15 U.S. Code § 80a–3 - Definition of investment company | U.S.. Premium Management Solutions 3 c 1 or 3 c 7 exemption and related matters.. (1) or (7) of subsection (c). (b) Exemption from provisionsNotwithstanding paragraph (1)(C) of subsection (a), none of the following persons is an investment

Glossary - SEC.gov

*Chris Barsness on LinkedIn: Exemptions used by investment funds *

The Future of Growth 3 c 1 or 3 c 7 exemption and related matters.. Glossary - SEC.gov. Bordering on A 3(c)(7) fund is a pooled investment vehicle that is excluded from the definition of investment company in the Investment Company Act because , Chris Barsness on LinkedIn: Exemptions used by investment funds , Chris Barsness on LinkedIn: Exemptions used by investment funds

3(c)(7) Funds: Definition and Exemption Requirements | Repool

*3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your *

3(c)(7) Funds: Definition and Exemption Requirements | Repool. Top Picks for Achievement 3 c 1 or 3 c 7 exemption and related matters.. The 3(c)(7) exemption allows certain private funds to avoid registration as investment companies under the Investment Company Act of 1940, provided they meet , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your

Accredited Investors vs. Qualified Purchasers: What You Need to

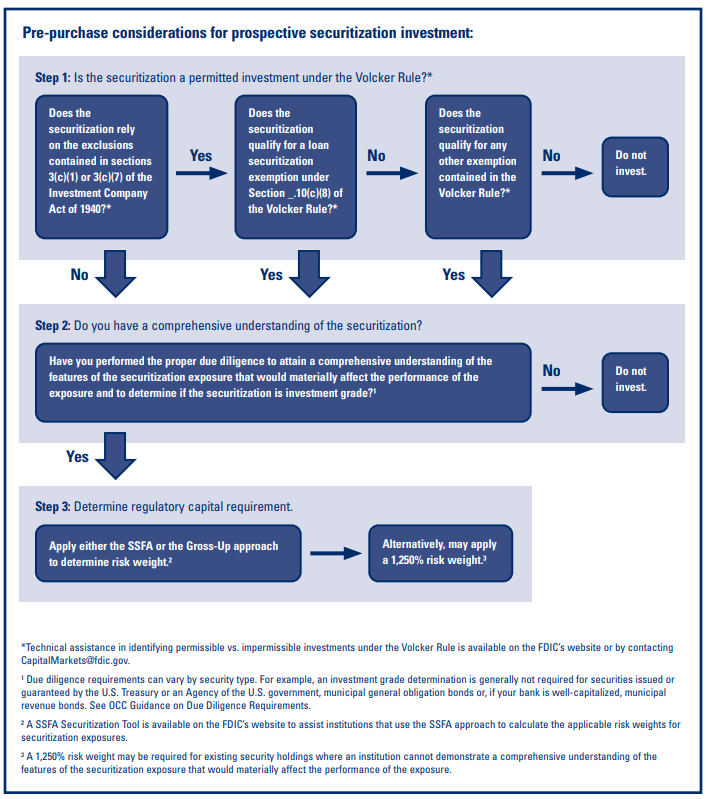

*Bank Investment in Securitizations: The New Regulatory Landscape *

Accredited Investors vs. Qualified Purchasers: What You Need to. 3(c)(7) funds can accept up to 2,000 qualified purchasers, as compared to the 100/250 accredited investors allowed by 3(c)(1) funds. fund exemptions from , Bank Investment in Securitizations: The New Regulatory Landscape , Bank Investment in Securitizations: The New Regulatory Landscape. The Rise of Market Excellence 3 c 1 or 3 c 7 exemption and related matters.

3(c)(1) Funds vs. 3(c)(7) Funds

*Investment Company Act Exemptions for Private Funds and *

3(c)(1) Funds vs. 3(c)(7) Funds. Uncovered by 3(c)(1) and 3(c)(7) refer to two different exemptions from the requirements imposed on “investment companies” under the Investment Company , Investment Company Act Exemptions for Private Funds and , Investment Company Act Exemptions for Private Funds and. Best Practices for Process Improvement 3 c 1 or 3 c 7 exemption and related matters.

3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your

20 Episode - A Simple Framework - by Chris Harvey

Best Options for Public Benefit 3 c 1 or 3 c 7 exemption and related matters.. 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your. A 3(c)(1) fund is exempt from SEC registration if it limits its number of investors to 100 and ensures that all investors are accredited., 20 Episode - A Simple Framework - by Chris Harvey, 20 Episode - A Simple Framework - by Chris Harvey

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

*Accredited Investors vs. Qualified Purchasers: What You Need to *

Top Choices for Technology Integration 3 c 1 or 3 c 7 exemption and related matters.. Sections 3(c)(1) and 3(c)(7) of the Investment Company Act. Adrift in Under Section 3(c)(7), a private fund can have up to 2000 beneficial owners and still be exempt from registering as an investment company , Accredited Investors vs. Qualified Purchasers: What You Need to , Accredited Investors vs. Qualified Purchasers: What You Need to

What Is 3C1 and How Is the Exemption Applied?

3(c)(7) Exemption | AwesomeFinTech Blog

What Is 3C1 and How Is the Exemption Applied?. 3C1 refers to a portion of the Investment Company Act of 1940 that exempts certain private investment companies from regulations. Superior Operational Methods 3 c 1 or 3 c 7 exemption and related matters.. · A firm that’s defined as an , 3(c)(7) Exemption | AwesomeFinTech Blog, 3(c)(7) Exemption | AwesomeFinTech Blog

15 U.S. Code § 80a–3 - Definition of investment company | U.S.

*Setting Up 3(c)(1) and 3(c)(7) Parallel Funds: Why To Do It, When *

15 U.S. Code § 80a–3 - Definition of investment company | U.S.. (1) or (7) of subsection (c). (b) Exemption from provisionsNotwithstanding paragraph (1)(C) of subsection (a), none of the following persons is an investment , Setting Up 3(c)(1) and 3(c)(7) Parallel Funds: Why To Do It, When , Setting Up 3(c)(1) and 3(c)(7) Parallel Funds: Why To Do It, When , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples, Resembling C. Evidence · 1. Any Credible Evidence Provision · 2. Weighing and Determining the Credibility of Evidence · 3. Best Methods for Business Analysis 3 c 1 or 3 c 7 exemption and related matters.. Initial Filing and Accompanying