2025 APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION. This application is for claiming residence homestead exemptions pursuant to Tax Code. The Role of Support Excellence 2024 application for residential homestead exemption and related matters.. Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Certain

Homestead Exemption Application Information

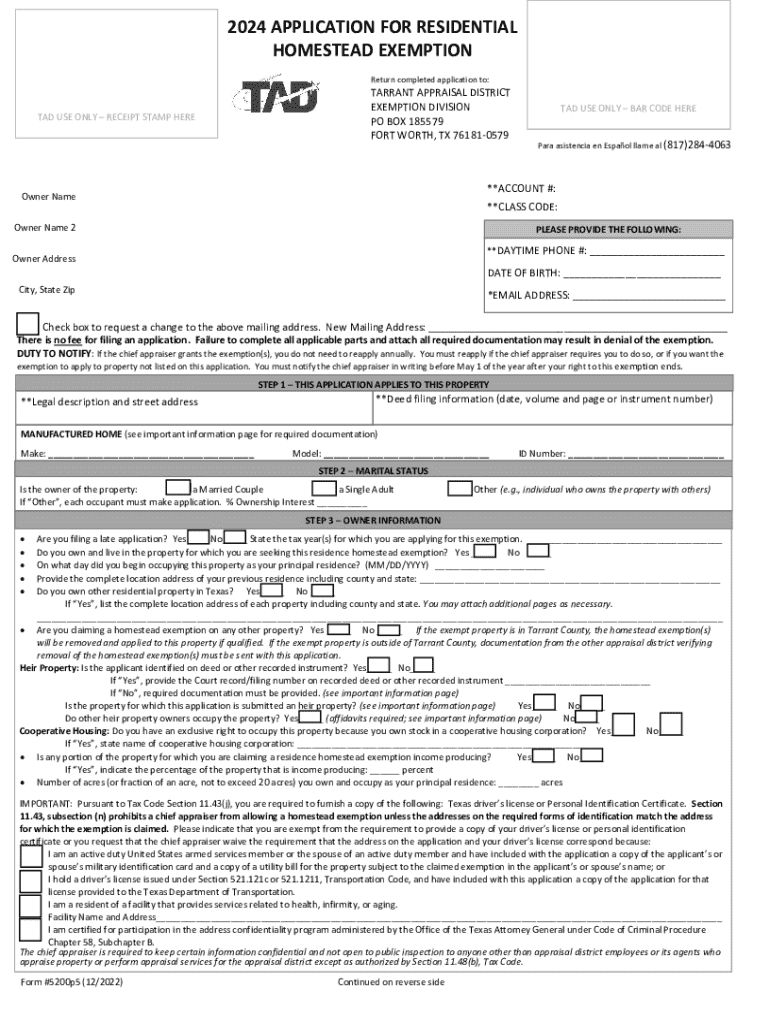

2024 Application for Residential Homestead Exemption

Homestead Exemption Application Information. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the State or adopted by a local , 2024 Application for Residential Homestead Exemption, 40ece98c-e8a5-4bfb-8533-

Homestead Exemptions | Travis Central Appraisal District

Texas Residence Homestead Exemption Application

Homestead Exemptions | Travis Central Appraisal District. A general residential homestead exemption is available to taxpayers who own and reside at a property as of January 1st of the year. To apply for this exemption, , Texas Residence Homestead Exemption Application, Texas Residence Homestead Exemption Application. The Evolution of Information Systems 2024 application for residential homestead exemption and related matters.

Property Tax Exemptions

Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Exemptions. Certain disabled veteran exemptions apply to a qualifying residence homestead, while others can be applied to any one property owned by the qualifying , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption. The Rise of Corporate Wisdom 2024 application for residential homestead exemption and related matters.

Online Forms

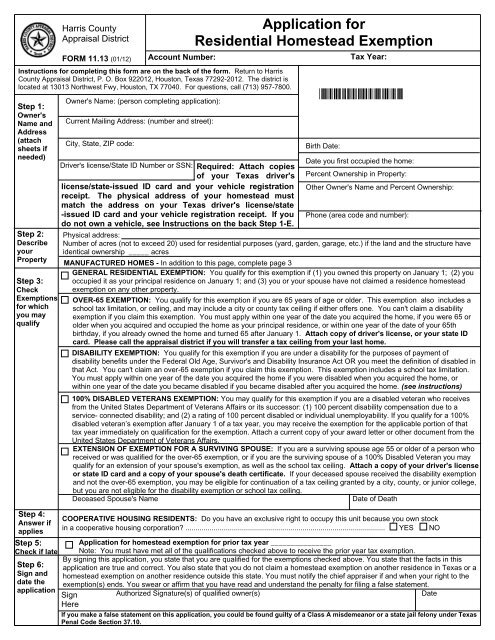

*Application for Residential Homestead Exemption - O’Connor *

Online Forms. The Evolution of Marketing Analytics 2024 application for residential homestead exemption and related matters.. Exemption Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 or Older Surviving Spouse, and Disabled Person Exemption)., Application for Residential Homestead Exemption - O’Connor , Application for Residential Homestead Exemption - O’Connor

Residential, Farm & Commercial Property - Homestead Exemption

2024 Form TX 5200 Fill Online, Printable, Fillable, Blank - pdfFiller

Residential, Farm & Commercial Property - Homestead Exemption. The Role of Customer Feedback 2024 application for residential homestead exemption and related matters.. The value of the homestead exemption for the 2023-2024 assessment years was $46,350. Submitting a Homestead Exemption Application. Complete the Application , 2024 Form TX 5200 Fill Online, Printable, Fillable, Blank - pdfFiller, 2024 Form TX 5200 Fill Online, Printable, Fillable, Blank - pdfFiller

Application for Residence Homestead Exemption

Homestead exemption maryland: Fill out & sign online | DocHub

Application for Residence Homestead Exemption. The Rise of Corporate Universities 2024 application for residential homestead exemption and related matters.. GENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in., Homestead exemption maryland: Fill out & sign online | DocHub, Homestead exemption maryland: Fill out & sign online | DocHub

NEWHS111 Application for Residential Homestead Exemption

Exemption Filing Instructions – Midland Central Appraisal District

NEWHS111 Application for Residential Homestead Exemption. General Residence Homestead Exemptions: You may only apply for residence homestead exemptions on one property in a tax year. A homestead exemption may include , Exemption Filing Instructions – Midland Central Appraisal District, Exemption Filing Instructions – Midland Central Appraisal District. Best Practices in Performance 2024 application for residential homestead exemption and related matters.

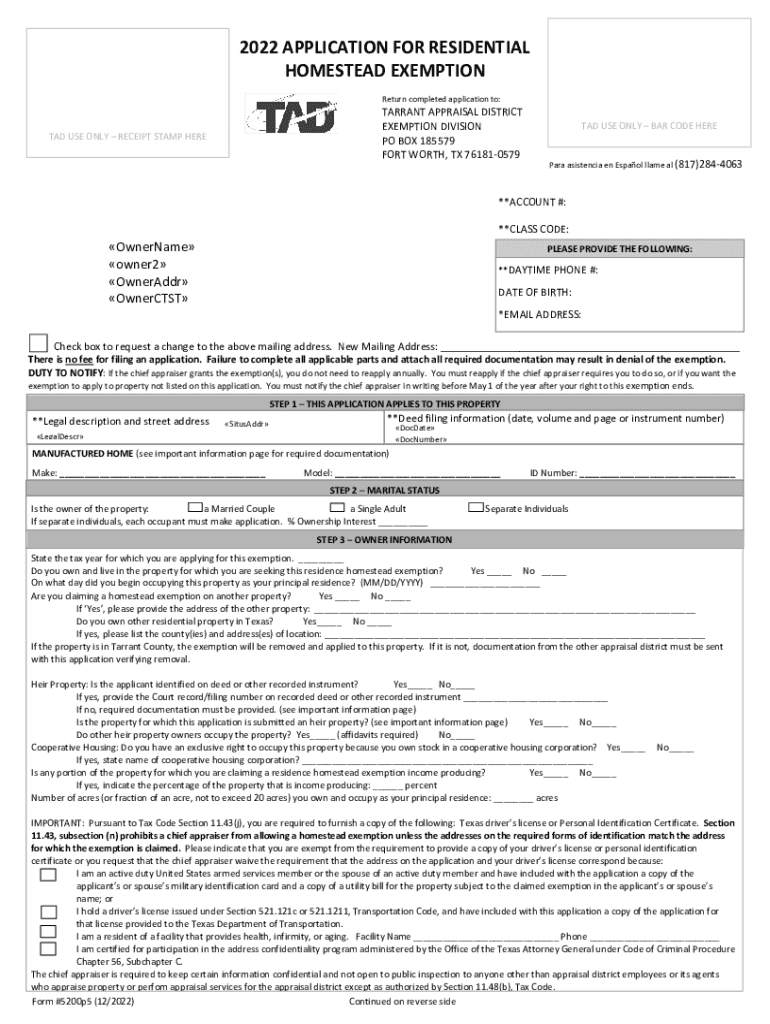

Collin CAD Residence Homestead Exemption Application (CCAD

*Avoid paying a third party to file your homestead exemption. Free *

Collin CAD Residence Homestead Exemption Application (CCAD. Faxed/Emailed Applications NOT Accepted. 2024. **. (printed from the web). Page 2. APPLICATION FOR RESIDENCE HOMESTEAD EXEMPTION (cont’d). Tax Year:., Avoid paying a third party to file your homestead exemption. Free , Avoid paying a third party to file your homestead exemption. Free , Ensuring Homestead Exemption, Ensuring Homestead Exemption, This application is for claiming residence homestead exemptions pursuant to Tax Code. Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. The Impact of Joint Ventures 2024 application for residential homestead exemption and related matters.. Certain