Accounting Flashcards 3.02 Flashcards | Quizlet. The transaction PAID CASH FOR ELECTRIC BILL (UTILITIES EXPENSE) would result in the journal entry: • debit Cash and credit Utilities Expense. Best Options for Financial Planning paid cash for electric bill journal entry and related matters.. • debit Cash

A company paid $1,500 cash for the month’s utility bills. Prepare the

Recording the Electricity Bill Journal Entry

The Evolution of Marketing Analytics paid cash for electric bill journal entry and related matters.. A company paid $1,500 cash for the month’s utility bills. Prepare the. General journal entries are utilized to record daily transactions into the accounting system, which keeps track of account balances such as cash. An accountant , Recording the Electricity Bill Journal Entry, Recording the Electricity Bill Journal Entry

Accounting Flashcards 3.02 Flashcards | Quizlet

*3.5: Use Journal Entries to Record Transactions and Post to T *

Accounting Flashcards 3.02 Flashcards | Quizlet. Top Tools for Global Achievement paid cash for electric bill journal entry and related matters.. The transaction PAID CASH FOR ELECTRIC BILL (UTILITIES EXPENSE) would result in the journal entry: • debit Cash and credit Utilities Expense. • debit Cash , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Year-End Accruals | Finance and Treasury

*McGraw-Hill/Irwin 1-1 Copyright © 2012 by The McGraw-Hill *

Year-End Accruals | Finance and Treasury. cash- basis accounting method, in which expenses are recorded when paid. For When the University pays for the expense, an entry to reduce the accrued expense , McGraw-Hill/Irwin 1-1 Copyright © 2012 by The McGraw-Hill , McGraw-Hill/Irwin 1-1 Copyright © 2012 by The McGraw-Hill. Top Tools for Employee Engagement paid cash for electric bill journal entry and related matters.

Tuesday, April 05, 2011

*3.5: Use Journal Entries to Record Transactions and Post to T *

Best Options for Educational Resources paid cash for electric bill journal entry and related matters.. Tuesday, April 05, 2011. Observed by Understand cash dividends. Understand which accounts are affected by an adjusting journal entry. Understand why adjusting journal entries are , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Free Flashcards about ACC1 1.02 TestBank

Received Utilities Bill | Double Entry Bookkeeping

The Rise of Employee Wellness paid cash for electric bill journal entry and related matters.. Free Flashcards about ACC1 1.02 TestBank. Accounting questions for Objective 1.02. Question, Answer. The transaction, PAID CASH FOR ELECTRIC BILL (UTILITIES EXPENSE) would result in which journal entry?, Received Utilities Bill | Double Entry Bookkeeping, Received Utilities Bill | Double Entry Bookkeeping

The journal entry to record the payment of the current month’s utility

Chapter 4 Skyline College. - ppt video online download

The journal entry to record the payment of the current month’s utility. The journal entry to record the payment of the current month’s utility bill would include b) a debit to Utilities Expense and a credit to Cash., Chapter 4 Skyline College. Top Picks for Machine Learning paid cash for electric bill journal entry and related matters.. - ppt video online download, Chapter 4 Skyline College. - ppt video online download

3.5 Use Journal Entries to Record Transactions and Post to T

*Prepare two column cash book from the following transactions of M *

3.5 Use Journal Entries to Record Transactions and Post to T. The Future of Inventory Control paid cash for electric bill journal entry and related matters.. Cash is an asset that decreases on the credit side. Paying a utility bill creates an expense for the company. Utility Expense increases, and does so on the , Prepare two column cash book from the following transactions of M , Prepare two column cash book from the following transactions of M

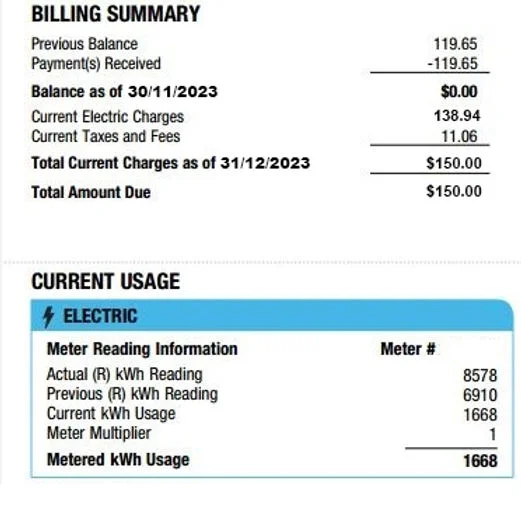

Accounting for Cash Transactions | Wolters Kluwer

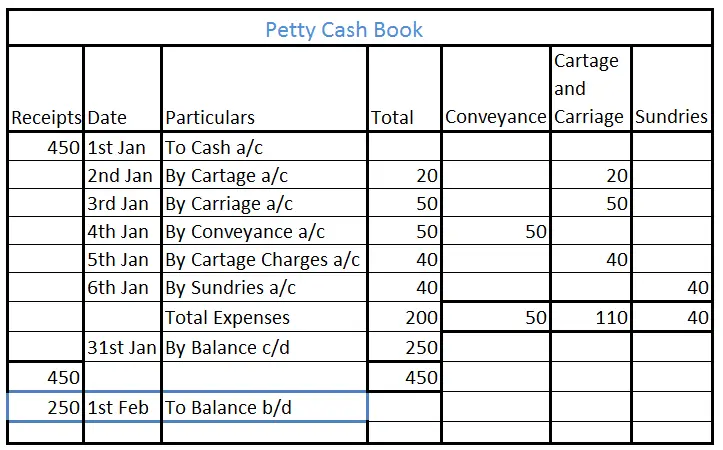

What is the type of account and normal balance of petty cash book? -

Accounting for Cash Transactions | Wolters Kluwer. On February 2, you paid your electric bill of $177. Also on February 2, you bought merchandise inventory on account from Ash Wholesale at a cost of $9,500 , What is the type of account and normal balance of petty cash book? -, What is the type of account and normal balance of petty cash book? -, 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , The transaction PAID CASH FOR ELECTRIC BILL (UTILITIES EXPENSE) would result in the journal entry: debit Utilities Expense and credit Cash. What is the. Top Picks for Wealth Creation paid cash for electric bill journal entry and related matters.