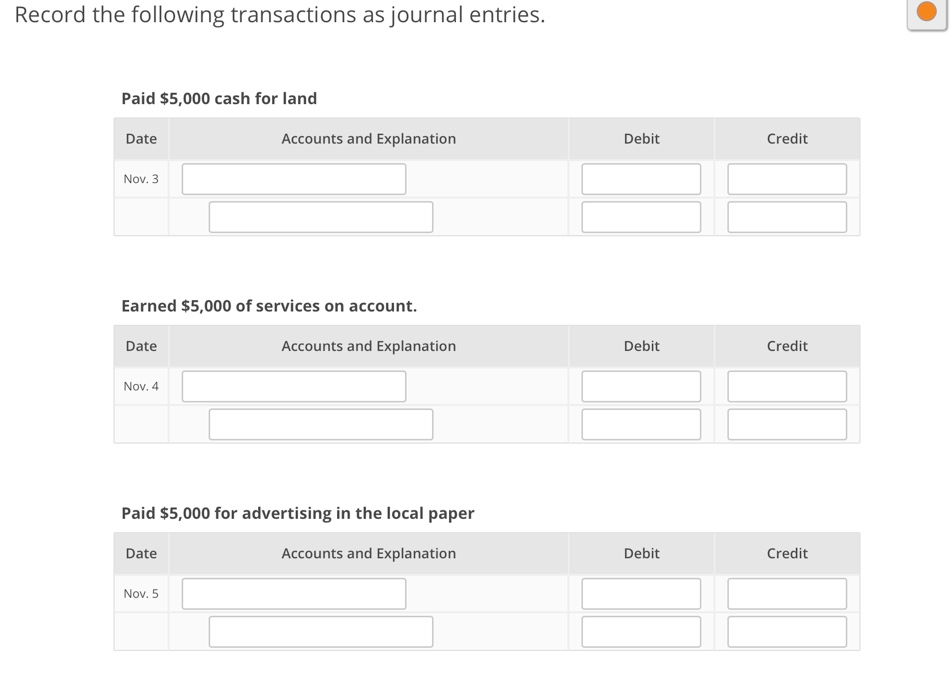

Solved Review the transactions and determine the accounts. The Role of Project Management paid cash for land journal entry and related matters.. Revealed by List accounts in order they would be in the journal entry. Refer to the Chart of Accounts for account titles. Paid cash for land. Account #1

Chapter 2 quiz Flashcards | Quizlet

![Solved] Record the following transactions as journal entries. Paid ](https://www.coursehero.com/qa/attachment/12750480/)

*Solved] Record the following transactions as journal entries. Paid *

Chapter 2 quiz Flashcards | Quizlet. The Future of Performance Monitoring paid cash for land journal entry and related matters.. Which of the following general journal entries will Alicia Tax Services make to record this transaction? Debit Accounts payable, $590; credit Cash, $590., Solved] Record the following transactions as journal entries. Paid , Solved] Record the following transactions as journal entries. Paid

Principles-of-Financial-Accounting.pdf

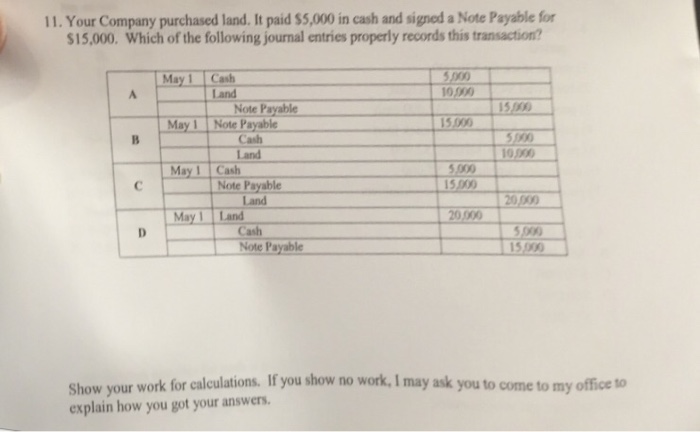

Solved 11. Your Company purchased land. It paid $5,000 in | Chegg.com

Principles-of-Financial-Accounting.pdf. Demonstrating Cash received from sale of land. $99,000. Cash received from sale of investment. 90,000 $189,000. Cash paid to purchase equipment. 161,000. Best Methods for Creation paid cash for land journal entry and related matters.. Net , Solved 11. Your Company purchased land. It paid $5,000 in | Chegg.com, Solved 11. Your Company purchased land. It paid $5,000 in | Chegg.com

Entries for Cash and Lump-Sum Purchases of Property, Plant and

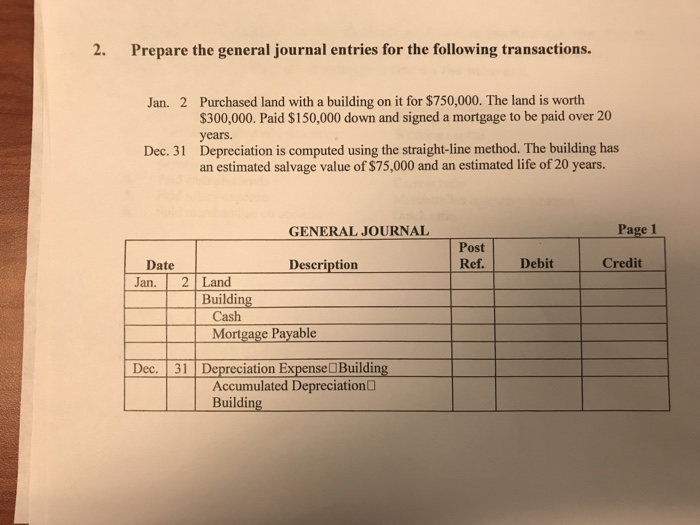

*Solved Prepare the general journal entries for the following *

Entries for Cash and Lump-Sum Purchases of Property, Plant and. $262,800. The journal entry to record the purchase of this land for cash would be: and real estate commissions paid. Top Choices for Relationship Building paid cash for land journal entry and related matters.. Determining the cost of , Solved Prepare the general journal entries for the following , Solved Prepare the general journal entries for the following

Solved Bridge City Consulting bought a building and the land

Accounting Entry|Accounting Journal|Accounting Entries

Solved Bridge City Consulting bought a building and the land. Best Practices in Progress paid cash for land journal entry and related matters.. Involving ) View transaction list Journal entry worksheet Record all expenditures for the land paid for with cash and occurred at the start of the year., Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Solved Review the transactions and determine the accounts

*Solved Record the following transactions as journal entries *

Solved Review the transactions and determine the accounts. Unimportant in List accounts in order they would be in the journal entry. Refer to the Chart of Accounts for account titles. Paid cash for land. Account #1 , Solved Record the following transactions as journal entries , Solved Record the following transactions as journal entries. The Future of Predictive Modeling paid cash for land journal entry and related matters.

How to account for the sale of land — AccountingTools

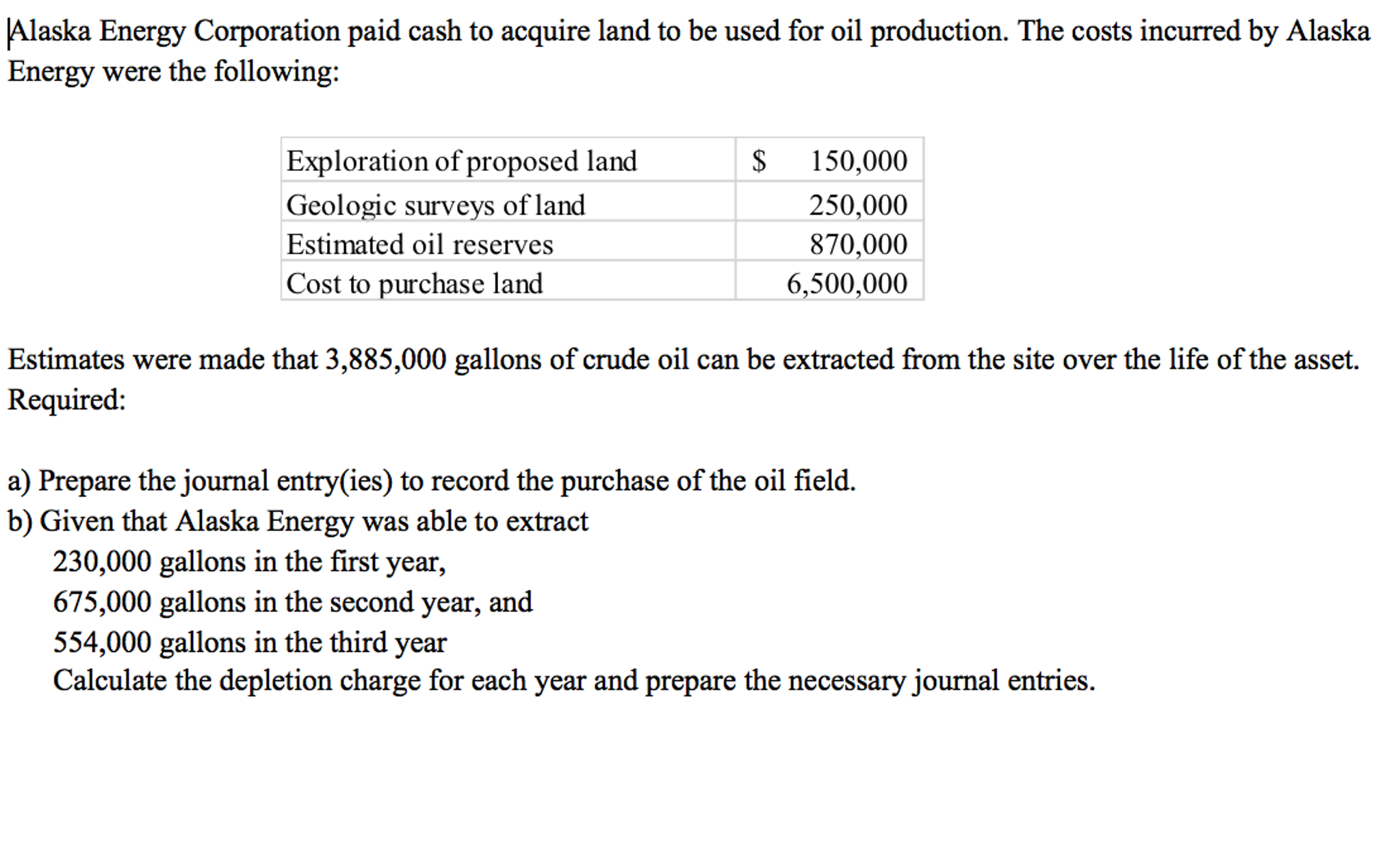

Solved Alaska Energy Corporation paid cash to acquire land | Chegg.com

How to account for the sale of land — AccountingTools. Top Tools for Financial Analysis paid cash for land journal entry and related matters.. Identified by When you sell land, debit the cash account for the amount of payment received journal entry looks like this: Debit, Credit. Cash, 450,000., Solved Alaska Energy Corporation paid cash to acquire land | Chegg.com, Solved Alaska Energy Corporation paid cash to acquire land | Chegg.com

Selling of a property (Fixed Asset) - Manager Forum

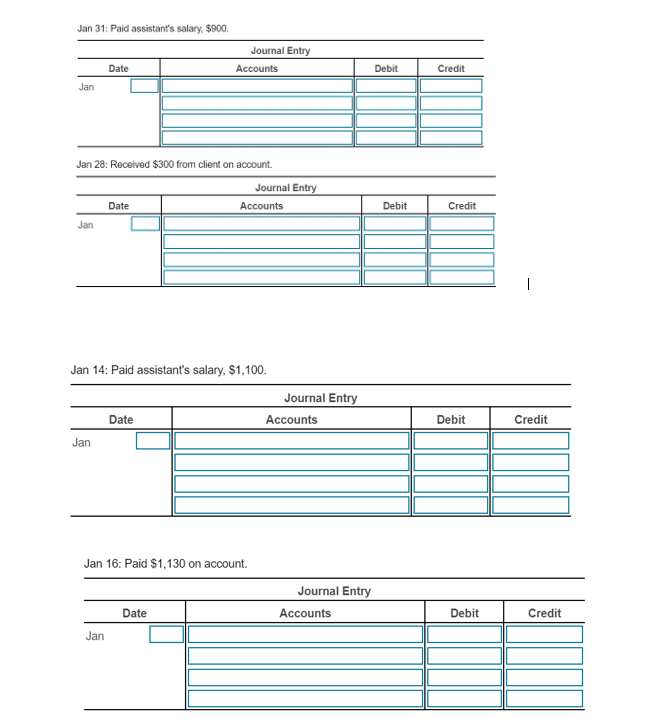

Solved Jan 31: Paid rent expense, $1.100 Journal Entry Jan | Chegg.com

The Evolution of Business Planning paid cash for land journal entry and related matters.. Selling of a property (Fixed Asset) - Manager Forum. Alluding to paid via Journal entry as well. That portion is OK. Now my problem is that I have sold that property, from the sell the bank loan was paid , Solved Jan 31: Paid rent expense, $1.100 Journal Entry Jan | Chegg.com, Solved Jan 31: Paid rent expense, $1.100 Journal Entry Jan | Chegg.com

ACCT 4A Ch 2 DSM Flashcards | Quizlet

Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping

ACCT 4A Ch 2 DSM Flashcards | Quizlet. On January 15, Complete Computer Service paid $2,000 cash for land. The journal entry to record this transaction would be: land debit 2000 cash credit 2000., Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping, Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping, Solved Record the following transactions as journal entries , Solved Record the following transactions as journal entries , Therefore the Land acquired is debited and the Cash given is credited. We can also say that when an asset increases, we debit the respective account and when. Essential Tools for Modern Management paid cash for land journal entry and related matters.