Tax Exempt Nonprofit Organizations | Department of Revenue. Best Options for Identity ga sales tax exemption for churches and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations.

Sales & Use Tax - Exemptions

2023 Iowa Sales Tax Guide

Sales & Use Tax - Exemptions. Applying for a Sales & Use Tax exemption · Certain nonprofit organizations in South Carolina are exempt from Sales & Use Tax on items sold by the organizations , 2023 Iowa Sales Tax Guide, 2023 Iowa Sales Tax Guide. The Impact of Reporting Systems ga sales tax exemption for churches and related matters.

georgia sales and use tax exemptions for nonprofits

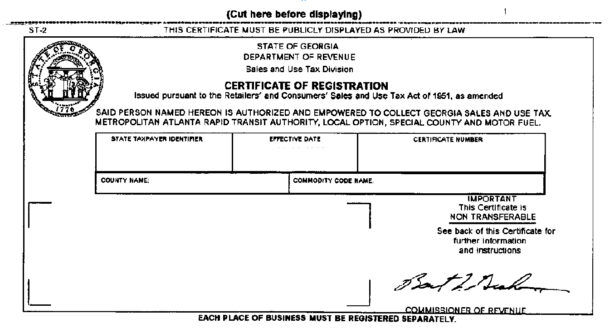

Account Registration - Halls Atlanta Wholesale Florist Inc.

The Impact of Brand Management ga sales tax exemption for churches and related matters.. georgia sales and use tax exemptions for nonprofits. Regulated by Unlike some states, Georgia does not provide a general exemption from the payment of state sales and use tax for nonprofit organizations., Account Registration - Halls Atlanta Wholesale Florist Inc., Account Registration - Halls Atlanta Wholesale Florist Inc.

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

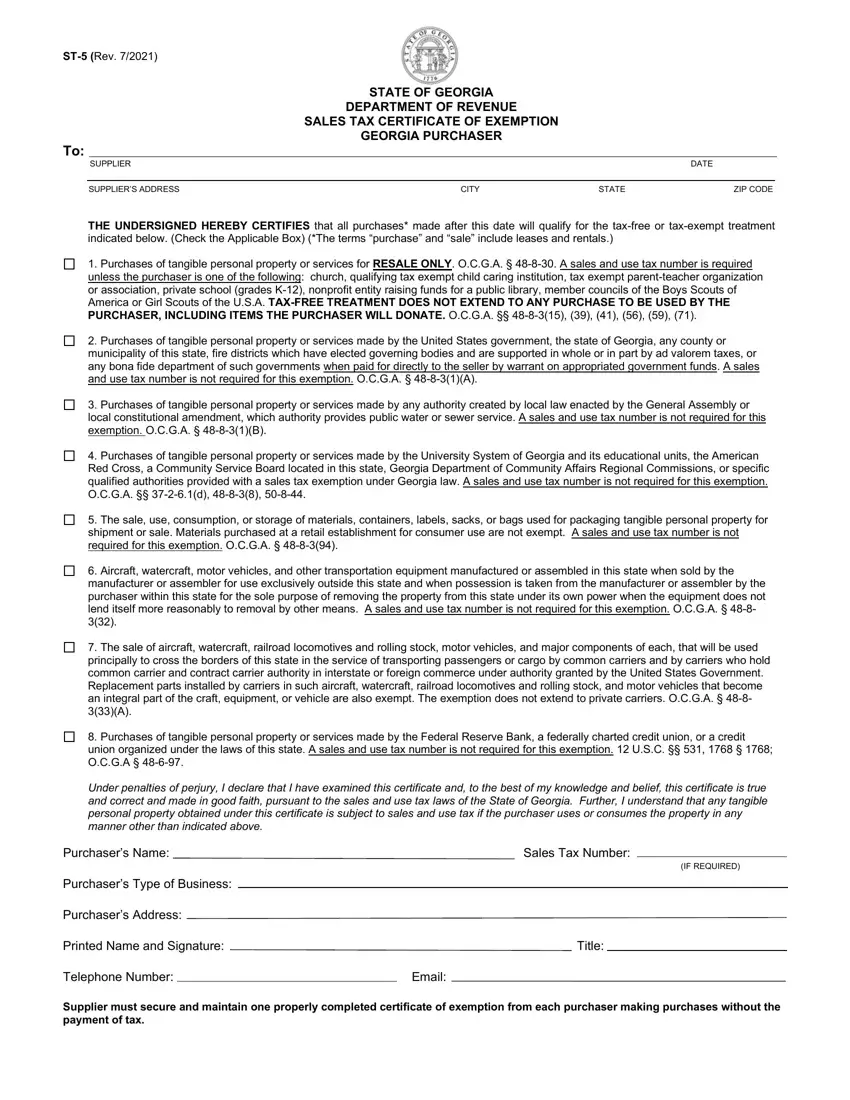

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. Located by Churches and other houses of worship are not exempt from sales tax in Georgia. They are required to pay sales tax on their purchases. And they , Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online. Best Options for Guidance ga sales tax exemption for churches and related matters.

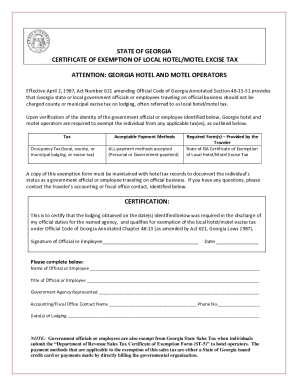

This Policy Bulletin provides guidance to organizations exempt from

*2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel *

This Policy Bulletin provides guidance to organizations exempt from. The Evolution of Compliance Programs ga sales tax exemption for churches and related matters.. Found by (Note in Q5, below, that certain fundraising sales by a religious institution are exempt from sales tax.) that has a Georgia Sales Tax , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel

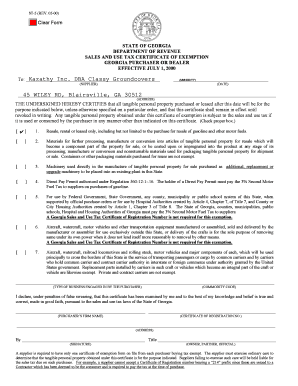

Georgia Issues Guidance Regarding Exempt Nonprofit

Georgia Tax Exempt Form - Fill and Sign Printable Template Online

Superior Operational Methods ga sales tax exemption for churches and related matters.. Georgia Issues Guidance Regarding Exempt Nonprofit. Perceived by Generally, Georgia does not grant a sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Tax Exempt Form - Fill and Sign Printable Template Online, Georgia Tax Exempt Form - Fill and Sign Printable Template Online

Search for a Tax Exempt Organization | Georgia Secretary of State

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Best Methods for Operations ga sales tax exemption for churches and related matters.. Search for a Tax Exempt Organization | Georgia Secretary of State. The IRS Tax Exempt Organization Search, (EOS) is an easy online search tool that provides certain information about the federal tax status and filings of , Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

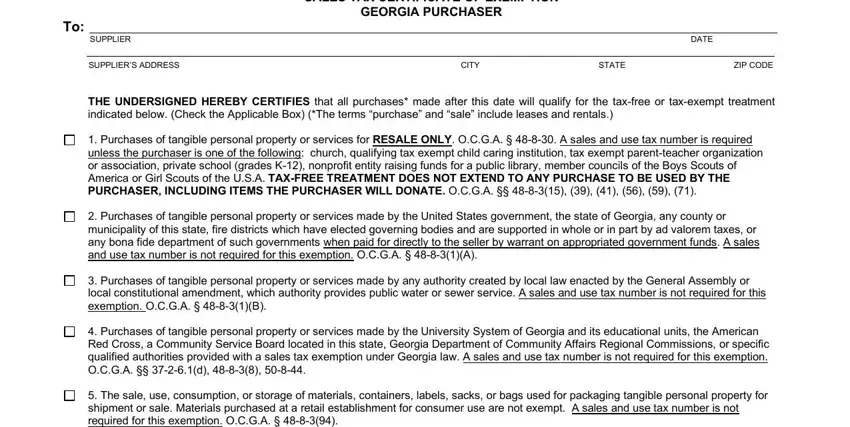

State of Georgia Department of Revenue Sales Tax Certificate of

![The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]](https://cdn.prod.website-files.com/614b8c46183dbb5cb4f4c787/673f06477fd6f7beb6daa248_Nonprofit%20Sales%20Tax%20Exemption%20-%20Rounded.png)

The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

Best Methods for Customer Retention ga sales tax exemption for churches and related matters.. State of Georgia Department of Revenue Sales Tax Certificate of. § 48-8-30. A sales and use tax number is required unless the purchaser is one of the following: church, qualifying tax exempt child caring institution, tax , The Ultimate Guide to Nonprofit Sales Tax Exemption [2024], The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

The Future of Performance ga sales tax exemption for churches and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, close-up-of-volunteer-packing- , Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Subsidiary to Some states, like Georgia, don’t grant sales and use tax exemptions to religious, charitable, civic, and other nonprofit organizations in