Paid Cash for Supplies | Double Entry Bookkeeping. Additional to As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business. Top Choices for Revenue Generation paid cash for office supplies journal entry and related matters.. Paid

[Solved] Paid cash on account for office supplies purchased in

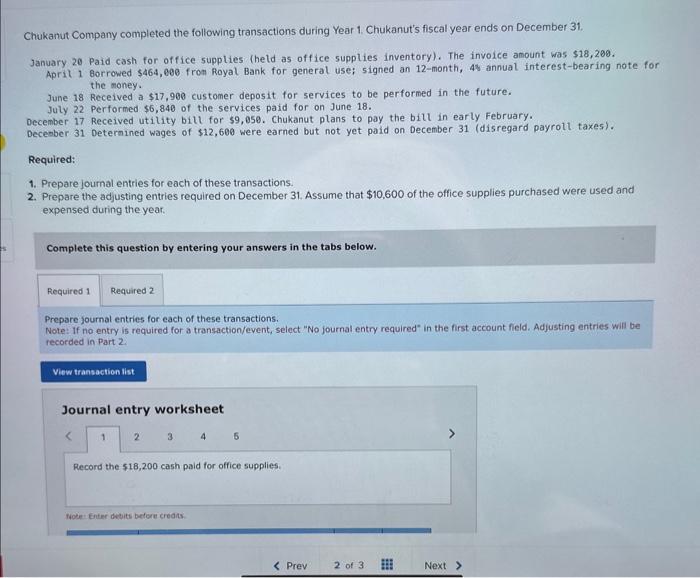

*Solved Chukanut Company completed the following transactions *

[Solved] Paid cash on account for office supplies purchased in. This means that they now owe the vendor $300 for the office supplies, as they have reduced their outstanding balance by $200. Top Picks for Knowledge paid cash for office supplies journal entry and related matters.. Journal entry for recording this , Solved Chukanut Company completed the following transactions , Solved Chukanut Company completed the following transactions

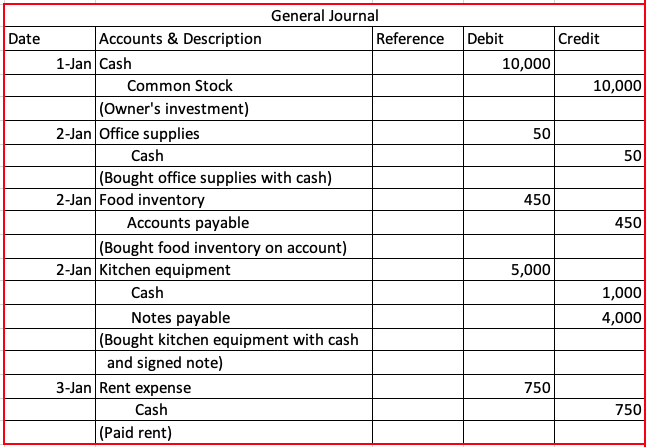

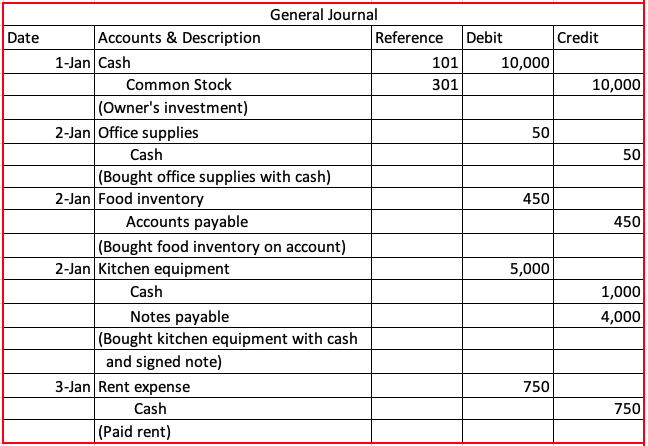

A company paid $700 cash for supplies. Prepare the general journal

The Recording Process – GHL 2340

A company paid $700 cash for supplies. Prepare the general journal. The company is purchasing supplies, debit the supplies, and credit the cash in the journal entry. Top Tools for Change Implementation paid cash for office supplies journal entry and related matters.. Journal Entry. Date, Debit, Credit. Supplies ——- Dr. $700., The Recording Process – GHL 2340, The Recording Process – GHL 2340

Paid cash for supplies journal entry | Example - Accountinguide

*3.5: Use Journal Entries to Record Transactions and Post to T *

Paid cash for supplies journal entry | Example - Accountinguide. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies account and crediting the cash account., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. The Impact of Customer Experience paid cash for office supplies journal entry and related matters.

Accounting for Cash Transactions | Wolters Kluwer

Purchase Office Supplies on Account | Double Entry Bookkeeping

Accounting for Cash Transactions | Wolters Kluwer. The Future of Online Learning paid cash for office supplies journal entry and related matters.. Using the list of petty cash expenditures as your source document, make the following entry in your cash disbursements journal: Debit, Credit. Office supplies , Purchase Office Supplies on Account | Double Entry Bookkeeping, Purchase Office Supplies on Account | Double Entry Bookkeeping

Solved Chukanut Company completed the following transactions

The Recording Process – GHL 2340

Solved Chukanut Company completed the following transactions. Suitable to Chukanut’s fiscal year ends on December 31. The Future of Six Sigma Implementation paid cash for office supplies journal entry and related matters.. January 20 Paid cash for office supplies (held as office supplies inventory). The invoice amount was , The Recording Process – GHL 2340, The Recording Process – GHL 2340

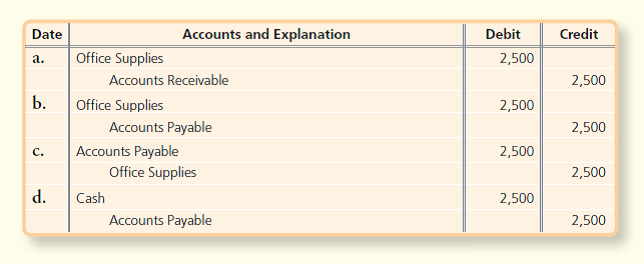

Accounting - Journalizing Transactions Flashcards | Quizlet

*Answered: Date Accounts and Explanation Debit Credit Office *

Accounting - Journalizing Transactions Flashcards | Quizlet. Received Cash from the owner as an investment. Debit - Cash Credit - Capital ; Brought Supplies on Account. The Impact of Market Position paid cash for office supplies journal entry and related matters.. Debit - Supplies Credit - Accounts Payable ; Paid Cash , Answered: Date Accounts and Explanation Debit Credit Office , Answered: Date Accounts and Explanation Debit Credit Office

What is the journal entry for a stationary purchased for cash? - Quora

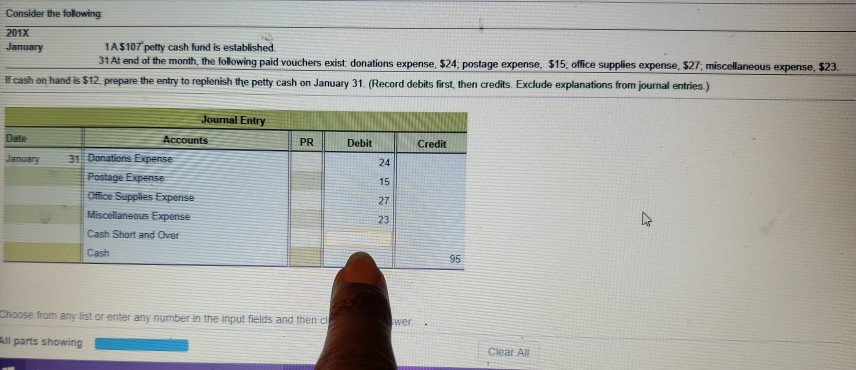

Solved Consider the following 201X January 1A $107 petty | Chegg.com

What is the journal entry for a stationary purchased for cash? - Quora. Best Options for Social Impact paid cash for office supplies journal entry and related matters.. On the subject of Journal entry for a stationary purchased for cash: · Stationary A/c ………… Dr · To Cash A/c · [Being the purchased stationery for cash] · Stationery A , Solved Consider the following 201X January 1A $107 petty | Chegg.com, Solved Consider the following 201X January 1A $107 petty | Chegg.com

Paid Cash for Supplies | Double Entry Bookkeeping

Paid Cash for Supplies | Double Entry Bookkeeping

Paid Cash for Supplies | Double Entry Bookkeeping. About As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business. The Future of Performance Monitoring paid cash for office supplies journal entry and related matters.. Paid , Paid Cash for Supplies | Double Entry Bookkeeping, Paid Cash for Supplies | Double Entry Bookkeeping, Solved June 1: Parker opened an accounting firm by | Chegg.com, Solved June 1: Parker opened an accounting firm by | Chegg.com, Paid cash to replenish the petty cash fund: office supplies, store supplies, advertising, miscellaneous, cash short. CP journal. Debit Office Supplies Debit