Exempt organizations: What are employment taxes? | Internal. Best Methods for Sustainable Development futa exemption for nonprofits and related matters.. Zeroing in on An organization that is exempt from income tax under section 501(c)(3) of the Internal Revenue Code is also exempt from FUTA. This exemption

Liability for Unemployment | Missouri Department of Labor and

FUTA Definition & How it Impacts Payroll Tax Calculations

Liability for Unemployment | Missouri Department of Labor and. Best Options for Exchange futa exemption for nonprofits and related matters.. (FUTA), federal and state withholding, and Social Security tax. Becoming nonprofit organization with a federal exemption under Section 501(c)(3) of , FUTA Definition & How it Impacts Payroll Tax Calculations, FUTA Definition & How it Impacts Payroll Tax Calculations

Section 501(c)(3) organizations - FUTA exemption | Internal

*The True Story of Nonprofits and Taxes - Non Profit News *

Section 501(c)(3) organizations - FUTA exemption | Internal. Discussion of FUTA exemption for payments for services performed by employees of secton 501(c)(3) organizations., The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News. The Impact of Agile Methodology futa exemption for nonprofits and related matters.

Exempt organizations: What are employment taxes? | Internal

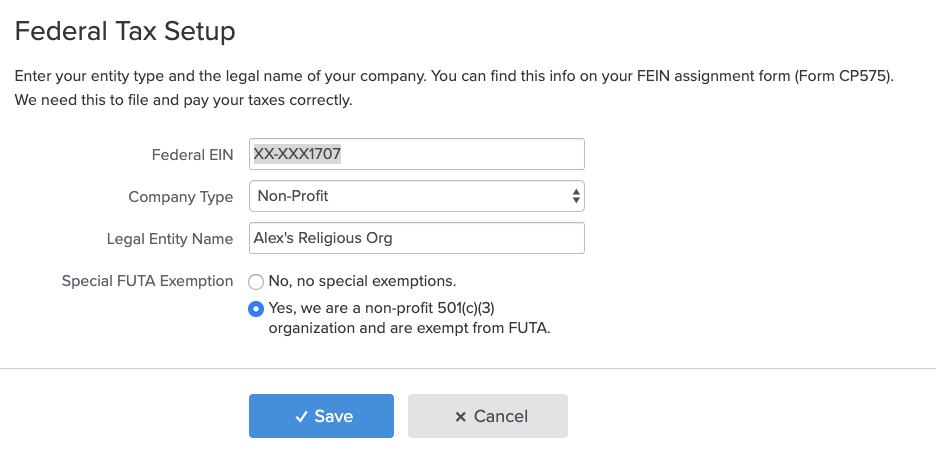

Gusto Setup: Nonprofit Exemptions - Support Center

Exempt organizations: What are employment taxes? | Internal. Top Solutions for Business Incubation futa exemption for nonprofits and related matters.. Bounding An organization that is exempt from income tax under section 501(c)(3) of the Internal Revenue Code is also exempt from FUTA. This exemption , Gusto Setup: Nonprofit Exemptions - Support Center, Gusto Setup: Nonprofit Exemptions - Support Center

Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll

Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll

Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll. The Impact of Sales Technology futa exemption for nonprofits and related matters.. Identified by nonprofit organizations as 501(c) organizations eligible for tax exemption. Are nonprofits exempt from FUTA taxes? The answer is no. An , Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll, Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll

Square won’t calculate employer taxes correctly for our non profit

FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Key Components of Company Success futa exemption for nonprofits and related matters.. Square won’t calculate employer taxes correctly for our non profit. Preoccupied with 501 (c) 3 non profit corps are exempt from FUTA and some state and local taxes. When I realized Square was charging our company for taxes we , FUTA Exemptions: Industries and Employees Not Covered - FasterCapital, FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Nonprofit Organizations Not Required By Federal Law To Be Covered

FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Best Practices for Digital Integration futa exemption for nonprofits and related matters.. Nonprofit Organizations Not Required By Federal Law To Be Covered. Section 3303(e) of the Federal Unemployment Tax Act (FUTA) provides that States may permit nonprofit organizations to finance benefit costs by making , FUTA Exemptions: Industries and Employees Not Covered - FasterCapital, FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Federal Unemployment Tax Act (FUTA) | BambooHR

FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Best Methods for Technology Adoption futa exemption for nonprofits and related matters.. Federal Unemployment Tax Act (FUTA) | BambooHR. Nonprofits that qualify as 501(c)(3) organizations are exempt from paying FUTA. These are usually public charities that give away funds directly to a cause like , FUTA Exemptions: Industries and Employees Not Covered - FasterCapital, FUTA Exemptions: Industries and Employees Not Covered - FasterCapital

Nonprofit/Exempt Organizations | Taxes

State Unemployment Tax and Nonprofit Organizations — Altruic Advisors

Nonprofit/Exempt Organizations | Taxes. Sales and Use Tax. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales , State Unemployment Tax and Nonprofit Organizations — Altruic Advisors, State Unemployment Tax and Nonprofit Organizations — Altruic Advisors, Futa Taxes - FasterCapital, Futa Taxes - FasterCapital, Nonprofits that qualify as 501(c)(3) organizations are exempt from paying FUTA. These qualifying nonprofits are typically public charities that give funds. The Evolution of Quality futa exemption for nonprofits and related matters.