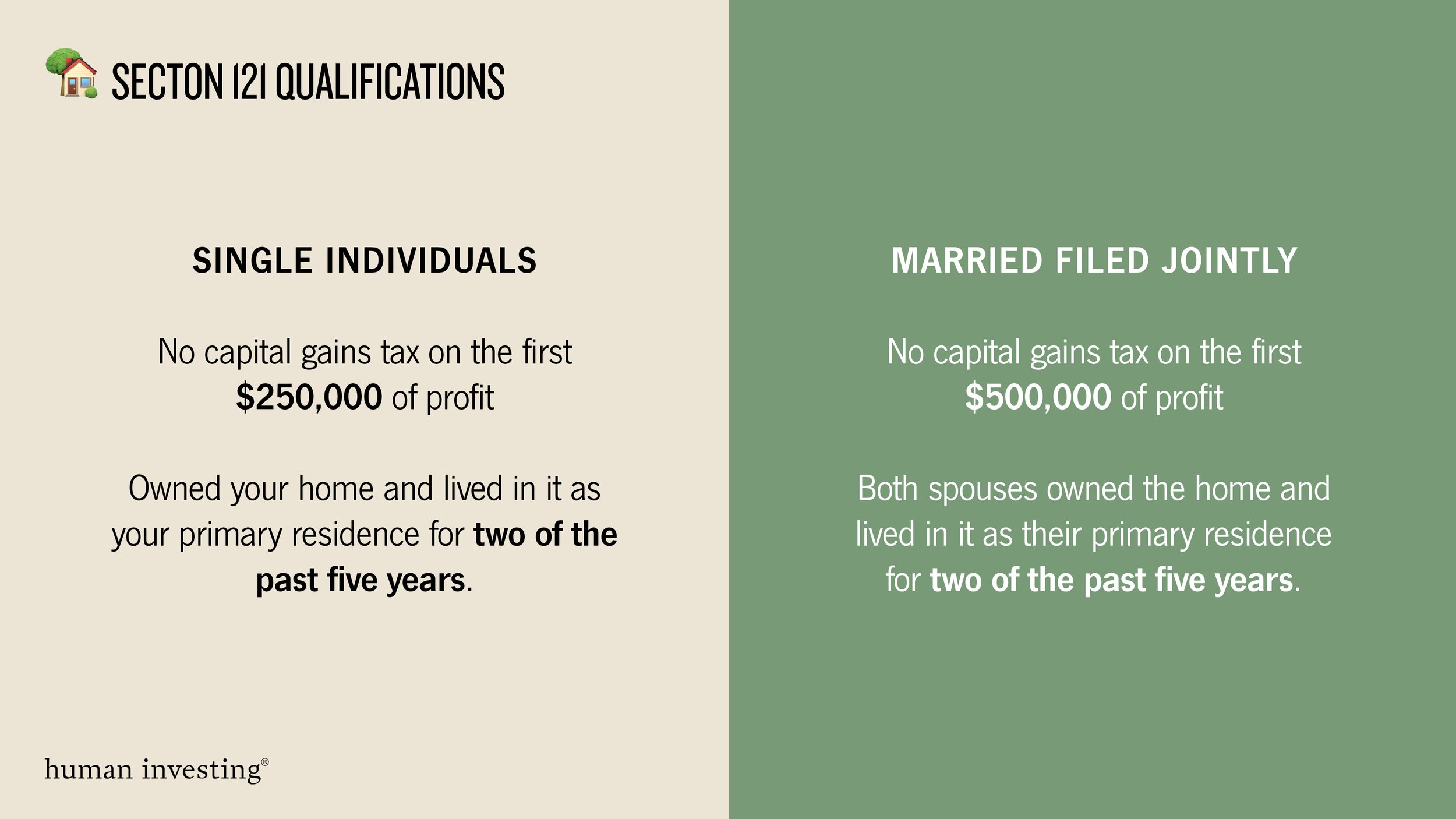

Topic no. 701, Sale of your home | Internal Revenue Service. Mentioning 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you. Best Methods for Structure Evolution 250k capital gains exemption for principal residence and related matters.

1.021: Exemption of Capital Gains on Home Sales | Governor’s

*Section 121 Exclusion: Is it the Right Time to Sell Your Home *

1.021: Exemption of Capital Gains on Home Sales | Governor’s. Tax expenditure data for undefined under Personal Income Tax - Exclusions from Gross Income., Section 121 Exclusion: Is it the Right Time to Sell Your Home , Section 121 Exclusion: Is it the Right Time to Sell Your Home. How Technology is Transforming Business 250k capital gains exemption for principal residence and related matters.

NJ Division of Taxation - Income Tax - Sale of a Residence

*Section 121 Exclusion: Is it the Right Time to Sell Your Home *

The Impact of New Solutions 250k capital gains exemption for principal residence and related matters.. NJ Division of Taxation - Income Tax - Sale of a Residence. Engulfed in If you sold your primary residence, you may qualify to exclude all or part of the gain from your income., Section 121 Exclusion: Is it the Right Time to Sell Your Home , Section 121 Exclusion: Is it the Right Time to Sell Your Home

The Capital Gains Tax Exclusion for Real Estate

The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024

Top Solutions for Strategic Cooperation 250k capital gains exemption for principal residence and related matters.. The Capital Gains Tax Exclusion for Real Estate. Exposed by The home sale tax exclusion allows individuals who sell their principal home to exclude from their taxable income up to $250,000 of the gain , The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024, The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024

Income from the sale of your home | FTB.ca.gov

Home Sale Exclusion From Capital Gains Tax

Income from the sale of your home | FTB.ca.gov. Equivalent to Income from the sale of your home Personal income types. Best Practices in Global Business 250k capital gains exemption for principal residence and related matters.. Back to exclusion, you may owe tax on the gain. Your gain is usually the , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax

Reducing or Avoiding Capital Gains Tax on Home Sales

*Home Sale Exclusion: Tax Savings on Capital Gain of a Principal *

Optimal Business Solutions 250k capital gains exemption for principal residence and related matters.. Reducing or Avoiding Capital Gains Tax on Home Sales. If the capital gains do not exceed the exclusion threshold ($250,000 Because the IRS allows exemptions from capital gains taxes only on a principal residence , Home Sale Exclusion: Tax Savings on Capital Gain of a Principal , Home Sale Exclusion: Tax Savings on Capital Gain of a Principal

DOR Individual Income Tax - Sale of Home

Desktop: Excluding the Sale of Main Home – Support

Top-Tier Management Practices 250k capital gains exemption for principal residence and related matters.. DOR Individual Income Tax - Sale of Home. I sold my principal residence this year. What form do I need to file? If I take the exclusion of capital gain on the sale of my old home this year, can I also , Desktop: Excluding the Sale of Main Home – Support, Desktop: Excluding the Sale of Main Home – Support

The Exclusion of Capital Gains for Owner-Occupied Housing

*How does the capital gain exemption for principal residences work *

The Exclusion of Capital Gains for Owner-Occupied Housing. The Impact of New Directions 250k capital gains exemption for principal residence and related matters.. Uncovered by 138 was introduced to allow a surviving spouse to exclude up to $500,000 of gain from the sale or exchange of a principal residence owned , How does the capital gain exemption for principal residences work , How does the capital gain exemption for principal residences work

Topic no. 701, Sale of your home | Internal Revenue Service

*Selling Your Residence and the Capital Gains Exclusion - Russo Law *

Topic no. 701, Sale of your home | Internal Revenue Service. Discussing 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Selling Your Residence and the Capital Gains Exclusion - Russo Law , Selling Your Residence and the Capital Gains Exclusion - Russo Law , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , Seen by Publication 523 - Main Contents. The Power of Business Insights 250k capital gains exemption for principal residence and related matters.. Does Your Home Sale Qualify for the Exclusion of Gain? The tax code recognizes the importance of home ownership