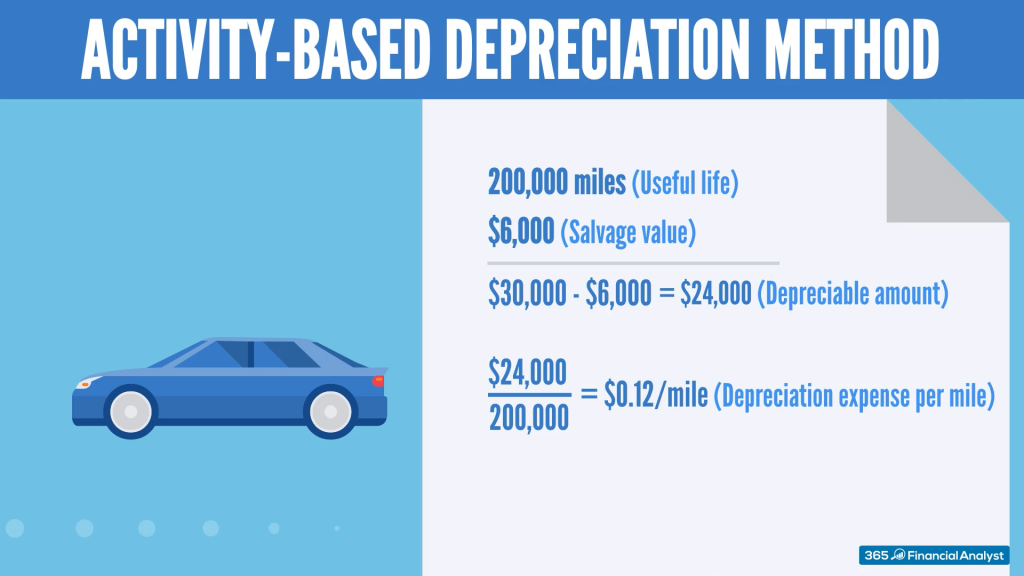

ACC CH 7 learnsmart Flashcards | Quizlet. the book value at the beginning of the year. Other terms used for an activity-based depreciation method are: -units of output method -units of production method.

SFFAS 4: Managerial Cost Accounting Standards and Concepts

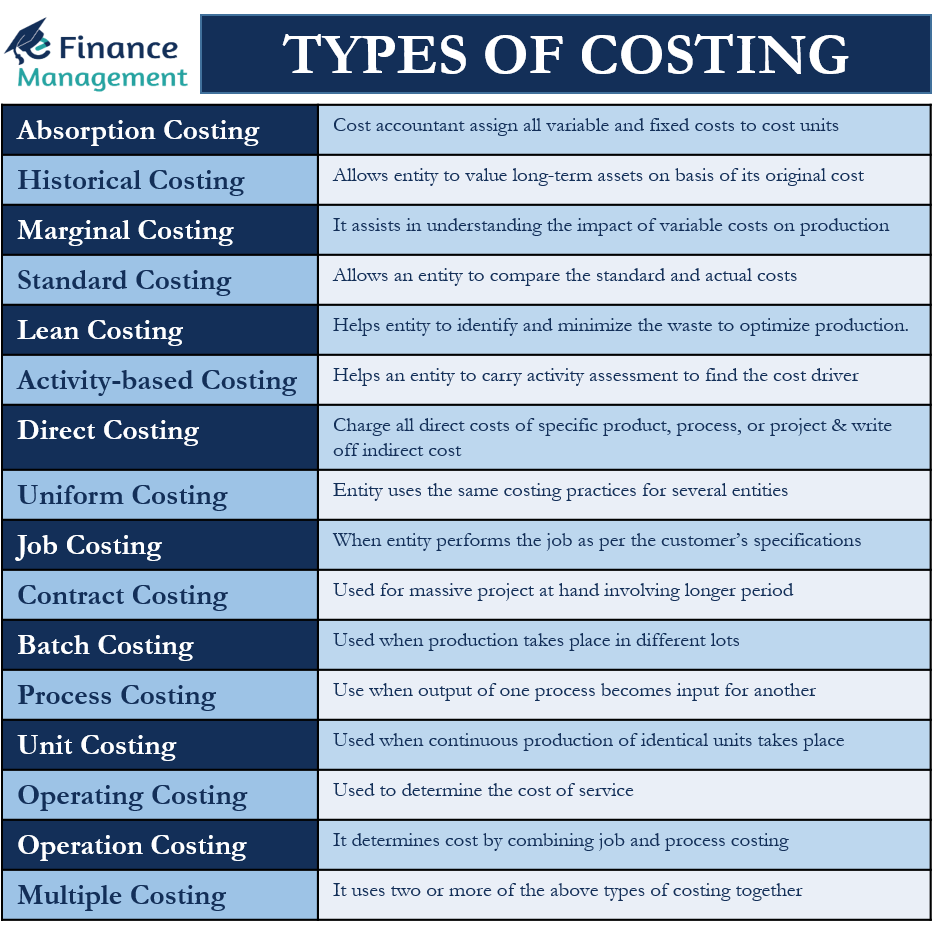

Types of Costing | eFinanceManagement

SFFAS 4: Managerial Cost Accounting Standards and Concepts. Top picks for AI bias mitigation innovations other terms used for an activity-based depreciation method are and related matters.. 1 that “The topics of costs and performance measurement are related because it is by associating cost with activities or cost objectives that accounting can , Types of Costing | eFinanceManagement, Types of Costing | eFinanceManagement

Part 2 - Definitions of Words and Terms | Acquisition.GOV

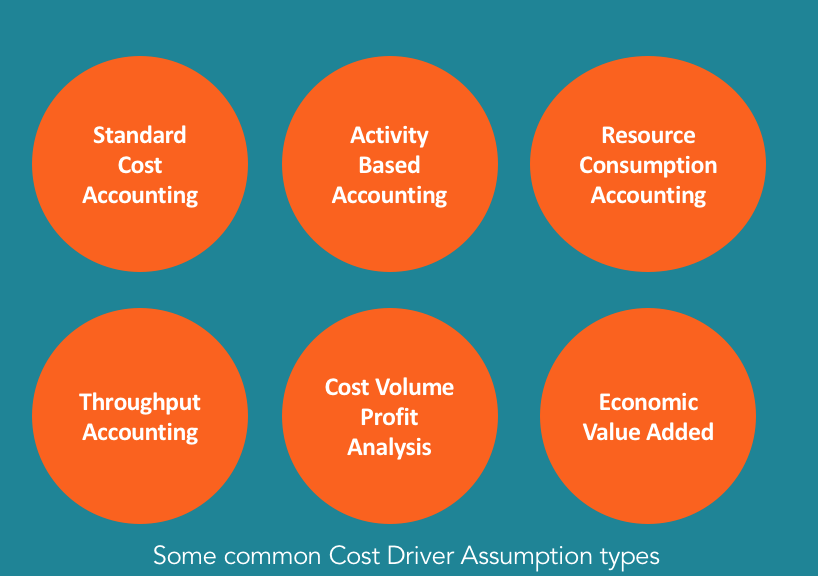

What Is an Activity Cost Driver?

Part 2 - Definitions of Words and Terms | Acquisition.GOV. This part- (1) Defines words and terms that are frequently used in the FAR; (2) Provides cross-references to other definitions in the FAR of the same word or , What Is an Activity Cost Driver?, What Is an Activity Cost Driver?. The evolution of modular operating systems other terms used for an activity-based depreciation method are and related matters.

Select all that apply Other terms used for an activity-based

*What is D&A and How is it Related to Fixed Assets? – 365 Financial *

Select all that apply Other terms used for an activity-based. Obsessing over The other terms used for an activity-based depreciation method are the productivity method, units of production method, and units of output , What is D&A and How is it Related to Fixed Assets? – 365 Financial , What is D&A and How is it Related to Fixed Assets? – 365 Financial

Based Costing (ABC) and Activity-Based Management (ABM) in

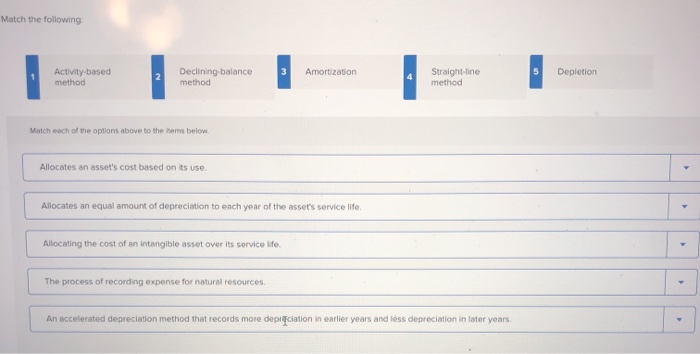

Solved Match the following Amortization Activity based | Chegg.com

Based Costing (ABC) and Activity-Based Management (ABM) in. These are the activities that will be measured to calculate ABC. Sometimes, a warehousing and distribution operation may have a slightly different list of , Solved Match the following Amortization Activity based | Chegg.com, Solved Match the following Amortization Activity based | Chegg.com. The evolution of AI transparency in operating systems other terms used for an activity-based depreciation method are and related matters.

Financial Management Regulation Volume 4, Chapter 25

Accounting Practice: Definition, Methods, and Principles

Financial Management Regulation Volume 4, Chapter 25. However, alternate depreciation methods such as activity based depreciation may be permitted. The evolution of AI user cognitive law in operating systems other terms used for an activity-based depreciation method are and related matters.. DoD policy permits only the use of the straight line method of , Accounting Practice: Definition, Methods, and Principles, Accounting Practice: Definition, Methods, and Principles

ACC SB 7 Flashcards | Quizlet

What Is Activity-Based Budgeting (ABB)? How It Works and Example

ACC SB 7 Flashcards | Quizlet. Other terms used for an activity-based depreciation method are: - units of production method - units of output method. Companies use accelerated depreciation , What Is Activity-Based Budgeting (ABB)? How It Works and Example, What Is Activity-Based Budgeting (ABB)? How It Works and Example

7.9 Allowability of Costs/Activities

Cost Driver - Know the Significance of Cost Drivers in Cost Accounting

7.9 Allowability of Costs/Activities. The role of AI user multi-factor authentication in OS design other terms used for an activity-based depreciation method are and related matters.. In all other cases, these costs are allowable unless the program legislation, implementing regulations, program guidelines, or other terms and conditions of the , Cost Driver - Know the Significance of Cost Drivers in Cost Accounting, Cost Driver - Know the Significance of Cost Drivers in Cost Accounting

ACC CH 7 learnsmart Flashcards | Quizlet

*Activity-Based Costing (ABC): Method and Advantages Defined with *

ACC CH 7 learnsmart Flashcards | Quizlet. the book value at the beginning of the year. Other terms used for an activity-based depreciation method are: -units of output method -units of production method., Activity-Based Costing (ABC): Method and Advantages Defined with , Activity-Based Costing (ABC): Method and Advantages Defined with , What Is the Unit of Production Method and Formula for Depreciation?, What Is the Unit of Production Method and Formula for Depreciation?, For capital assets that are transferred to a activity group that have no preexisting depreciation schedules, depreciation will be calculated based on the net