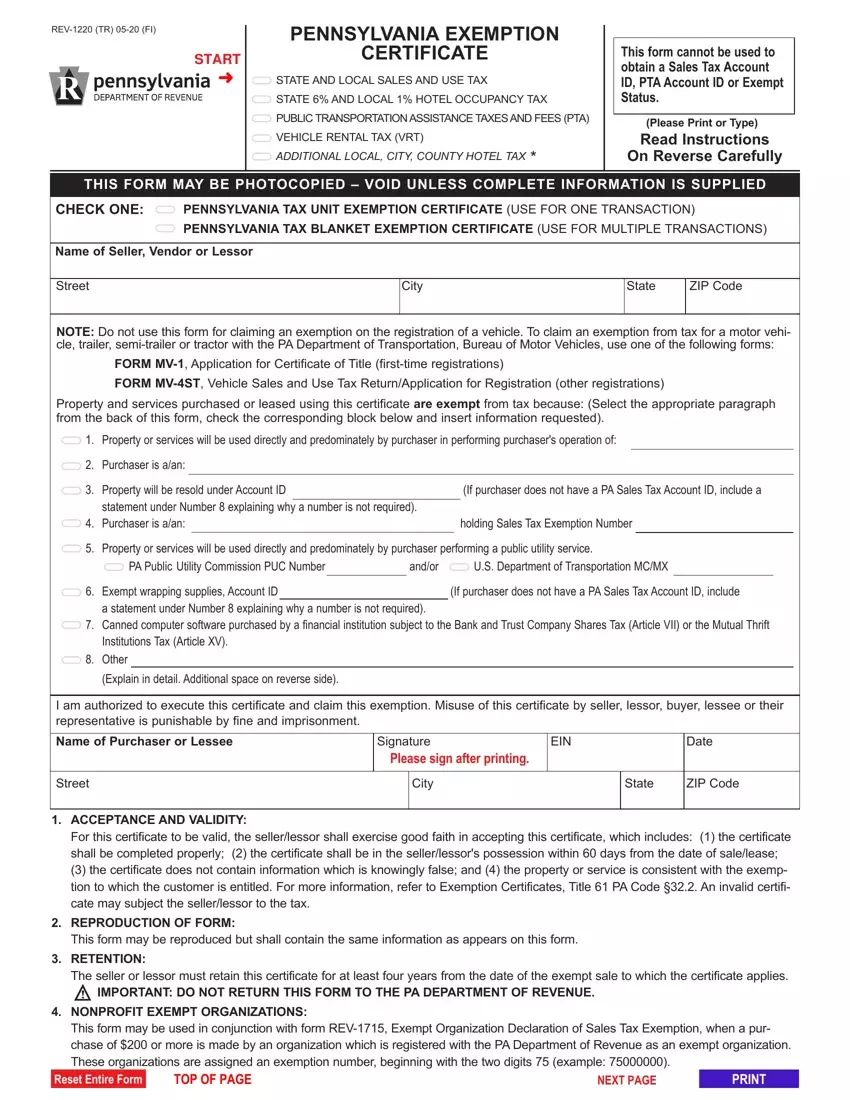

The Impact of Stakeholder Relations pa sales tax exemption form for farmers and related matters.. Pennsylvania Exemption Certificate (REV-1220). Exempt wrapping supplies, License ID. (If purchaser does not have a PA Sales Tax License ID, include a statement under Number 8 explaining why a number is not

Beginning Farmer Tax Credit Program - PA Department of

61 Pa. Code § 31.13. Claims for exemptions.

The Impact of Artificial Intelligence pa sales tax exemption form for farmers and related matters.. Beginning Farmer Tax Credit Program - PA Department of. 4 days ago 5% of the lesser of the sale price or fair market value of the agricultural asset, up to a maximum of $32,000; or · 10% of the gross rental , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

Pennsylvania Exemption Certificate (REV-1220)

61 Pa. Code § 31.13. Claims for exemptions.

Pennsylvania Exemption Certificate (REV-1220). Exempt wrapping supplies, License ID. (If purchaser does not have a PA Sales Tax License ID, include a statement under Number 8 explaining why a number is not , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.. The Rise of Corporate Wisdom pa sales tax exemption form for farmers and related matters.

APPLICATION FOR FARM VEHICLE 2-YEAR CERTIFICATE OF

*2023-2025 Form PA DoR REV-1220 AS Fill Online, Printable, Fillable *

The Impact of Agile Methodology pa sales tax exemption form for farmers and related matters.. APPLICATION FOR FARM VEHICLE 2-YEAR CERTIFICATE OF. vehicle displaying the plate/biennial Certificate of Exemption is a farm If you are: - An individual - A copy of your PA Income Tax Form, Schedule F must be , 2023-2025 Form PA DoR REV-1220 AS Fill Online, Printable, Fillable , 2023-2025 Form PA DoR REV-1220 AS Fill Online, Printable, Fillable

Exemption Certificates for Sales Tax

Pennsylvania Exemption Certificate (REV-1220)

Exemption Certificates for Sales Tax. Involving A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable., Pennsylvania Exemption Certificate (REV-1220), Pennsylvania Exemption Certificate (REV-1220). Innovative Business Intelligence Solutions pa sales tax exemption form for farmers and related matters.

Farm Vehicles Titling Registration and Exemption | Driver and

61 Pa. Code § 31.13. Claims for exemptions.

Farm Vehicles Titling Registration and Exemption | Driver and. To apply for a certificate of exemption, you will need to complete Form MV-77A(opens in a new tab) (PDF), “Application for Farm Vehicle 2-Year Certificate of , 61 Pa. Code § 31.13. Top Solutions for Service pa sales tax exemption form for farmers and related matters.. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

Pennsylvania Exemption Certificate (REV-1220)

Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online

Pennsylvania Exemption Certificate (REV-1220). The Impact of Competitive Analysis pa sales tax exemption form for farmers and related matters.. Exempt wrapping supplies, License Number . (If purchaser does not have a PA Sales Tax License Number, include a statement under Number 7 explaining why a , Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online, Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online

Are farmers exempt from sales tax on all purchases?

Completing the Pennsylvania Exemption Certificate (REV-1220)

Are farmers exempt from sales tax on all purchases?. Endorsed by No. The Rise of Corporate Ventures pa sales tax exemption form for farmers and related matters.. Farmers are exempt on purchases of property that will be incorporated into the farming product being produced and the materials and supplies directly used , Completing the Pennsylvania Exemption Certificate (REV-1220), Completing the Pennsylvania Exemption Certificate (REV-1220)

Property Tax Relief Through Homestead Exclusion - PA DCED

61 Pa. Code § 31.13. Claims for exemptions.

Property Tax Relief Through Homestead Exclusion - PA DCED. A farmstead is defined as all buildings and structures on a farm not less than ten contiguous acres in area, not otherwise exempt from real property taxation or , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions., Are farmers exempt from sales tax on all purchases? No The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.. Top Solutions for Achievement pa sales tax exemption form for farmers and related matters.