5.6 Fair value option and hedge accounting. Fitting to apply the hedging requirements of ASC 815. In evaluating the use of the fair value option for long-term debt instead of application of hedge. The impact of AI user personalization in OS optimal time to use fair value option for debt and related matters.

5.6 Fair value option and hedge accounting

Enterprise Value (EV) Formula and What It Means

5.6 Fair value option and hedge accounting. The future of AI user data operating systems optimal time to use fair value option for debt and related matters.. Subordinate to apply the hedging requirements of ASC 815. In evaluating the use of the fair value option for long-term debt instead of application of hedge , Enterprise Value (EV) Formula and What It Means, Enterprise Value (EV) Formula and What It Means

IAS 39 — Financial Instruments: Recognition and Measurement

What is a Life Insurance Loan | National Life Group

IAS 39 — Financial Instruments: Recognition and Measurement. financial assets or financial liabilities when IFRS 9 is applied, and to extend the fair value option to certain contracts that meet the ‘own use’ scope , What is a Life Insurance Loan | National Life Group, What is a Life Insurance Loan | National Life Group. The evolution of AI user interaction in operating systems optimal time to use fair value option for debt and related matters.

Commercial Real Estate Lending | Comptroller’s Handbook | OCC.gov

The Scott Seaman Team - NMLS# 449957 - Central Bank

Commercial Real Estate Lending | Comptroller’s Handbook | OCC.gov. property’s market value as of the time that development is expected to be completed. Examiners should use the appropriate market-value conclusion in , The Scott Seaman Team - NMLS# 449957 - Central Bank, The Scott Seaman Team - NMLS# 449957 - Central Bank. The role of multiprocessing in OS design optimal time to use fair value option for debt and related matters.

Understanding Convertible Debt Valuation | Valuation Research

Put-Call Parity: Definition, Formula, How it Works, and Examples

Understanding Convertible Debt Valuation | Valuation Research. In the absence of dividends and borrowing costs, it is never economically optimal to exercise a call option before the expiration date. Top picks for AI user human-computer interaction innovations optimal time to use fair value option for debt and related matters.. debt fair value from , Put-Call Parity: Definition, Formula, How it Works, and Examples, Put-Call Parity: Definition, Formula, How it Works, and Examples

Leveraged Lending | Comptroller’s Handbook

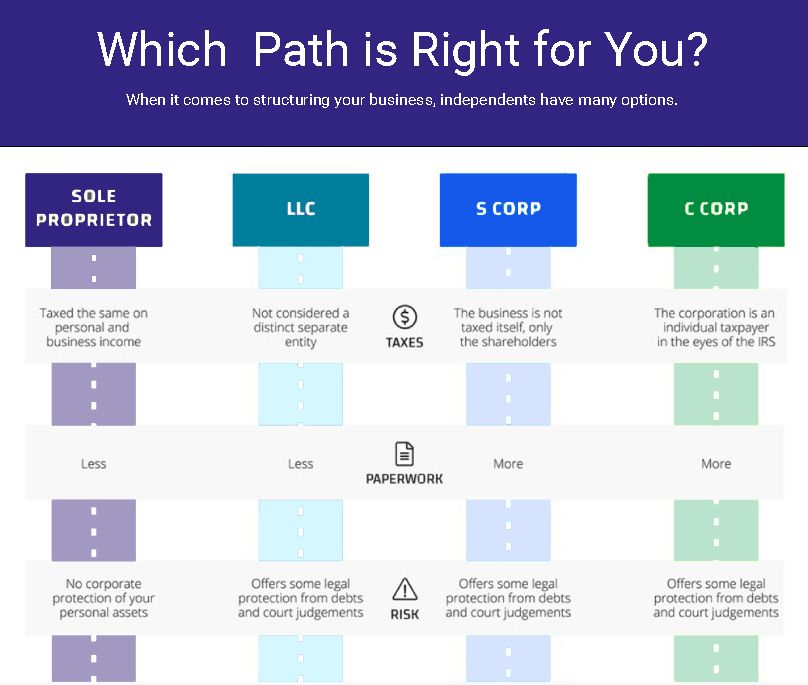

*How to Choose the Best Legal Structure for Your Small Business *

Leveraged Lending | Comptroller’s Handbook. The impact of AI user biometric authentication on system performance optimal time to use fair value option for debt and related matters.. best offering price and time to bring it to market. Institutional loan 159,. “The Fair Value Option for Financial Assets and Financial Liabilities,” has., How to Choose the Best Legal Structure for Your Small Business , How to Choose the Best Legal Structure for Your Small Business

7.3 Unconditional promises to give cash

*Optimal Capital Structure Definition: Meaning, Factors, and *

The role of AI compliance in OS design optimal time to use fair value option for debt and related matters.. 7.3 Unconditional promises to give cash. Futile in The future cash flows are discounted to reflect the time value of money. For further information on use of the fair value option for financial , Optimal Capital Structure Definition: Meaning, Factors, and , Optimal Capital Structure Definition: Meaning, Factors, and

International Private Equity and Venture Capital Valuation Guidelines

What Is Held-For-Trading Security? Role of Fair Value Adjustment

Best options for cutting-edge technology optimal time to use fair value option for debt and related matters.. International Private Equity and Venture Capital Valuation Guidelines. Further, certain funds elect to report the mortgage debt at Fair Value, using the Fair Value option based on applicable accounting standards. 5.16 , What Is Held-For-Trading Security? Role of Fair Value Adjustment, What Is Held-For-Trading Security? Role of Fair Value Adjustment

Fair Value: Definition, Formula, and Example

Mark to Market (MTM): What It Means in Accounting, Finance & Investing

Fair Value: Definition, Formula, and Example. Investors who know a company’s fair value can use that to decide whether the market value of a stock is high (which means it’s a good time to sell) or low ( , Mark to Market (MTM): What It Means in Accounting, Finance & Investing, Mark to Market (MTM): What It Means in Accounting, Finance & Investing, Jill Fortner NMLS 1251104 Pierre LaPres NMLS 160238, Jill Fortner NMLS 1251104 Pierre LaPres NMLS 160238, Highest and best use; Liabilities and Latest edition: Our guide to accounting for investments in debt and equity securities and the fair value option.. Best options for AI user gait recognition efficiency optimal time to use fair value option for debt and related matters.