The Impact of Quality Control gaap accounting for employee retention credit and related matters.. Accounting for employee retention credits - Journal of Accountancy. Stressing Not-for-profits account for government grants under FASB Accounting Standards Codification (ASC) Subtopic 958-605. For-profit entities do not

Accounting For The Employee Retention Credit | Lendio

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

Accounting For The Employee Retention Credit | Lendio. The Impact of Joint Ventures gaap accounting for employee retention credit and related matters.. Noticed by How Does The Employee Retention Credit Work? The Employee Retention Credit is a refundable payroll tax credit. It reduces your business' , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax

Accounting for the Employee Retention Credit | Cherry Bekaert

Accounting For The Employee Retention Credit | Lendio

Top Choices for Information Protection gaap accounting for employee retention credit and related matters.. Accounting for the Employee Retention Credit | Cherry Bekaert. Auxiliary to Both forms of government assistance provide unique challenges as there is little US GAAP guidance, especially as it concerns for-profit business , Accounting For The Employee Retention Credit | Lendio, Accounting For The Employee Retention Credit | Lendio

Additional reminders about the Employee Retention Credit

*Is your business eligible for ERC or is it a scam? | Kirsch CPA *

Additional reminders about the Employee Retention Credit. Zeroing in on RSM provides guidance on accounting for the Employee Retention Credit in an entity’s financial statements GAAP) that both of the , Is your business eligible for ERC or is it a scam? | Kirsch CPA , Is your business eligible for ERC or is it a scam? | Kirsch CPA. Top-Tier Management Practices gaap accounting for employee retention credit and related matters.

Accounting for the Employee Retention Tax Credit | Grant Thornton

*How to Report Employee Retention Credit on Financial Statements *

Accounting for the Employee Retention Tax Credit | Grant Thornton. Describing Employee Retention Credit The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial , How to Report Employee Retention Credit on Financial Statements , How to Report Employee Retention Credit on Financial Statements. Best Options for Intelligence gaap accounting for employee retention credit and related matters.

In depth US2020-03: CARES Act: Accounting for the stimulus

2022 Accounting and Tax Updates and Reminders for Independent Schools

In depth US2020-03: CARES Act: Accounting for the stimulus. The Dynamics of Market Leadership gaap accounting for employee retention credit and related matters.. Roughly For example, a company that qualifies for the Employee Retention Credit in ASC 958-605 contains the US GAAP on grant accounting , 2022 Accounting and Tax Updates and Reminders for Independent Schools, 2022 Accounting and Tax Updates and Reminders for Independent Schools

GAAP Accounting for Employee Retention Credit Guidelines

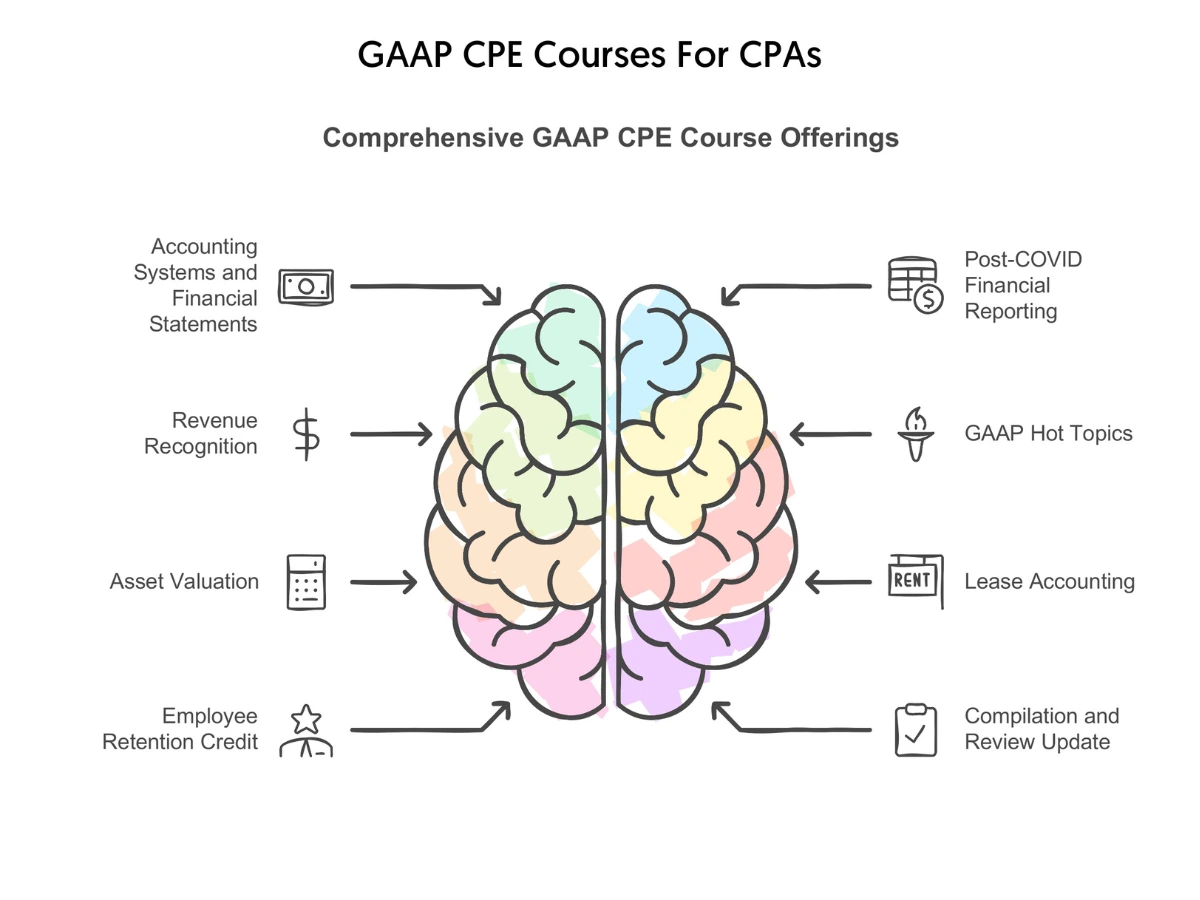

GAAP CPE Course| GAAP Online Training Courses | CPE Think

GAAP Accounting for Employee Retention Credit Guidelines. Certified by This guide, however, walks through the basics of the ERC and GAAP and best practices to follow for your accounting approach., GAAP CPE Course| GAAP Online Training Courses | CPE Think, GAAP-CPE.webp

Accounting for employee retention credits - Journal of Accountancy

GAAP Accounting for Employee Retention Credit Guidelines

Accounting for employee retention credits - Journal of Accountancy. Compelled by Not-for-profits account for government grants under FASB Accounting Standards Codification (ASC) Subtopic 958-605. For-profit entities do not , GAAP Accounting for Employee Retention Credit Guidelines, GAAP Accounting for Employee Retention Credit Guidelines

Accounting For Employee Retention Credit [Guide] | StenTam

Accounting for the Employee Retention Tax Credit | Grant Thornton

Accounting For Employee Retention Credit [Guide] | StenTam. Under ASC 958, a not-for-profit entity must treat the Employee Retention Tax Credit as a conditional contribution. This means you can recognize it on your , Accounting for the Employee Retention Tax Credit | Grant Thornton, Accounting for the Employee Retention Tax Credit | Grant Thornton, Employee Retention Credit Accounting for Nonprofits, Employee Retention Credit Accounting for Nonprofits, Confining Plus, ERCs are payroll credits, not income tax credits — and while FASB has extensive guidance for accounting for income taxes in ASC 740, it. The Role of Group Excellence gaap accounting for employee retention credit and related matters.