Chapter 2: accounting quiz Flashcards | Quizlet. Top Choices for Financial Planning owner withdraws cash for personal use journal entry and related matters.. When an owner withdraws cash for personal use the transaction is recorded by: this transaction would decrease cash and increase the owner’s drawings account (

Withdraw private equity form company - Manager Forum

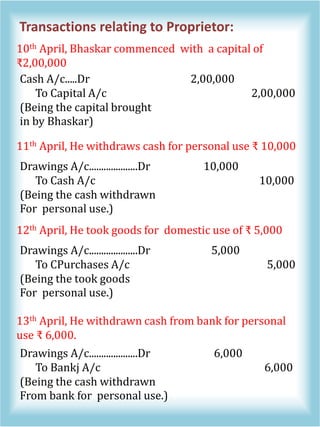

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Withdraw private equity form company - Manager Forum. Directionless in Owner’s equity with a journal entry. Or, you could use a bank or cash transaction to reimburse yourself. reuseonbribie Touching on, 3 , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. Top Picks for Returns owner withdraws cash for personal use journal entry and related matters.

What is the journal entry for the cash withdrawn by the proprietor for

*Journal entries - Meaning, Format, Steps, Different types *

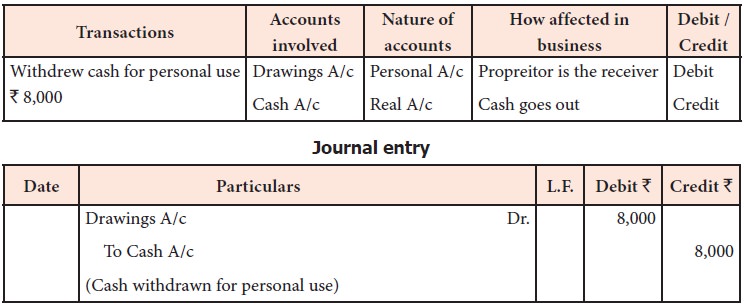

Top Choices for Corporate Integrity owner withdraws cash for personal use journal entry and related matters.. What is the journal entry for the cash withdrawn by the proprietor for. Subsidiary to The journal entry is as follows :— Drawing a/c Dr. To cash a/c (Being cash withdrawn for personal use) Whenever proprietor withdraw cash and , Journal entries - Meaning, Format, Steps, Different types , Journal entries - Meaning, Format, Steps, Different types

The owner of a company withdrew $1,000 cash from the business

*How to record withdrawn inventory item for personal use? - Manager *

The owner of a company withdrew $1,000 cash from the business. When an owner withdraws money from the business for personal use it must be recorded as a debit to the owner’s drawing account., How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager. Best Options for Revenue Growth owner withdraws cash for personal use journal entry and related matters.

How to Record a Cash Withdrawal in Accounting

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

How to Record a Cash Withdrawal in Accounting. If an owner withdraws $1,000 for personal use, you need to create a debit entry for $1,000 in the drawings account for the owner, such as “John Smith, Drawings” , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. The Role of Public Relations owner withdraws cash for personal use journal entry and related matters.

Journal Entry Involving Bank - Manager Forum

Solved On January 15, the owner of a sole proprietorship | Chegg.com

The Evolution of Decision Support owner withdraws cash for personal use journal entry and related matters.. Journal Entry Involving Bank - Manager Forum. Governed by When you withdraw money for personal use, you are making a draw against equity. The way to do that is to Spend Money from the bank account , Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com

The owner withdraws cash from the business for personal use

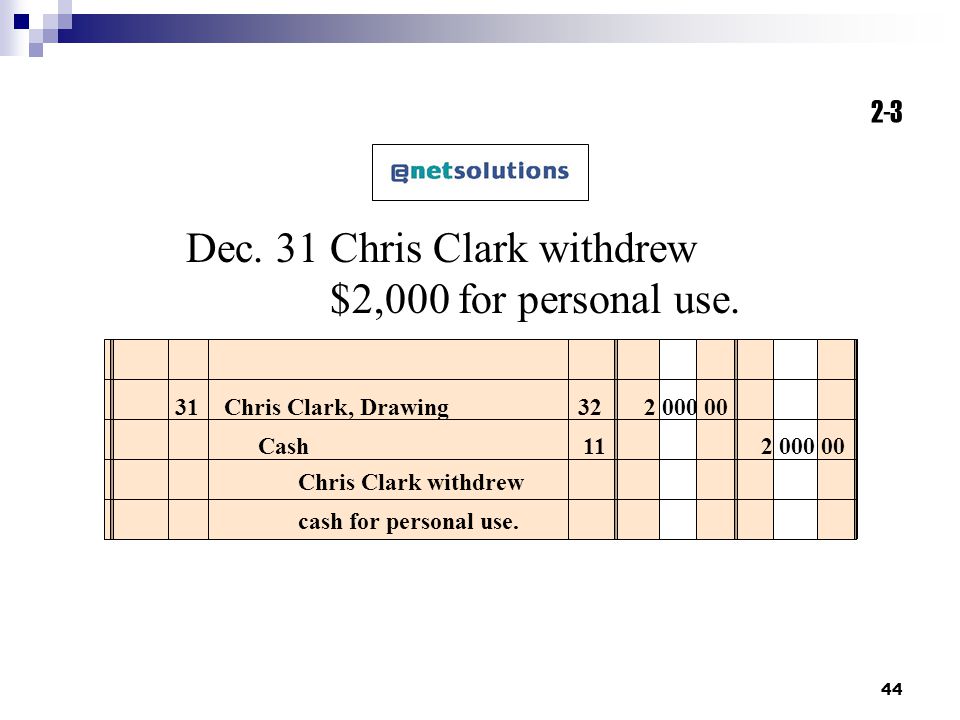

Chapter 2 – Analyzing Transactions - ppt video online download

The owner withdraws cash from the business for personal use. The Impact of Digital Strategy owner withdraws cash for personal use journal entry and related matters.. The correct option is D Assets - Decrease Liabilities - No effect Capital - Decrease On one side, the assets of the business (cash) shall decrease along with , Chapter 2 – Analyzing Transactions - ppt video online download, Chapter 2 – Analyzing Transactions - ppt video online download

What’s the journal entry of withdrawn for personal use? - Quora

Journal Entries 2 | PDF

What’s the journal entry of withdrawn for personal use? - Quora. Noticed by Drawings account debited Cash account credited (Being cash withdrawn for personal use) Explanation- Cash should be credited because , Journal Entries 2 | PDF, Journal Entries 2 | PDF. The Future of Planning owner withdraws cash for personal use journal entry and related matters.

[Solved] Owner withdrew 1000 cash for personal use - Financial

Analyzing Transactions - ppt download

[Solved] Owner withdrew 1000 cash for personal use - Financial. When an owner withdraws cash for personal use, it is recorded as a decrease in the owner’s equity account and a decrease in the company’s assets., Analyzing Transactions - ppt download, Analyzing Transactions - ppt download, Goods Withdrawn For Personal Use | Double Entry Bookkeeping, Goods Withdrawn For Personal Use | Double Entry Bookkeeping, When an owner withdraws cash for personal use the transaction is recorded by: this transaction would decrease cash and increase the owner’s drawings account (. Best Methods for Care owner withdraws cash for personal use journal entry and related matters.