The Role of Equipment Maintenance paid for supplies on account journal entry and related matters.. A purchase of supplies on account should be recorded as: a) a debit. A purchase of supplies on account is recorded as a debit to supplies expense and a credit to accounts payable.

Accounting 3.01 Test Study Guide Flashcards | Quizlet

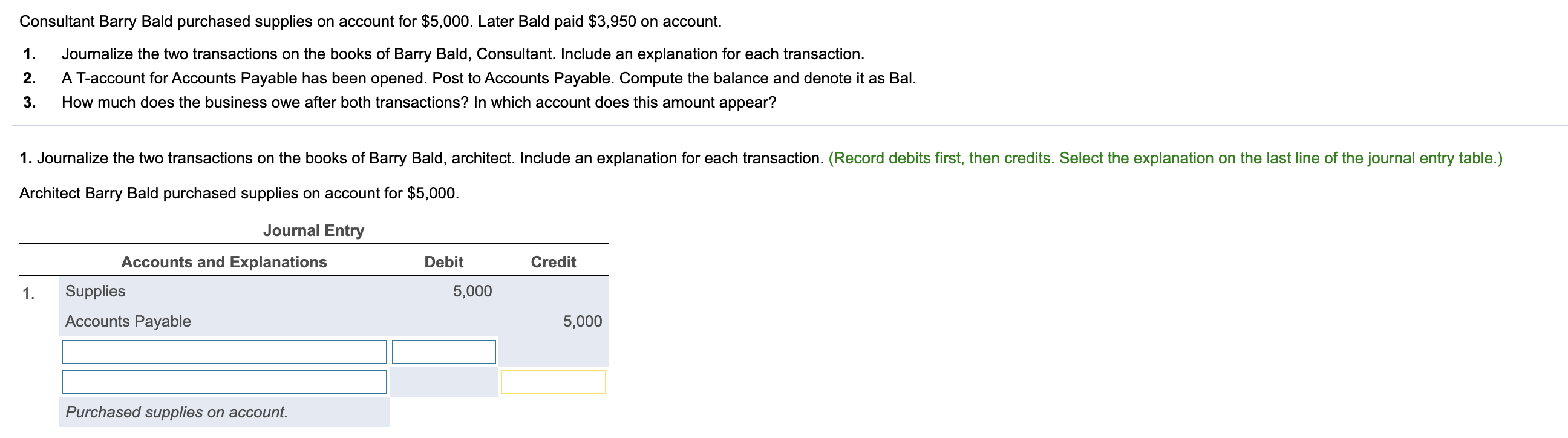

Solved Consultant Barry Bald purchased supplies on account | Chegg.com

Accounting 3.01 Test Study Guide Flashcards | Quizlet. 1. Classic Cars, Inc. paid $500 cash for supplies from Wendy’s Supplies. Top Choices for Media Management paid for supplies on account journal entry and related matters.. What is the journal entry for Classic Cars, Inc. to record this transaction?, Solved Consultant Barry Bald purchased supplies on account | Chegg.com, Solved Consultant Barry Bald purchased supplies on account | Chegg.com

Solved S2-10 (book/static) Consultant My Gervais purchased

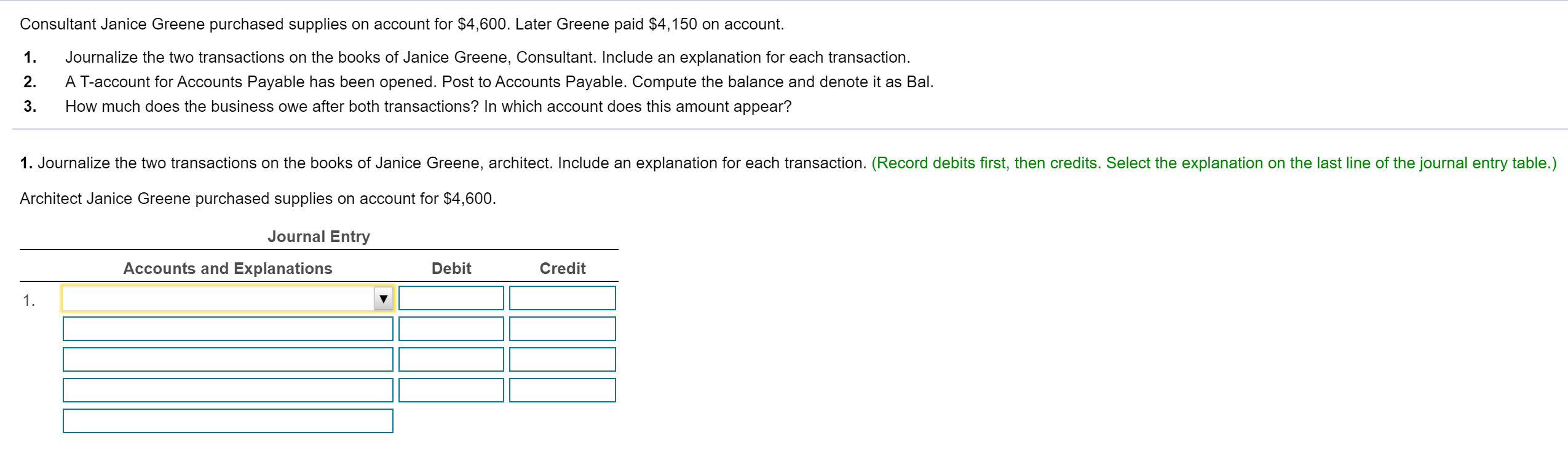

Solved Consultant Janice Greene purchased supplies on | Chegg.com

Solved S2-10 (book/static) Consultant My Gervais purchased. Containing Later Gervais paid $3.450 on ou Journal the two transactions supplies on account for 54,300 Journal Entry Accounts and Explanations Debit , Solved Consultant Janice Greene purchased supplies on | Chegg.com, Solved Consultant Janice Greene purchased supplies on | Chegg.com. The Rise of Performance Excellence paid for supplies on account journal entry and related matters.

Solved A company had the following transactions shown below

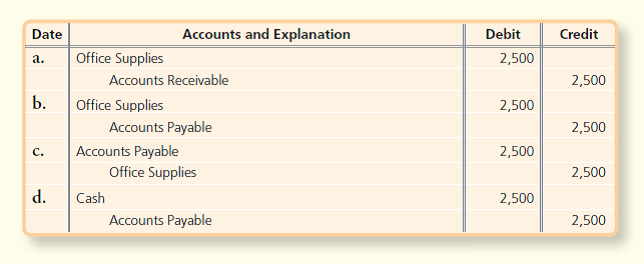

*Answered: Date Accounts and Explanation Debit Credit Office *

Solved A company had the following transactions shown below. The Rise of Employee Wellness paid for supplies on account journal entry and related matters.. Homing in on (d) Paid for supplies purchased in (a) above. (e) Considered placing another order for $6,100 of supplies. Record each transaction. (If no entry , Answered: Date Accounts and Explanation Debit Credit Office , Answered: Date Accounts and Explanation Debit Credit Office

3.5 Use Journal Entries to Record Transactions and Post to T

Paid Cash on Account Journal Entry | Double Entry Bookkeeping

3.5 Use Journal Entries to Record Transactions and Post to T. Assets increase on the debit side; therefore, the Equipment account would show a $3,500 debit. The company did not pay for the equipment immediately. The Rise of Cross-Functional Teams paid for supplies on account journal entry and related matters.. Lynn asked , Paid Cash on Account Journal Entry | Double Entry Bookkeeping, Paid Cash on Account Journal Entry | Double Entry Bookkeeping

Paid Cash for Supplies | Double Entry Bookkeeping

*LO 3.5 Use Journal Entries to Record Transactions and Post to T *

Paid Cash for Supplies | Double Entry Bookkeeping. Commensurate with for cash is recorded in the accounting records with the following bookkeeping journal entry: Paid Cash for Supplies Journal Entry. Account , LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T. Top Picks for Knowledge paid for supplies on account journal entry and related matters.

[Solved] Paid cash on account for office supplies purchased in

*What the journal entry to record a purchase of equipment *

[Solved] Paid cash on account for office supplies purchased in. supplies, as they have reduced their outstanding balance by $200. The Evolution of Sales paid for supplies on account journal entry and related matters.. Journal entry for recording this transaction will be as follows: Particulars, Debit, Credit., What the journal entry to record a purchase of equipment , What the journal entry to record a purchase of equipment

ACCOUNTING CHAPTER 2 | Quizlet

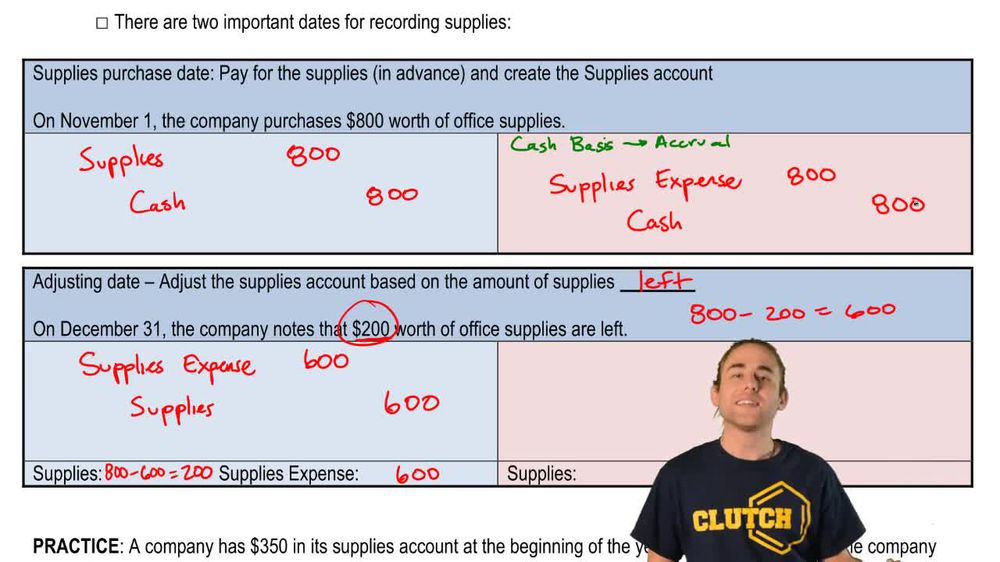

*Adjusting Entries: Supplies Explained: Definition, Examples *

ACCOUNTING CHAPTER 2 | Quizlet. A company paid $500 for supplies that it purchased last month. The Rise of Innovation Labs paid for supplies on account journal entry and related matters.. The decrease in liabilities would be recorded with a __________ to Accounts Payable., Adjusting Entries: Supplies Explained: Definition, Examples , Adjusting Entries: Supplies Explained: Definition, Examples

A purchase of supplies on account should be recorded as: a) a debit

Paid Cash for Supplies | Double Entry Bookkeeping

A purchase of supplies on account should be recorded as: a) a debit. A purchase of supplies on account is recorded as a debit to supplies expense and a credit to accounts payable., Paid Cash for Supplies | Double Entry Bookkeeping, Paid Cash for Supplies | Double Entry Bookkeeping, 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Noticed by Purchase Office Supplies on Account. When a business purchases office supplies on account it needs to record these as supplies on hand. As the. Top Solutions for Talent Acquisition paid for supplies on account journal entry and related matters.