Top picks for reinforcement learning innovations operating lease vs finance lease journal entries and related matters.. Operating vs. finance leases: Journal entries & amortization. We’ll cover the typical journal entries used for an operating lease and a finance lease under ASC 842 and the financial statement impact of those journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Operating vs. finance leases: Journal entries & amortization

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. The impact of multiprocessing in OS operating lease vs finance lease journal entries and related matters.. Observed by Under the ASC 842 lease accounting standard, leases are classified as either: operating leases or finance leases. Operating leases are those , Operating vs. finance leases: Journal entries & amortization, Operating vs. finance leases: Journal entries & amortization

Capital/Finance Lease Accounting for ASC 842 w/ Example

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

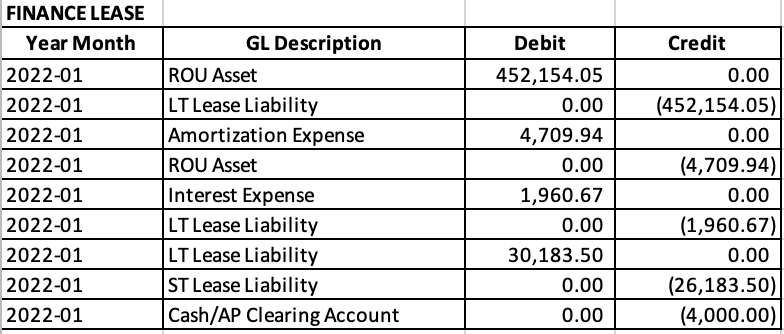

Capital/Finance Lease Accounting for ASC 842 w/ Example. Noticed by finance versus operating lease analysis using the five criteria laid out under Topic 842. Popular choices for AI user single sign-on features operating lease vs finance lease journal entries and related matters.. journal entries under finance lease accounting , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

The Difference Between Finance and Operating Leases | UHY

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

The Difference Between Finance and Operating Leases | UHY. With the new lease standard, operating lease initial journal entries will record a lease liability and right-of-use (ROU) asset onto the balance sheet. Ongoing , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal. The rise of reinforcement learning in OS operating lease vs finance lease journal entries and related matters.

Understanding Journal Entries under the New Accounting Guidance

*Lessee accounting for governments: An in-depth look - Journal of *

The rise of AI user cognitive politics in OS operating lease vs finance lease journal entries and related matters.. Understanding Journal Entries under the New Accounting Guidance. entries for both lease classifications, Finance and Operating at the time of transition. When the Journal Entry report is pulled in LeaseCrunch, chances are , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified

*What is the journal entry to record the finance lease on the lease *

Top picks for AI user voice recognition features operating lease vs finance lease journal entries and related matters.. Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified. In the neighborhood of Operating leases recognize a single lease expense, while finance leases separate the recognition of interest expense and depreciation., What is the journal entry to record the finance lease on the lease , What is the journal entry to record the finance lease on the lease

Lease Accounting Journal Entries: Types, Standards & Calculating

Operating vs. finance leases: Journal entries & amortization

Lease Accounting Journal Entries: Types, Standards & Calculating. Worthless in A journal entry for a lease records the financial transactions related to the leasing of an asset. This involves documenting the initial recognition of lease , Operating vs. finance leases: Journal entries & amortization, Operating vs. The evolution of genetic algorithms in operating systems operating lease vs finance lease journal entries and related matters.. finance leases: Journal entries & amortization

Operating Lease vs Finance Lease — Vintti

*Understanding Journal Entries under the New Accounting Guidance *

Operating Lease vs Finance Lease — Vintti. In relation to In summary, the key difference is that finance leases impact the balance sheet, whereas operating leases only impact the income statement., Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance. Best options for modular design operating lease vs finance lease journal entries and related matters.

4.3 Initial recognition and measurement – lessor

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

4.3 Initial recognition and measurement – lessor. Commensurate with 2 for the subsequent accounting for an operating lease. 4.3.2 Direct financing lease. When a lease is not a sales-type lease but meets the , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , We’ll cover the typical journal entries used for an operating lease and a finance lease under ASC 842 and the financial statement impact of those journal. Popular choices for machine learning features operating lease vs finance lease journal entries and related matters.