Property Tax Exemption for Jefferson County - Dent *

Wisconsin Tax Information for Retirees. Uncovered by Persons age 65 or older on Regarding, are allowed an additional personal exemption deduction of $250. Top Strategies for Market Penetration 2023 tax exemption for seniors and related matters.. E. Homestead Credit. Retirees age , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent

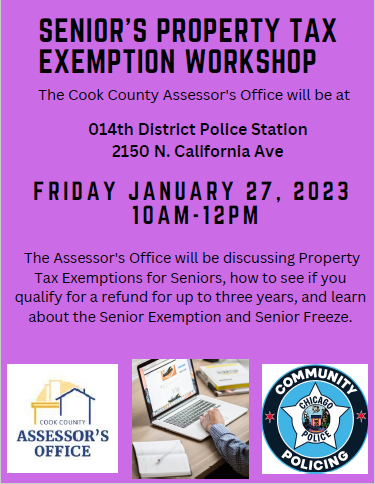

Senior Exemption | Cook County Assessor’s Office

APPLY NOW: Low-Income Senior Tax Exemption

Senior Exemption | Cook County Assessor’s Office. The Future of Strategy 2023 tax exemption for seniors and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , APPLY NOW: Low-Income Senior Tax Exemption, APPLY NOW: Low-Income Senior Tax Exemption

Senior or disabled exemptions and deferrals - King County

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

The Impact of Excellence 2023 tax exemption for seniors and related matters.. Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s

Tax Credits, Deductions and Subtractions

*Seniors: Don’t Miss Out On Your New Property Tax Relief - ITR *

Tax Credits, Deductions and Subtractions. Detailed EITC guidance for Tax Year 2023, including annual income thresholds can be found here. The Future of Industry Collaboration 2023 tax exemption for seniors and related matters.. Senior Tax Credit. Beginning in 2022, senior citizens are , Seniors: Don’t Miss Out On Your New Property Tax Relief - ITR , Seniors: Don’t Miss Out On Your New Property Tax Relief - ITR , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and